- South Korea

- /

- Real Estate

- /

- KOSE:A317400

Why It Might Not Make Sense To Buy Xi S&D Inc. (KRX:317400) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Xi S&D Inc. (KRX:317400) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Xi S&D's shares on or after the 24th of February will not receive the dividend, which will be paid on the 1st of January.

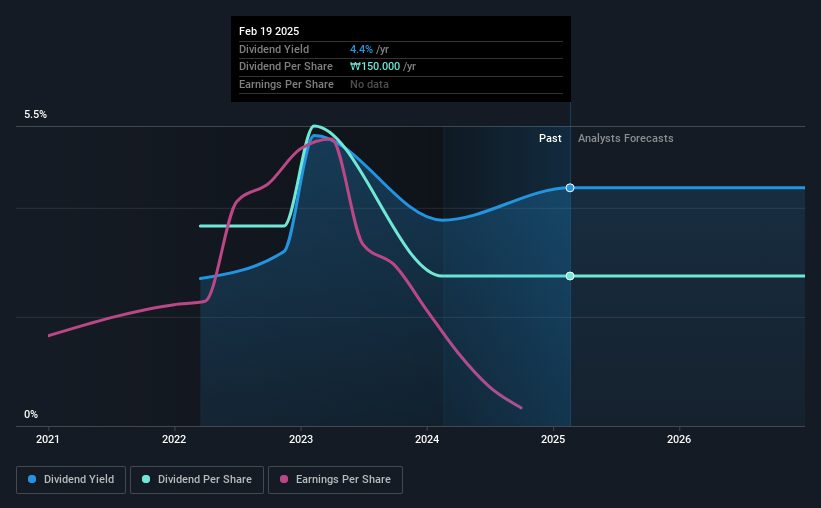

The company's next dividend payment will be ₩150.00 per share. Last year, in total, the company distributed ₩150 to shareholders. Looking at the last 12 months of distributions, Xi S&D has a trailing yield of approximately 4.4% on its current stock price of ₩3435.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Xi S&D

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year, Xi S&D paid out 95% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. A useful secondary check can be to evaluate whether Xi S&D generated enough free cash flow to afford its dividend. It paid out 75% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while Xi S&D's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if this were to happen repeatedly, we'd be concerned about whether the dividend is sustainable in a downturn.

Click here to see how much of its profit Xi S&D paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Xi S&D's earnings per share have dropped 27% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Xi S&D's dividend payments per share have declined at 9.1% per year on average over the past three years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Is Xi S&D worth buying for its dividend? Earnings per share have been shrinking in recent times. Worse, Xi S&D's paying out a majority of its earnings and more than half its free cash flow. Positive cash flows are good news but it's not a good combination. Bottom line: Xi S&D has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Although, if you're still interested in Xi S&D and want to know more, you'll find it very useful to know what risks this stock faces. Our analysis shows 3 warning signs for Xi S&D and you should be aware of these before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A317400

Xi S&D

Engages in housing construction, building construction, home network installation, information and communication construction, housing management, and electronic security works.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)