In recent weeks, global markets have exhibited mixed performance, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs amid a rally in growth stocks, while small-cap stocks represented by the Russell 2000 Index experienced a decline. This divergence underscores the importance of identifying high-growth tech stocks that can thrive in an environment marked by robust job growth and potential interest rate cuts from the Federal Reserve. In such a dynamic market landscape, investors often seek companies with strong innovation capabilities and competitive advantages to capitalize on emerging opportunities within the technology sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

GC Biopharma (KOSE:A006280)

Simply Wall St Growth Rating: ★★★★☆☆

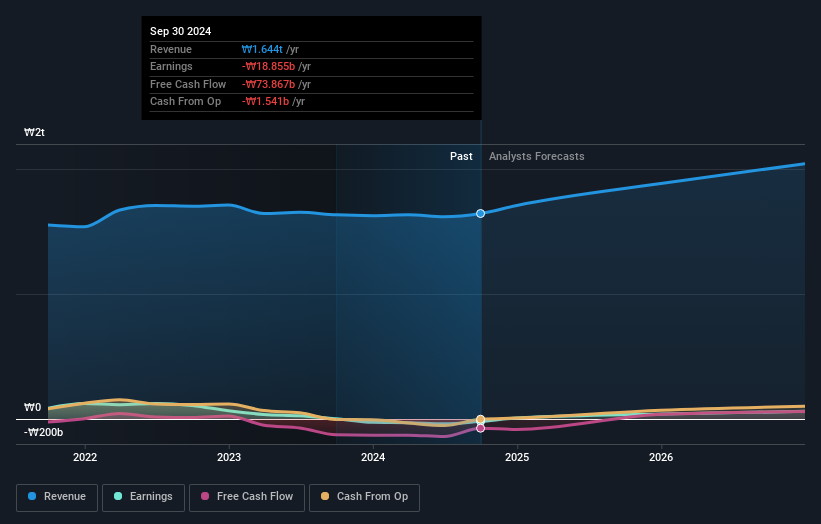

Overview: GC Biopharma Corp. is a biopharmaceutical company that develops and sells pharmaceutical drugs both in South Korea and internationally, with a market capitalization of ₩1.60 trillion.

Operations: GC Biopharma generates revenue primarily from the manufacturing and sales of pharmaceuticals, which amounted to ₩1.50 trillion. The company also earns from diagnosis and analysis of samples, contributing ₩208.75 billion to its revenue streams.

GC Biopharma's recent strides in biotechnology spotlight its innovative edge, particularly with the launch of 'GC1130A', a pioneering treatment for Sanfillippo syndrome type A. This first-in-class therapy, which leverages intracerebroventricular delivery to enhance efficacy significantly, underscores GC Biopharma's commitment to addressing unmet medical needs. Financially, the company demonstrated robust growth with a 108% increase in earnings this year and is projected to turn profitable within three years. Despite challenges in covering interest payments from earnings, their strategic collaborations and leadership enhancements signal strong forward momentum in high-stakes markets like enzyme replacement therapies and age-related macular degeneration treatments.

- Click to explore a detailed breakdown of our findings in GC Biopharma's health report.

Evaluate GC Biopharma's historical performance by accessing our past performance report.

Shenzhen Yanmade Technology (SHSE:688312)

Simply Wall St Growth Rating: ★★★★★☆

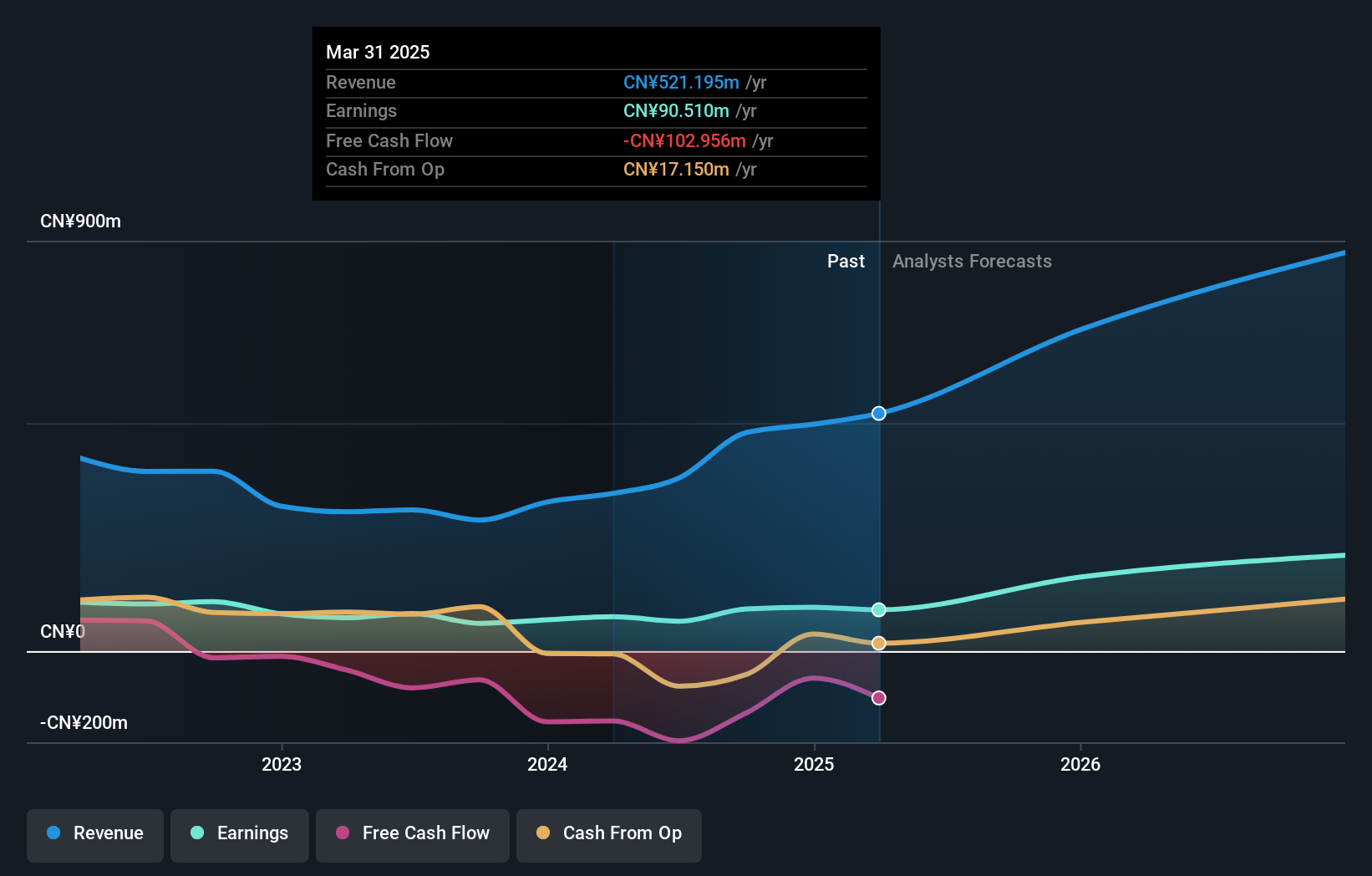

Overview: Shenzhen Yanmade Technology Inc. focuses on the research and development, design, production, and sale of automated and intelligent test equipment primarily in China, with a market cap of CN¥4.85 billion.

Operations: Yanmade Technology specializes in automated and intelligent test equipment, emphasizing innovation in design and production. The company primarily serves the Chinese market, leveraging its expertise to cater to the growing demand for advanced testing solutions.

Shenzhen Yanmade Technology has shown remarkable performance, with its revenue soaring to CNY 360.44 million from CNY 208.12 million in just nine months, reflecting a growth trajectory that surpasses many in the electronics sector. This surge is mirrored in net income, which climbed to CNY 68.83 million from CNY 45.16 million previously, and earnings per share also increased from CNY 0.31 to CNY 0.49. The firm's commitment to innovation is evident in its R&D spending trends, aligning with an anticipated revenue growth of 26.6% per year and earnings expected to rise by 34.7% annually—figures that notably outpace broader market averages. Despite challenges like a forecasted lower Return on Equity at just over 11%, Shenzhen Yanmade continues to invest heavily in research and development, reinforcing its potential for sustained technological advancements and market competitiveness in the fast-evolving tech landscape of China.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

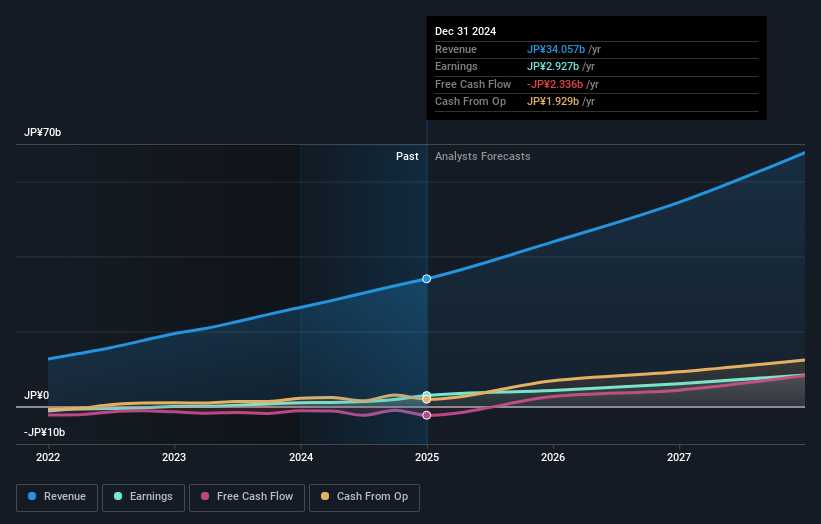

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of ¥142.46 billion.

Operations: Appier Group generates revenue primarily through its AI SaaS Business, which reported ¥32.19 billion in revenue. The company focuses on providing AI platforms that enable enterprises to make informed decisions based on data analysis.

Appier Group has demonstrated robust growth dynamics, with a forecasted revenue increase of 19.8% per year, outpacing the Japanese market average of 4.1%. This growth is underpinned by substantial investments in R&D, which have surged to represent a significant portion of their revenue, aligning with their strategic focus on advanced AI and generative AI technologies. Notably, their earnings are expected to climb by 37.8% annually, significantly higher than the broader market's 7.8%, reflecting Appier's effective leverage of innovations like the AIXPERT platform for optimizing digital advertising campaigns. The firm also recently revised its dividend outlook upwards and completed a share buyback program worth ¥145 million, signaling strong financial health and commitment to shareholder value amidst aggressive expansion efforts.

- Click here to discover the nuances of Appier Group with our detailed analytical health report.

Review our historical performance report to gain insights into Appier Group's's past performance.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1289 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

A software-as-a-service company, provides artificial intelligence (AI) platforms for enterprises to make data-driven decisions in Japan and internationally.

Flawless balance sheet with solid track record.