- Japan

- /

- Trade Distributors

- /

- TSE:9960

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by political shifts and mixed economic signals, major U.S. stock indexes have shown divergence, with growth stocks outperforming their value counterparts significantly. Amid these dynamics, dividend stocks remain an attractive option for investors seeking steady income streams, particularly in sectors that may be resilient to the fluctuations seen in energy and materials markets. A good dividend stock typically offers a combination of reliable yield and financial stability, making it a potential anchor for portfolios during times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.54% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1929 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

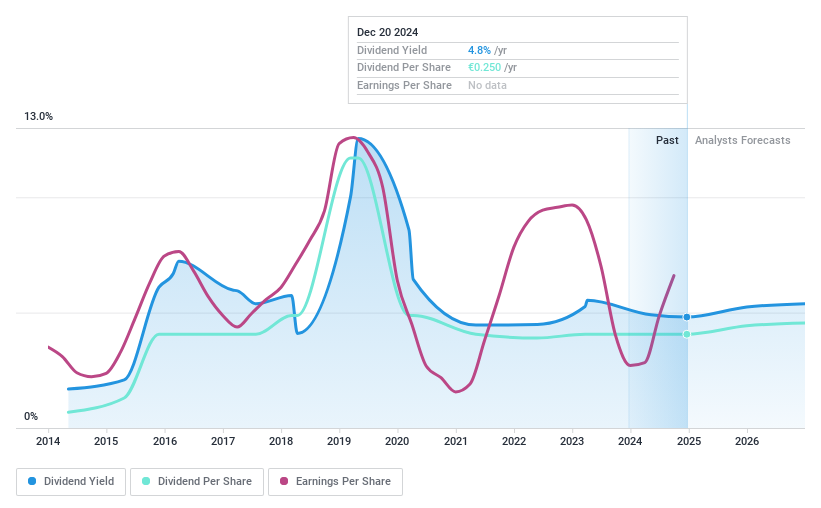

Altri SGPS (ENXTLS:ALTR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Altri SGPS is a company that produces and sells cellulosic fibers and energy both in Portugal and internationally, with a market cap of €1.06 billion.

Operations: Altri SGPS generates revenue primarily from the production and commercialization of cellulosic fibers, amounting to €841.88 million.

Dividend Yield: 4.8%

Altri SGPS has demonstrated strong earnings growth, with a recent net income surge to €27.6 million in Q3 2024 from €0.2 million the previous year, supporting its dividend sustainability. Despite a low cash payout ratio of 22.6%, indicating dividends are well-covered by cash flows, the dividend yield of 4.85% lags behind top-tier Portuguese payers. The company faces challenges with an unstable dividend history and high debt levels, impacting reliability perceptions among investors.

- Take a closer look at Altri SGPS' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Altri SGPS is trading behind its estimated value.

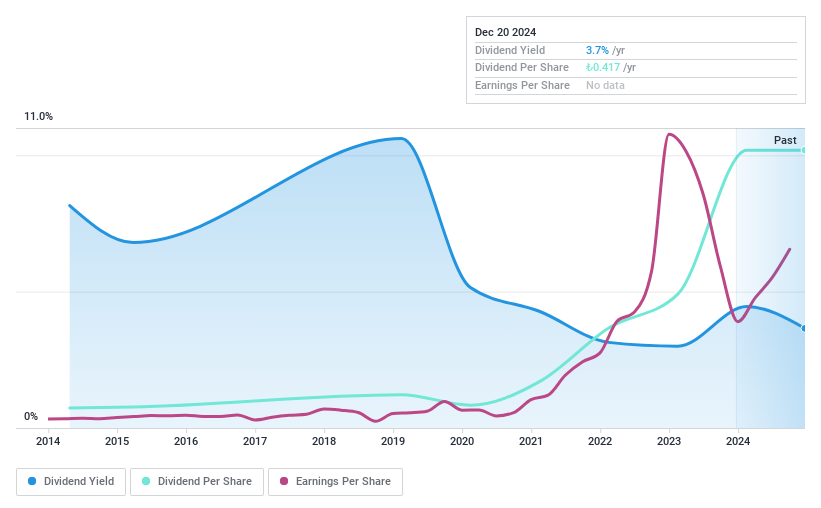

Aksa Akrilik Kimya Sanayii (IBSE:AKSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aksa Akrilik Kimya Sanayii A.S. operates in the manufacturing and sale of textiles, chemicals, and other industrial products both in Turkey and internationally, with a market cap of TRY40.13 billion.

Operations: Aksa Akrilik Kimya Sanayii A.S. generates its revenue primarily from the Fibres segment, which accounts for TRY18.91 billion, followed by Energy at TRY1.17 billion.

Dividend Yield: 4%

Aksa Akrilik Kimya Sanayii's dividend yield of 4.03% ranks in the top 25% of Turkish payers but is not well-supported by free cash flows, raising sustainability concerns. Despite a reasonable payout ratio of 58.3%, earnings cover dividends, yet past payments have been volatile and unreliable over the decade. Recent earnings improved with TRY 1.1 billion net income for nine months ending September 2024, contrasting last year's loss, potentially stabilizing future payouts amidst declining sales figures.

- Delve into the full analysis dividend report here for a deeper understanding of Aksa Akrilik Kimya Sanayii.

- Our valuation report here indicates Aksa Akrilik Kimya Sanayii may be overvalued.

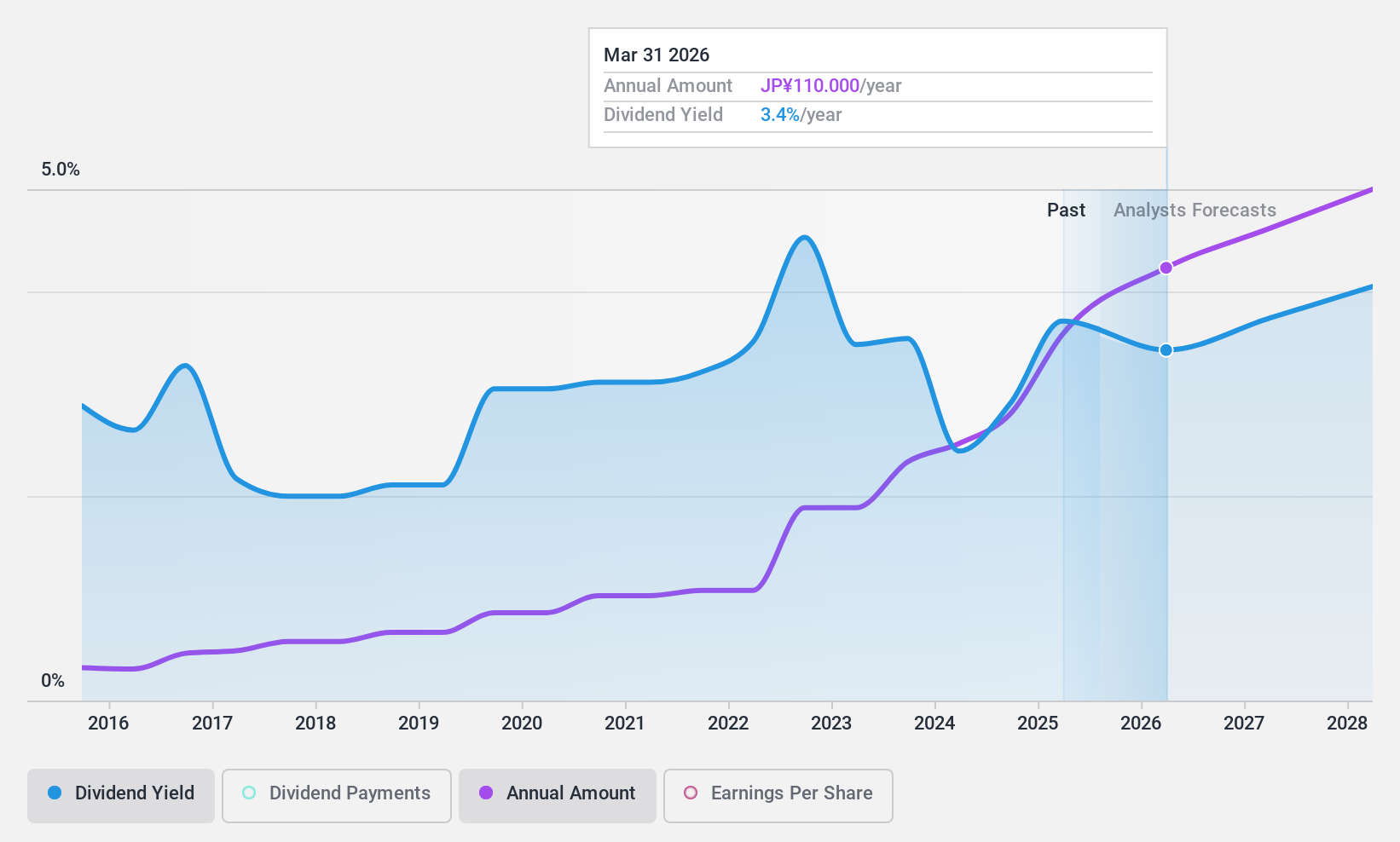

Totech (TSE:9960)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Totech Corporation operates in Japan, specializing in the sale of environment control equipment, with a market capitalization of approximately ¥106.10 billion.

Operations: Totech Corporation's revenue is primarily derived from its Merchandise Sales Business, which accounts for ¥86.50 billion, and its Construction Business, contributing ¥61.32 billion.

Dividend Yield: 3.5%

Totech Corporation's dividend payments are well-supported by a low payout ratio of 22.3% and a cash payout ratio of 30%, indicating sustainability. Despite a recent stock split, the company's dividends remain stable, with reliable growth over the past decade. However, its current yield of 3.46% is below Japan's top tier payers. The recent follow-on equity offering may impact future payouts, but earnings guidance suggests continued profitability with JPY 9 billion expected for fiscal year-end March 2025.

- Click to explore a detailed breakdown of our findings in Totech's dividend report.

- Upon reviewing our latest valuation report, Totech's share price might be too pessimistic.

Taking Advantage

- Embark on your investment journey to our 1929 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Totech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9960

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives