- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7915

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

In a week marked by mixed performances across major U.S. stock indexes, growth stocks have notably outperformed their value counterparts, with the S&P 500 and Nasdaq Composite hitting record highs while small-cap indices like the Russell 2000 saw declines. Amidst this backdrop of diverging market trends and economic indicators such as job growth rebounding in November, investors are closely watching high-growth tech stocks for potential expansion opportunities. Identifying a promising stock often involves assessing its ability to capitalize on current market dynamics and sector-specific momentum, particularly in technology where innovation drives growth potential.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiit S.p.A. is a company that offers cloud services to businesses both in Italy and internationally, with a market cap of €537.16 million.

Operations: Wiit S.p.A. specializes in delivering cloud services to businesses across Italy and international markets, focusing on secure and scalable solutions. The company generates revenue primarily through its cloud service offerings, catering to a diverse range of industries seeking IT infrastructure support.

Wiit S.p.A. has demonstrated robust growth, with earnings surging by 35.4% over the past year, outpacing the IT industry's average of 22.7%. This trend is expected to continue, with forecasts predicting a significant earnings increase of 28.4% annually, well above Italy's market average growth rate of 7.1%. Additionally, Wiit’s revenue growth at 8.2% per annum also exceeds the broader Italian market's pace of 4%, signaling strong sectoral performance despite not reaching high-growth thresholds like some global peers at 20% or more annually. The company’s strategic focus on enhancing its technological capabilities is evident from its R&D investments which are crucial for sustaining innovation and competitiveness in the rapidly evolving tech landscape.

- Click here to discover the nuances of Wiit with our detailed analytical health report.

Gain insights into Wiit's past trends and performance with our Past report.

Enplas (TSE:6961)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Enplas Corporation is a company that produces and distributes semiconductor components, automobile parts, optical communication devices, and life science products both in Japan and globally, with a market capitalization of ¥46.38 billion.

Operations: The company's primary revenue streams are the Semiconductor Business and Energy Saving Solutions Business, generating ¥16.25 billion and ¥13.84 billion, respectively. The Digital Communication Business contributes ¥5.64 billion, while the Life Science Business adds ¥2.58 billion to total revenues.

Enplas Corporation, amidst a challenging market, has managed to project an impressive earnings growth of 21.2% annually, outstripping the Japanese market's average of 7.8%. This growth is supported by a strategic emphasis on R&D, with expenses tailored to foster innovation—crucial in maintaining competitive advantage in the electronics sector. Despite a volatile share price recently, Enplas also anticipates revenue increases at 7.9% per year, surpassing the national average of 4.1%, which could signal resilience and adaptability in its operational approach. The company's focus on high-quality earnings and positive free cash flow further underscores its potential to sustain growth amid industry fluctuations.

- Unlock comprehensive insights into our analysis of Enplas stock in this health report.

Explore historical data to track Enplas' performance over time in our Past section.

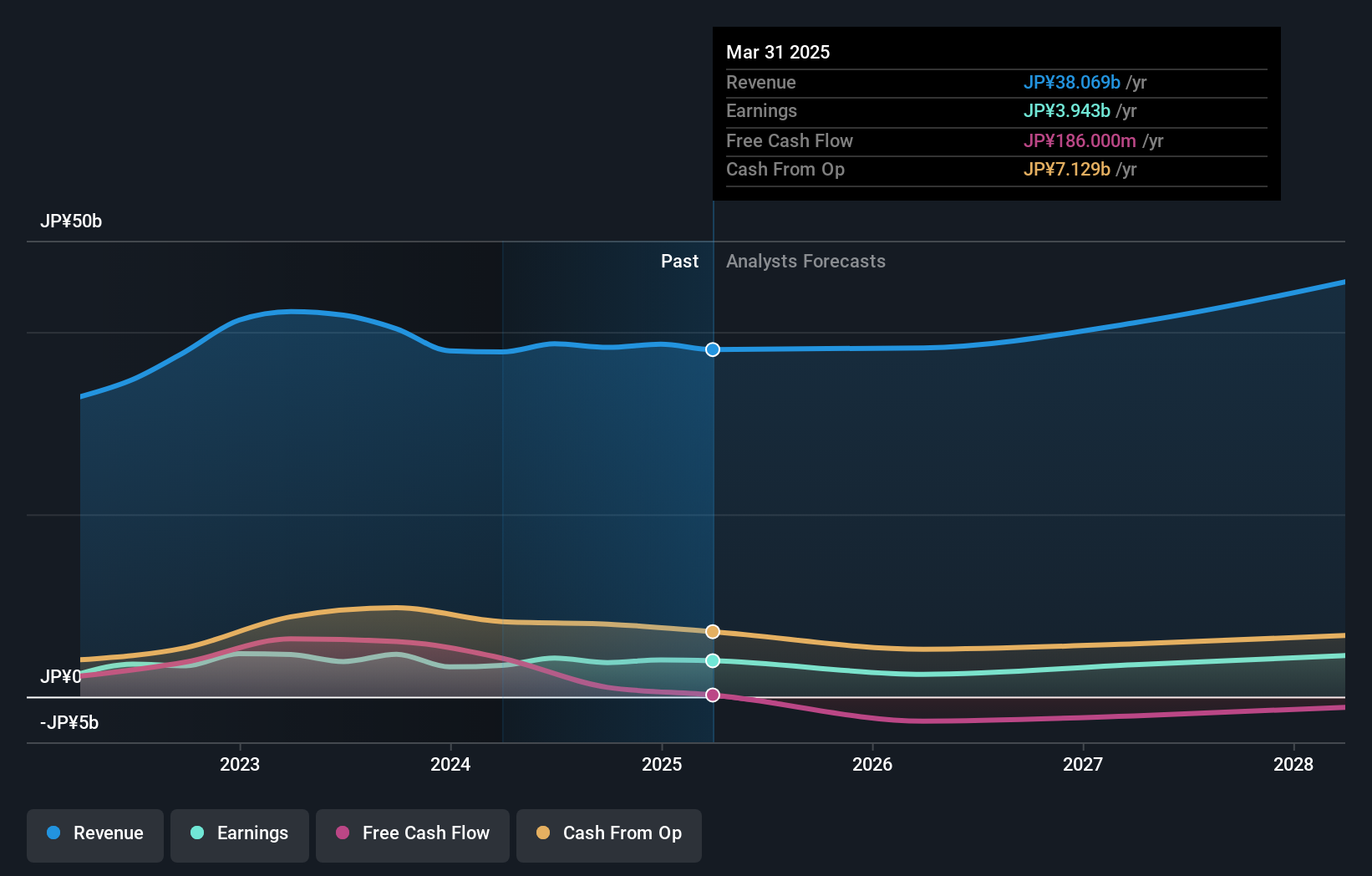

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nissha Co., Ltd. operates in the industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics sectors both in Japan and internationally, with a market capitalization of approximately ¥74.34 billion.

Operations: With a market capitalization of approximately ¥74.34 billion, Nissha Co., Ltd. generates significant revenue from its industrial materials and device sectors, contributing ¥73.12 billion and ¥67.26 billion respectively. The medical technology segment also plays a crucial role with revenues of ¥43.39 billion, highlighting the company's diverse business operations across multiple industries globally.

Nissha has demonstrated a robust growth trajectory, with earnings forecasted to surge by 27.7% annually, outpacing the Japanese market's average of 7.8%. This impressive growth is underpinned by a strategic focus on R&D, which has seen investments tailored to drive innovation and competitiveness in the tech sector. Recently, Nissha announced a share repurchase program aimed at enhancing shareholder returns, committing ¥1 billion towards buying back up to 600,000 shares by March 2025. This move underscores the company's confidence in its financial health and future prospects despite operating in a highly competitive environment where technological advancements are pivotal.

- Click here and access our complete health analysis report to understand the dynamics of Nissha.

Review our historical performance report to gain insights into Nissha's's past performance.

Taking Advantage

- Dive into all 1289 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7915

Nissha

Engages in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics businesses in Japan and internationally.

Excellent balance sheet with reasonable growth potential.