3 Stocks Estimated To Be Trading At Discounts Of Up To 46.5%

Reviewed by Simply Wall St

As global markets experience a divergence in performance, with major indices hitting record highs while others face declines, investors are keenly observing the mixed economic signals and geopolitical developments. In this environment, identifying stocks that may be undervalued can offer potential opportunities for those looking to capitalize on market inefficiencies. A good stock in such conditions is often one that demonstrates strong fundamentals yet trades at a price below its intrinsic value, providing a margin of safety amidst market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| Management SolutionsLtd (TSE:7033) | ¥1713.00 | ¥3407.79 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2884.09 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Visional (TSE:4194) | ¥8500.00 | ¥16990.44 | 50% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707)

Overview: Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd. operates in the pharmaceutical industry with a focus on biochemical products and has a market cap of CN¥22.83 billion.

Operations: Nanjing King-Friend Biochemical Pharmaceutical Co., Ltd. generates its revenue primarily from the pharmaceutical sector, with a specialization in biochemical products.

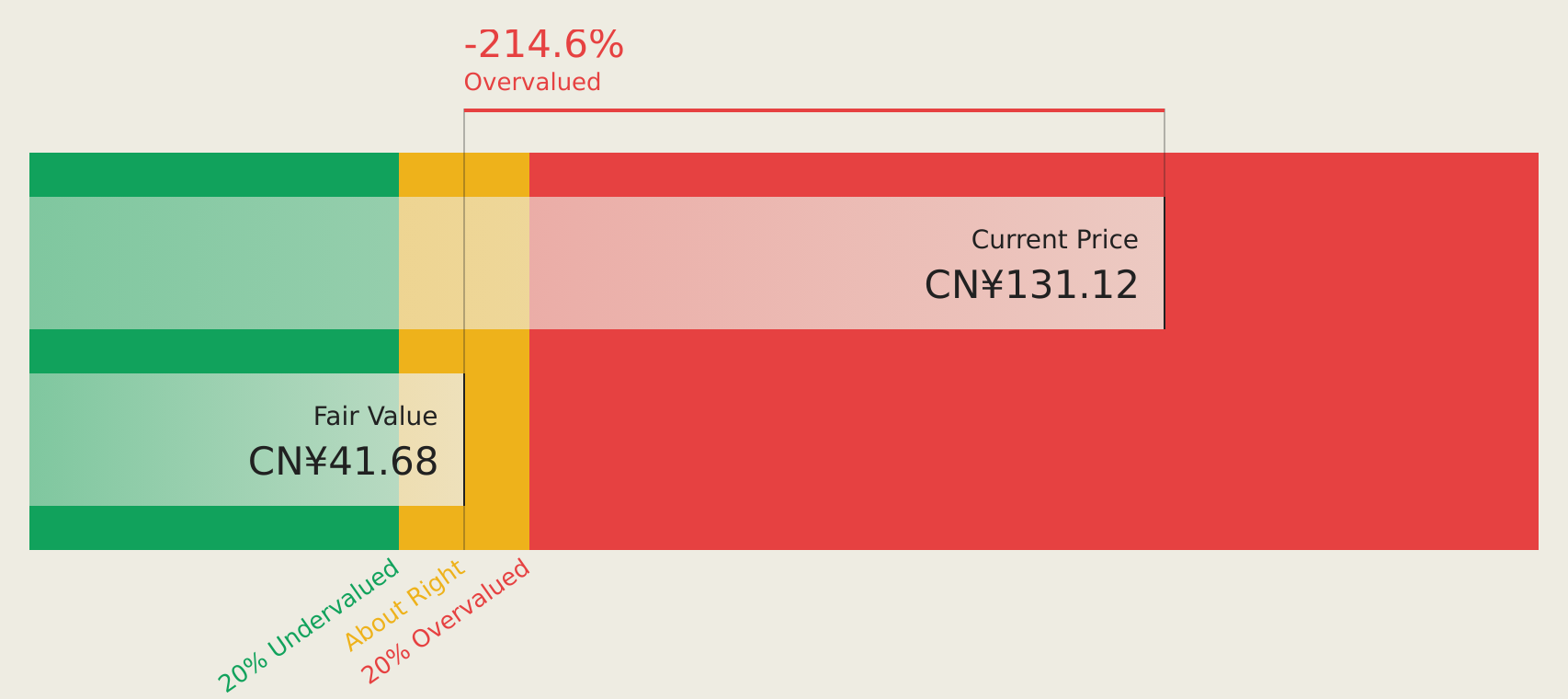

Estimated Discount To Fair Value: 46.5%

Nanjing King-Friend Biochemical Pharmaceutical is trading at CN¥14.11, significantly below its estimated fair value of CN¥26.38, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income to CN¥605.78 million for the first nine months of 2024, the company's revenue growth forecast of 25.5% per year surpasses market averages and supports potential profitability within three years, although current dividends remain inadequately covered by earnings.

- The analysis detailed in our Nanjing King-Friend Biochemical PharmaceuticalLtd growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Nanjing King-Friend Biochemical PharmaceuticalLtd.

Giantec Semiconductor (SHSE:688123)

Overview: Giantec Semiconductor Corporation focuses on the research, development, design, and sale of memory, analog, and mixed-signal integrated circuits across various international markets, with a market cap of CN¥9.12 billion.

Operations: The company's revenue from the integrated circuit design industry amounts to CN¥970.87 million.

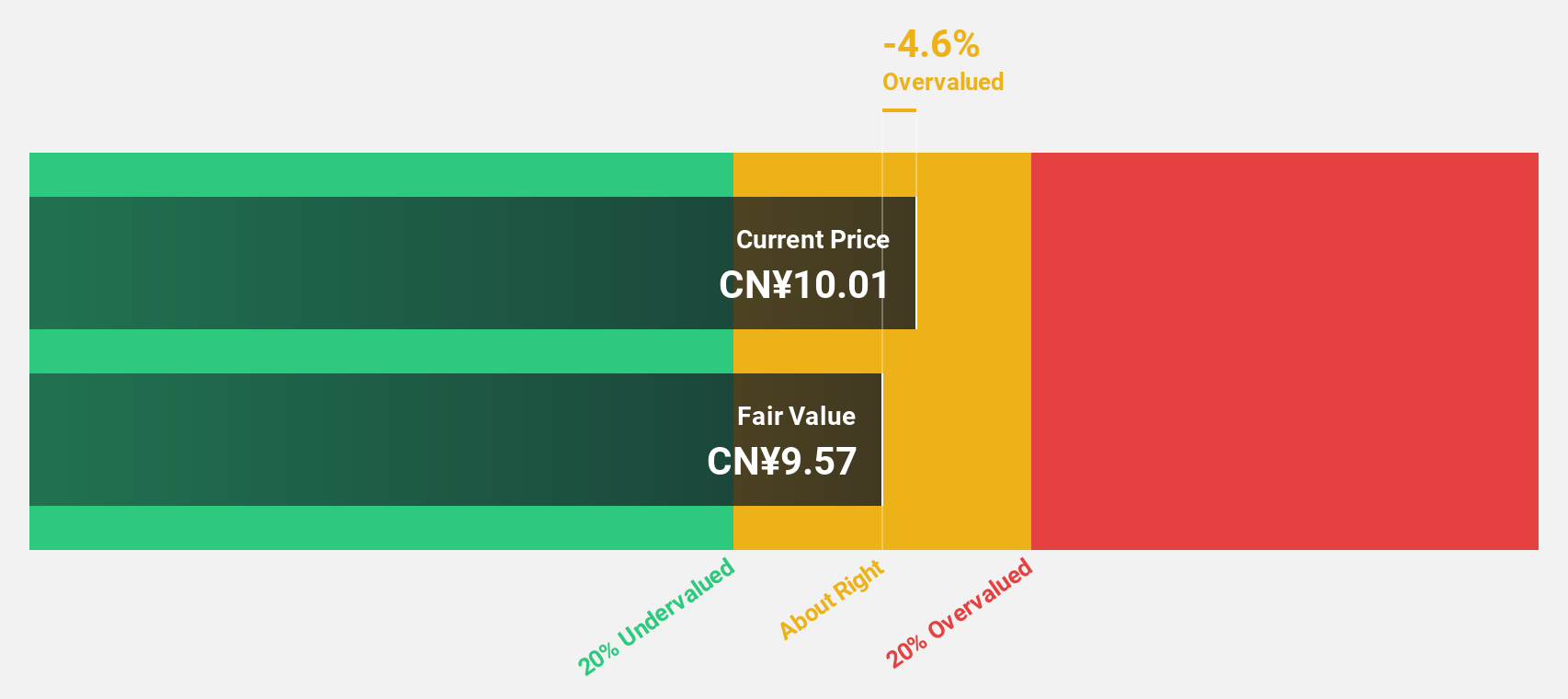

Estimated Discount To Fair Value: 24.5%

Giantec Semiconductor is trading at CN¥57.88, below its estimated fair value of CN¥76.71, indicating undervaluation based on cash flows. The company reported significant revenue growth to CN¥769.08 million for the first nine months of 2024, up from CN¥501.69 million a year ago, and net income rose to CN¥211.36 million from CN¥82.42 million. Earnings are forecasted to grow significantly at 42.3% annually over the next three years, outpacing market averages despite recent share price volatility.

- Our growth report here indicates Giantec Semiconductor may be poised for an improving outlook.

- Take a closer look at Giantec Semiconductor's balance sheet health here in our report.

Mebuki Financial GroupInc (TSE:7167)

Overview: Mebuki Financial Group, Inc., along with its subsidiaries, offers banking products and services both in Japan and internationally, with a market capitalization of approximately ¥664.84 billion.

Operations: Mebuki Financial Group, Inc. generates revenue through its banking products and services offered domestically and internationally.

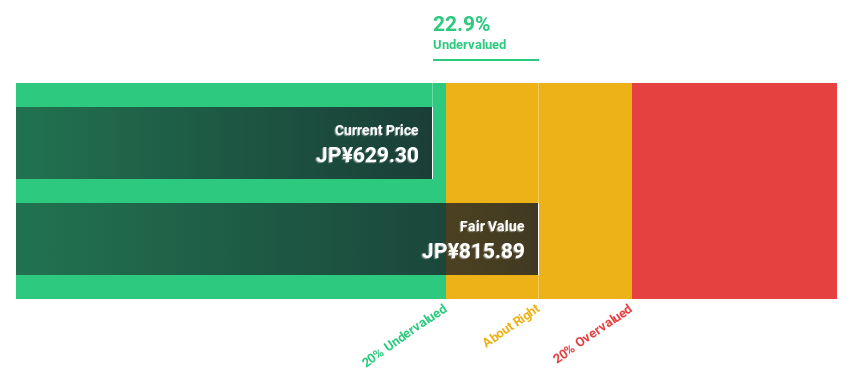

Estimated Discount To Fair Value: 16.5%

Mebuki Financial Group is trading at ¥675.7, below its estimated fair value of ¥809.07, suggesting undervaluation based on cash flows. The company's revenue is projected to grow at 20.2% annually, surpassing market averages, though earnings growth is moderate at 13.1%. Recent announcements include a share repurchase program and raised earnings guidance for fiscal 2025, reflecting efforts to enhance shareholder returns and improve capital efficiency amid an unstable dividend history.

- Insights from our recent growth report point to a promising forecast for Mebuki Financial GroupInc's business outlook.

- Unlock comprehensive insights into our analysis of Mebuki Financial GroupInc stock in this financial health report.

Seize The Opportunity

- Delve into our full catalog of 886 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7167

Mebuki Financial GroupInc

Provides banking products and services in Japan and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives