- South Korea

- /

- Pharma

- /

- KOSE:A003060

Risks Still Elevated At These Prices As Aprogen Biologics Inc. (KRX:003060) Shares Dive 26%

Unfortunately for some shareholders, the Aprogen Biologics Inc. (KRX:003060) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

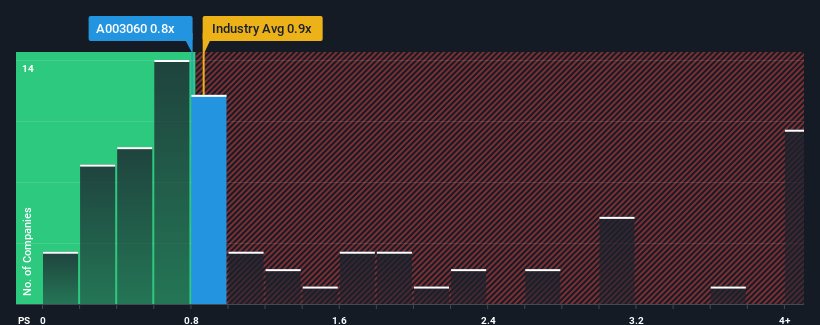

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Aprogen Biologics' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Korea is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Aprogen Biologics

What Does Aprogen Biologics' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Aprogen Biologics has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Aprogen Biologics' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Aprogen Biologics?

Aprogen Biologics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Pleasingly, revenue has also lifted 65% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 55% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Aprogen Biologics' P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Following Aprogen Biologics' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aprogen Biologics' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Aprogen Biologics (of which 1 is significant!) you should know about.

If you're unsure about the strength of Aprogen Biologics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003060

Aprogen Biologics

Manufactures and sells pharmaceutical products primarily in South Korea.

Adequate balance sheet slight.