- South Korea

- /

- Metals and Mining

- /

- KOSE:A002240

Undiscovered Gems with Potential for December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have faced particular challenges, reflecting broader investor sentiment and economic indicators. Despite these hurdles, the search for undiscovered gems remains compelling, as investors seek stocks with strong fundamentals that can thrive amidst fluctuating interest rates and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Kiswire (KOSE:A002240)

Simply Wall St Value Rating: ★★★★★★

Overview: Kiswire Ltd. is a global company specializing in the manufacture and sale of steel wires, with a market capitalization of ₩487.27 billion.

Operations: Kiswire generates revenue primarily from the sale of wire rods and ropes, with the wire rod segment contributing ₩1.12 trillion and the rope division adding ₩774.82 billion to its revenue streams.

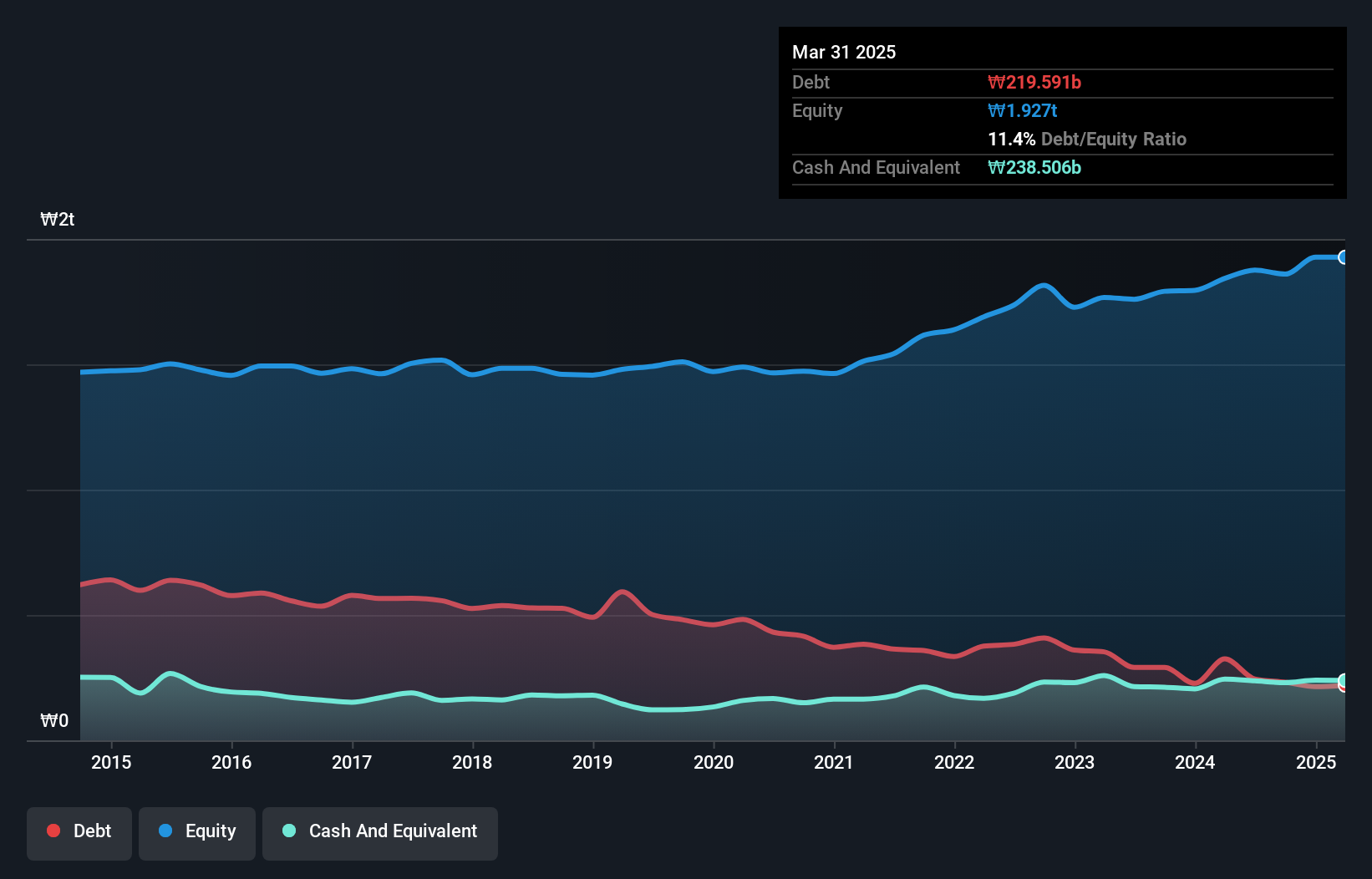

Kiswire's recent performance reveals a mixed bag of financial metrics. Trading at 73.2% below its fair value, it seems undervalued, offering potential for those seeking hidden opportunities. The company reported a net loss of ₩18,487 million in the latest quarter compared to a net income of ₩20,068 million last year, indicating some challenges. However, earnings grew by 43% over the past year despite industry struggles with -42% growth in metals and mining. A satisfactory net debt to equity ratio of 0.07% and well-covered interest payments (9.5x EBIT) highlight financial stability amidst these fluctuations.

- Click to explore a detailed breakdown of our findings in Kiswire's health report.

Gain insights into Kiswire's historical performance by reviewing our past performance report.

Stella Chemifa (TSE:4109)

Simply Wall St Value Rating: ★★★★★★

Overview: Stella Chemifa Corporation is engaged in the manufacturing and sale of inorganic fluorine compounds both domestically in Japan and internationally, with a market capitalization of ¥49.13 billion.

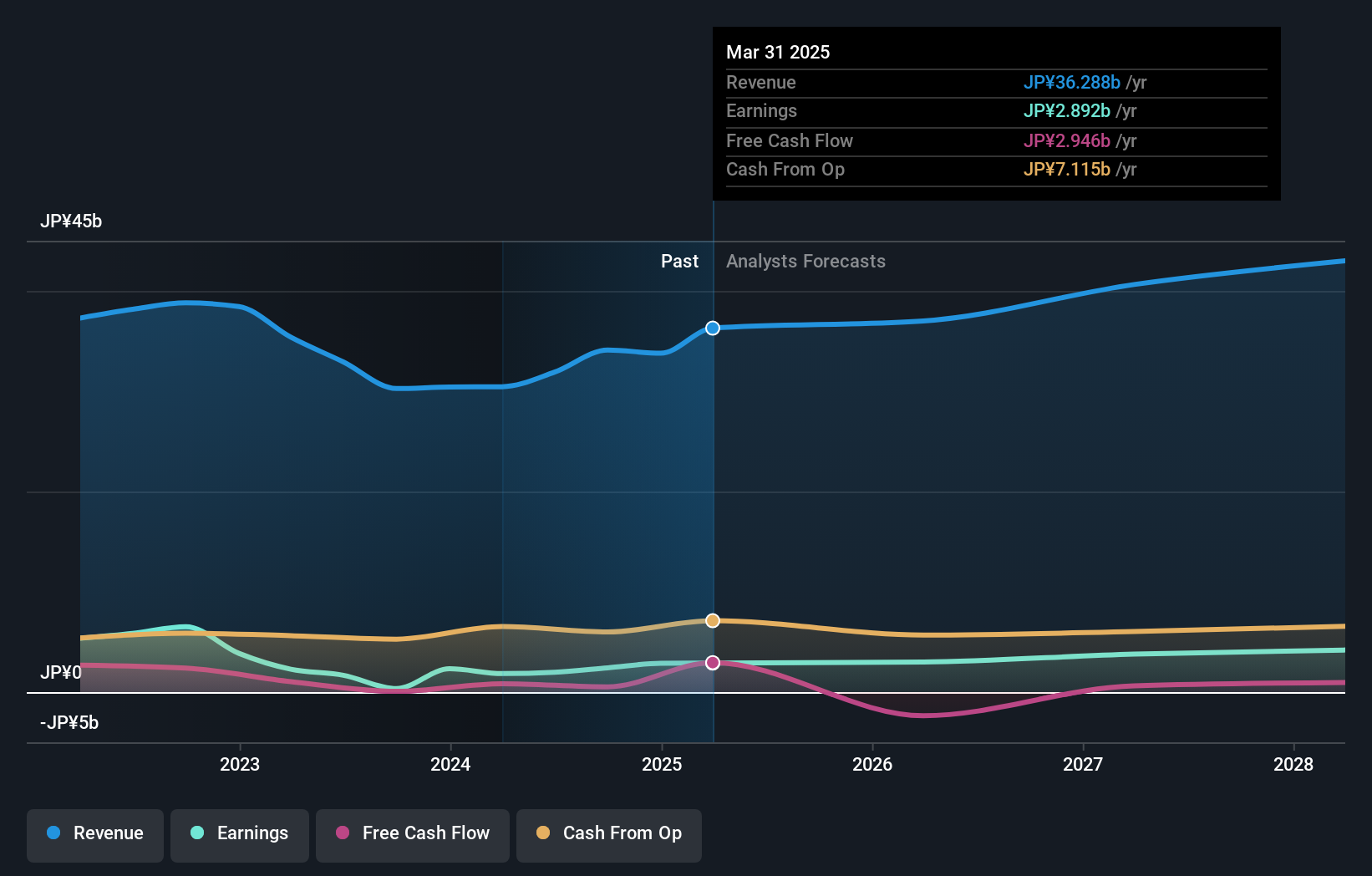

Operations: Stella Chemifa's primary revenue stream is from High-Purity Chemicals, generating ¥29.48 billion, followed by Transportation at ¥7.86 billion.

Stella Chemifa, a nimble player in the chemicals sector, has seen its earnings skyrocket by 585% over the past year, outpacing industry growth of 14%. Trading at a 48% discount to its estimated fair value, it presents an intriguing opportunity. The company's debt management appears robust, with cash exceeding total debt and a reduced debt-to-equity ratio from 31% to 10% over five years. Recently announcing a share repurchase program worth ¥1.2 billion for capital efficiency and shareholder returns further underscores its strategic focus on enhancing value. Future earnings are forecasted to grow annually by nearly 20%.

- Get an in-depth perspective on Stella Chemifa's performance by reading our health report here.

Understand Stella Chemifa's track record by examining our Past report.

Iwaki (TSE:6237)

Simply Wall St Value Rating: ★★★★★☆

Overview: Iwaki Co., Ltd. manufactures and sells chemical pumps and pump controller products for OEMs across various markets and applications both in Japan and internationally, with a market cap of ¥56.24 billion.

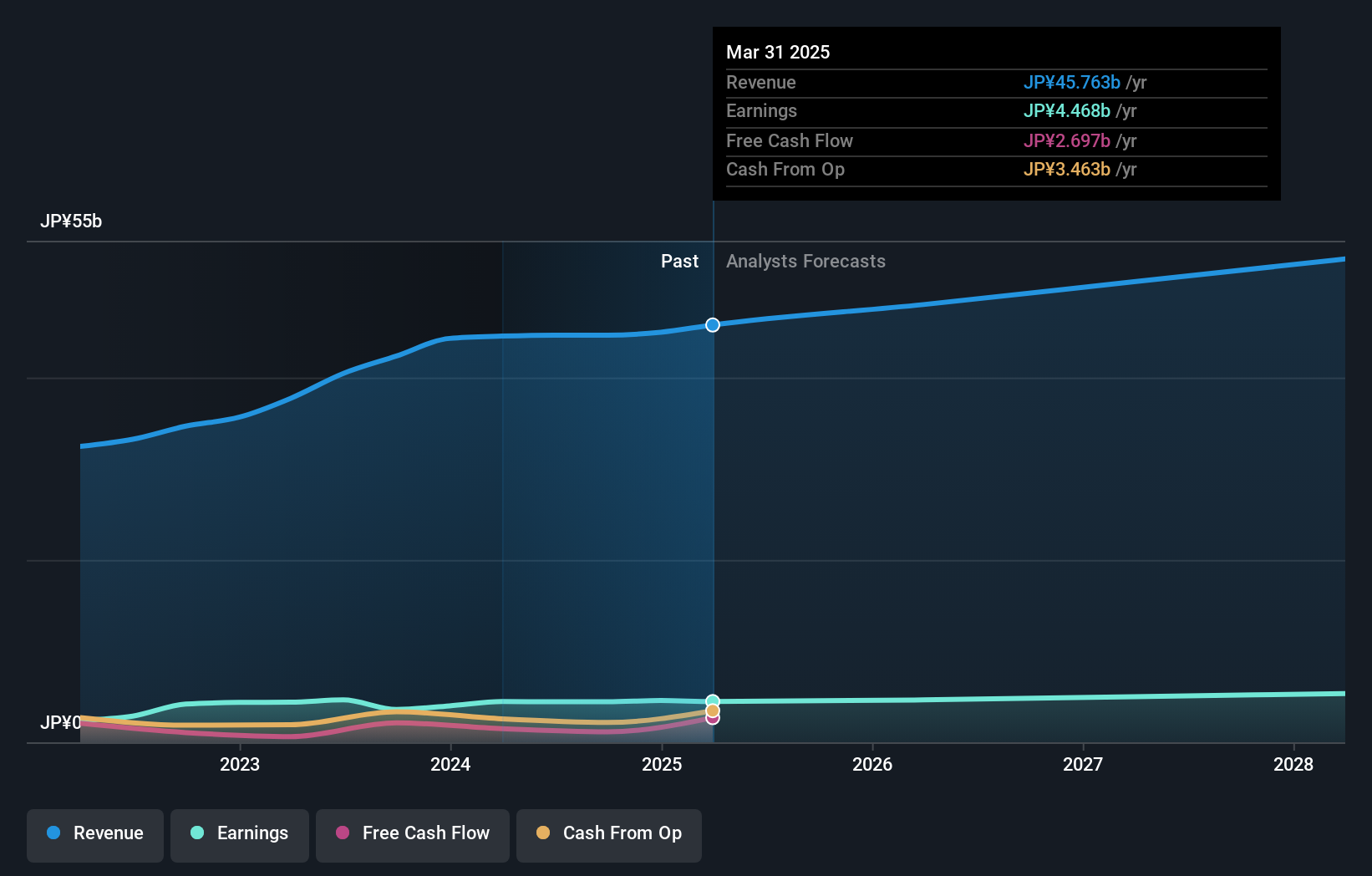

Operations: The Chemical Pump Business is the primary revenue stream for Iwaki Co., Ltd., generating ¥44.64 billion in sales.

Iwaki, a notable player in the machinery sector, showcases a compelling profile with its price-to-earnings ratio of 12.8x, favorably lower than the JP market's 13.5x. Over the past year, earnings have surged by 23.5%, significantly outpacing the industry average of 0.8%. The company is not only profitable but also free cash flow positive, indicating robust financial health and operational efficiency. Recently, Iwaki announced an increased dividend of ¥25 per share compared to ¥21 last year, reflecting confidence in its ongoing performance and future prospects for growth at an anticipated rate of 5.5% annually.

- Click here to discover the nuances of Iwaki with our detailed analytical health report.

Review our historical performance report to gain insights into Iwaki's's past performance.

Next Steps

- Unlock our comprehensive list of 4632 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiswire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A002240

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives