- South Korea

- /

- Pharma

- /

- KOSE:A009420

Spotlight On Hanall Biopharma And 2 Other Stocks Believed To Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the midst of a volatile global market, marked by cautious Federal Reserve commentary and political uncertainties, investors are navigating a landscape where U.S. stocks have experienced declines and economic data presents mixed signals. With interest rates in flux and inflation concerns persisting, identifying undervalued stocks becomes crucial for those seeking potential opportunities amidst broader market challenges. In such an environment, a good stock is often characterized by strong fundamentals that suggest it may be trading below its intrinsic value, offering potential for growth as market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥43.43 | CN¥86.61 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.95 | ₹2250.68 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

Let's explore several standout options from the results in the screener.

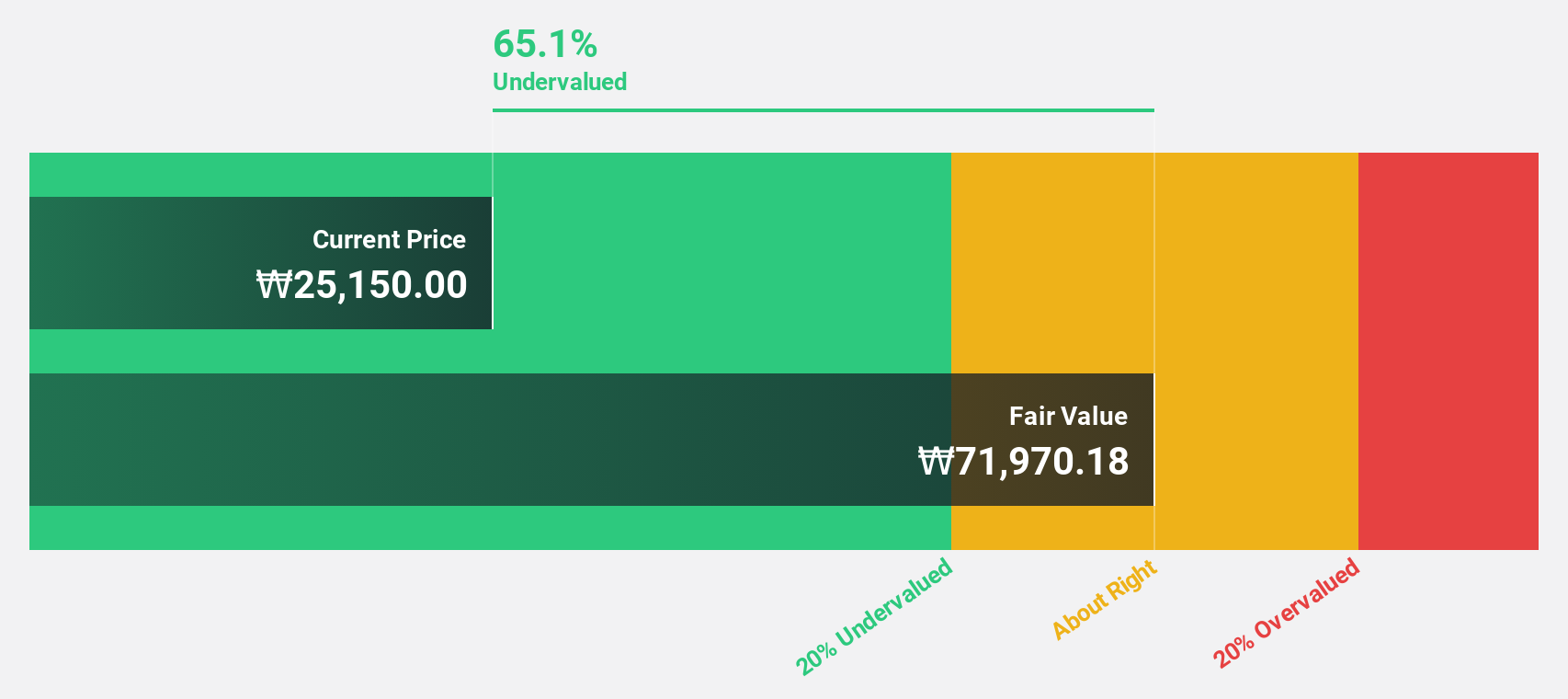

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩1.75 trillion.

Operations: The company's revenue segment is primarily derived from the manufacture and sale of pharmaceuticals, totaling ₩134.24 billion.

Estimated Discount To Fair Value: 47.6%

Hanall Biopharma is trading significantly below its estimated fair value, suggesting potential undervaluation. Despite recent earnings declines, the company is expected to achieve profitability within three years with above-average market growth. Its diverse pipeline, including promising developments in Parkinson's and dry eye treatments, enhances its long-term prospects. However, share price volatility remains a concern. Analysts agree on a potential stock price rise of over 50%, reflecting optimism about future performance amidst ongoing product advancements.

- Our growth report here indicates Hanall Biopharma may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Hanall Biopharma's balance sheet health report.

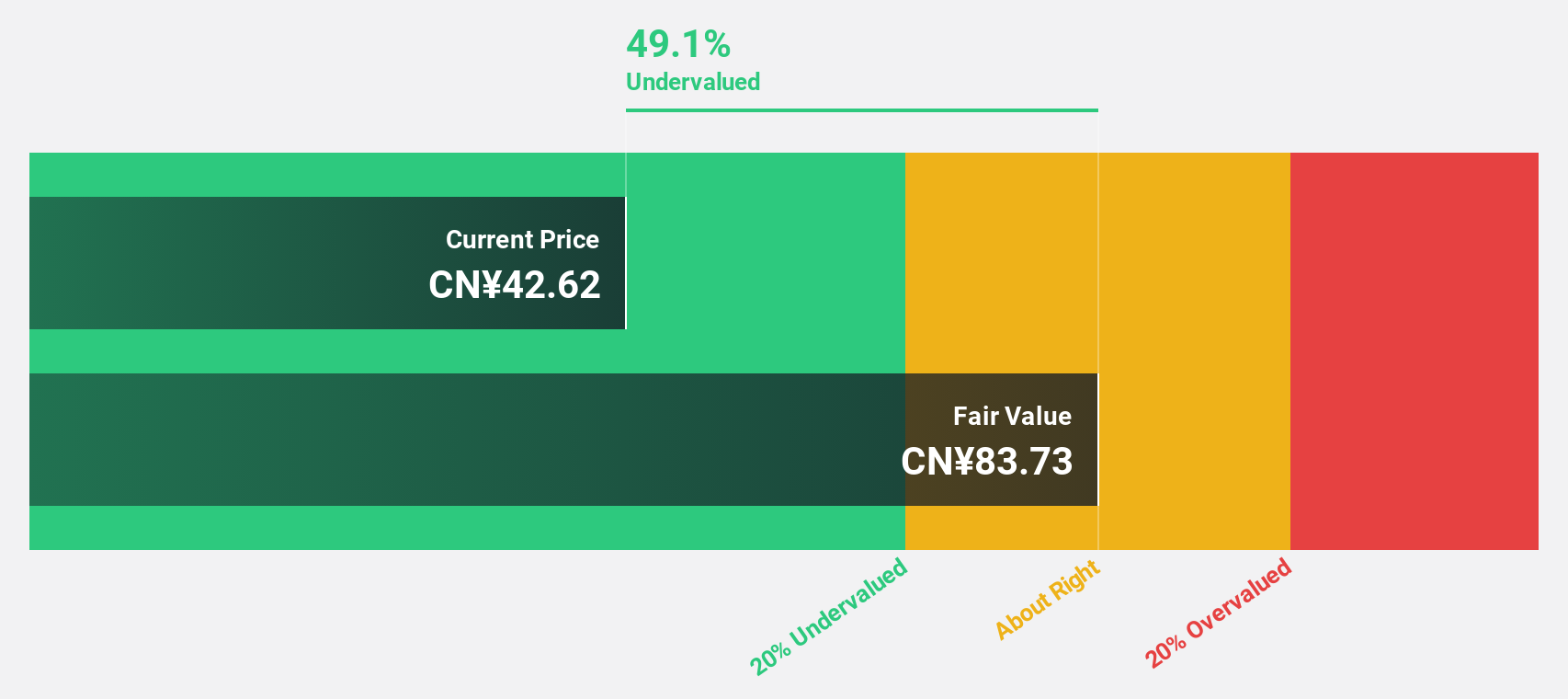

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. focuses on the R&D, design, production, sale, and service of cosmetics in China with a market cap of CN¥13.85 billion.

Operations: The company's revenue is primarily derived from Personal Products, totaling CN¥2.64 billion.

Estimated Discount To Fair Value: 13.9%

Guangdong Marubi Biotechnology is trading 13.9% below its estimated fair value of CN¥40.09, indicating potential undervaluation based on cash flows. The company reported a revenue increase to CN¥1.95 billion and net income of CN¥238.8 million for the first nine months of 2024, reflecting strong performance despite large one-off items affecting earnings quality. While earnings are forecast to grow significantly at 25.34% annually, dividend coverage remains weak due to limited free cash flow support.

- In light of our recent growth report, it seems possible that Guangdong Marubi Biotechnology's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Guangdong Marubi Biotechnology stock in this financial health report.

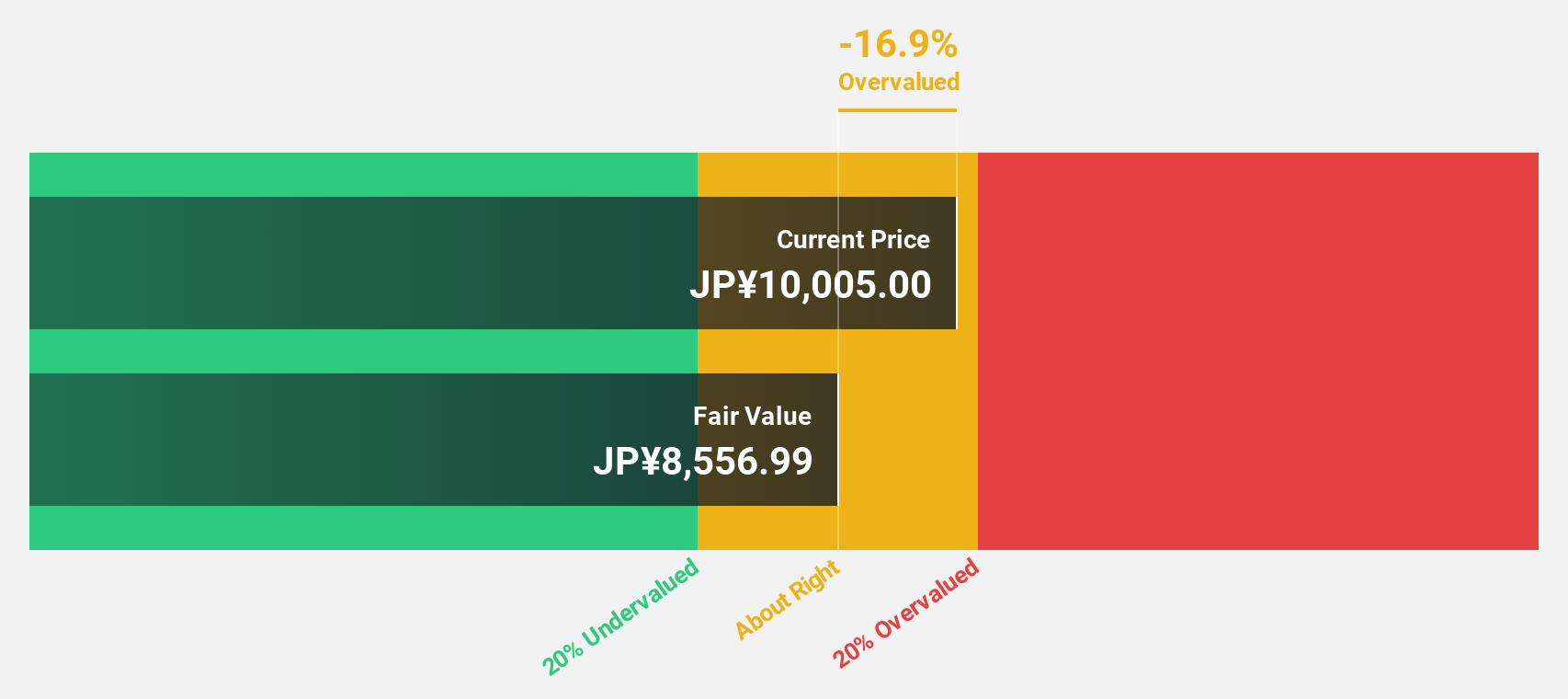

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated is a company that develops and sells security-related software for computers and related services both in Japan and internationally, with a market cap of ¥1.10 trillion.

Operations: The company's revenue segments are ¥85.04 billion from Japan, ¥65.17 billion from Europe, ¥70.30 billion from the Americas, and ¥125.59 billion from the Asia Pacific region.

Estimated Discount To Fair Value: 24.1%

Trend Micro is trading at ¥8560, over 24% below its estimated fair value of ¥11275.53, highlighting potential undervaluation based on cash flows. The company forecasts revenue growth of 5.7% annually, surpassing the JP market average. Recent initiatives include AI-driven security tools enhancing cloud protection and a partnership with the Paris Peace Forum to advance global AI security frameworks, potentially strengthening Trend Micro's position in cybersecurity innovation and governance.

- The analysis detailed in our Trend Micro growth report hints at robust future financial performance.

- Dive into the specifics of Trend Micro here with our thorough financial health report.

Taking Advantage

- Click here to access our complete index of 871 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanall Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009420

Hanall Biopharma

A pharmaceutical company, manufactures and sells pharmaceutical products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives