- South Korea

- /

- Machinery

- /

- KOSE:A267270

Asian Market: AprilBioLtd And 2 Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, investors are increasingly looking towards Asian markets for potential opportunities. In this climate, identifying stocks that may be undervalued becomes crucial, as these could offer resilience amidst volatility and an attractive entry point for long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shanghai V-Test Semiconductor Tech (SHSE:688372) | CN¥82.38 | CN¥163.36 | 49.6% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥50.25 | CN¥97.87 | 48.7% |

| Nan Juen International (TPEX:6584) | NT$233.00 | NT$454.20 | 48.7% |

| Japan Eyewear Holdings (TSE:5889) | ¥2103.00 | ¥4095.17 | 48.6% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥61.70 | CN¥120.88 | 49% |

| GigaVis (KOSDAQ:A420770) | ₩40850.00 | ₩80645.70 | 49.3% |

| Everest Medicines (SEHK:1952) | HK$53.20 | HK$105.05 | 49.4% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥67.78 | CN¥132.90 | 49% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.25 | CN¥59.80 | 49.4% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥28.07 | CN¥54.50 | 48.5% |

We'll examine a selection from our screener results.

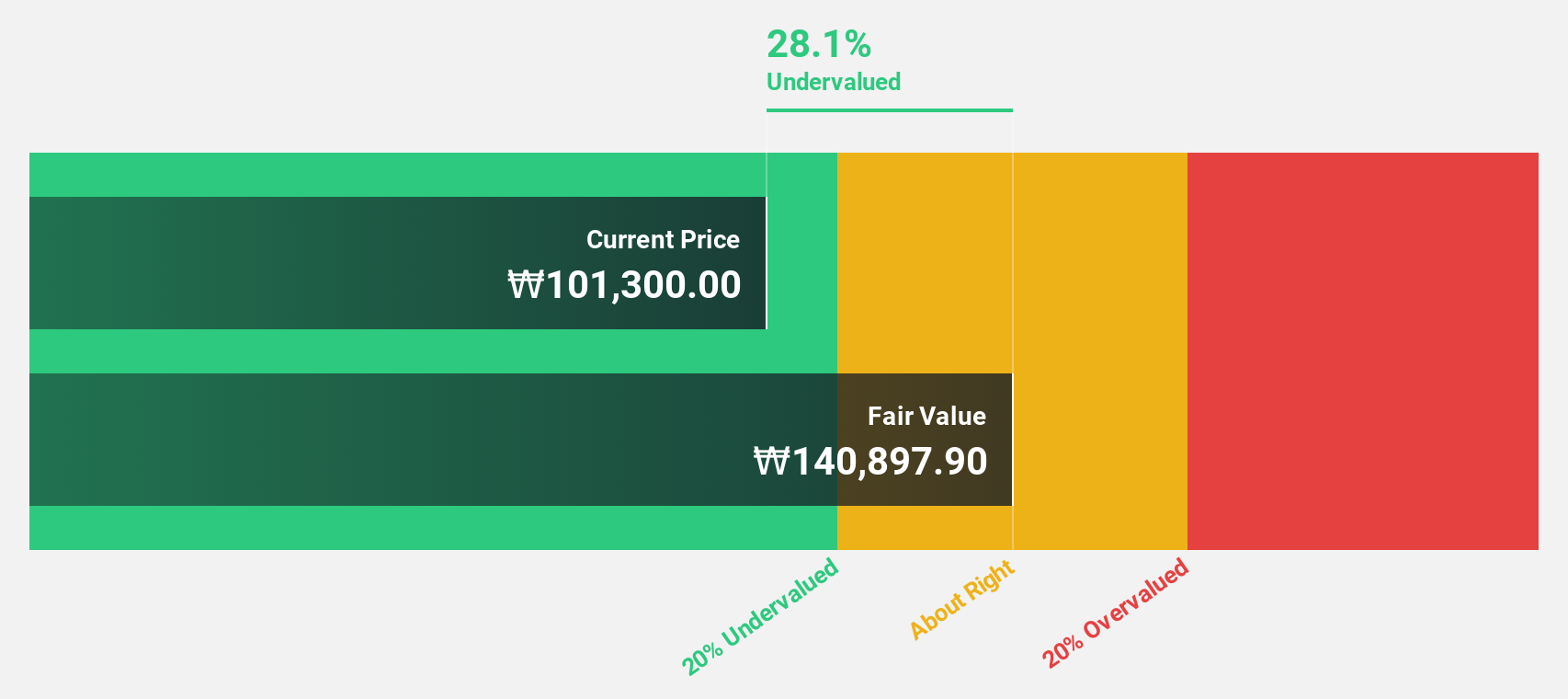

AprilBioLtd (KOSDAQ:A397030)

Overview: AprilBio Co., Ltd. develops long-acting biobetter and antibody biologics, with a market cap of ₩775.16 billion.

Operations: AprilBio Co., Ltd. does not have specified revenue segments available in the provided text.

Estimated Discount To Fair Value: 30.7%

AprilBio Ltd. is trading at ₩34,350, which is 30.7% below its estimated fair value of ₩49,573.33, indicating it may be undervalued based on cash flows. The company forecasts significant earnings growth of 87.12% annually and revenue growth of 64% per year, outpacing the Korean market averages. However, recent profit margins have declined from last year's levels and the stock has experienced high price volatility over the past three months.

- Upon reviewing our latest growth report, AprilBioLtd's projected financial performance appears quite optimistic.

- Take a closer look at AprilBioLtd's balance sheet health here in our report.

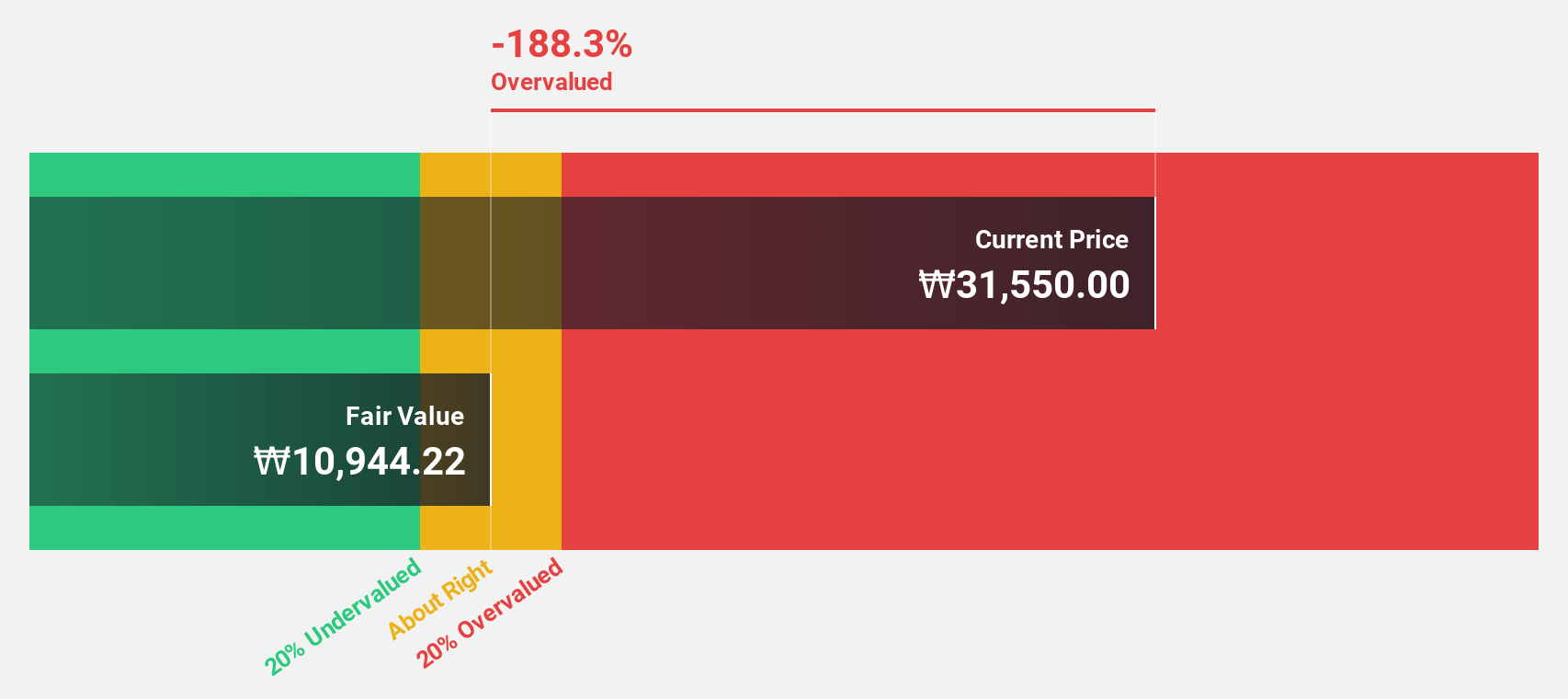

HD Hyundai Construction Equipment (KOSE:A267270)

Overview: HD Hyundai Construction Equipment Co., Ltd. operates in the construction machinery industry, focusing on manufacturing and distributing equipment like excavators and loaders, with a market cap of ₩1.68 trillion.

Operations: The company's revenue primarily comes from its Construction Machinery & Equipment segment, totaling ₩3.48 billion.

Estimated Discount To Fair Value: 28.4%

HD Hyundai Construction Equipment is trading at ₩96,600, significantly below its estimated fair value of ₩134,923.95, highlighting potential undervaluation based on cash flows. Despite earnings being forecast to grow 47.4% annually—surpassing the Korean market's growth rate—recent financial results show a decline in net income and earnings per share compared to the previous year. Additionally, the company's recent share buyback program may influence investor sentiment positively despite these concerns.

- According our earnings growth report, there's an indication that HD Hyundai Construction Equipment might be ready to expand.

- Click here to discover the nuances of HD Hyundai Construction Equipment with our detailed financial health report.

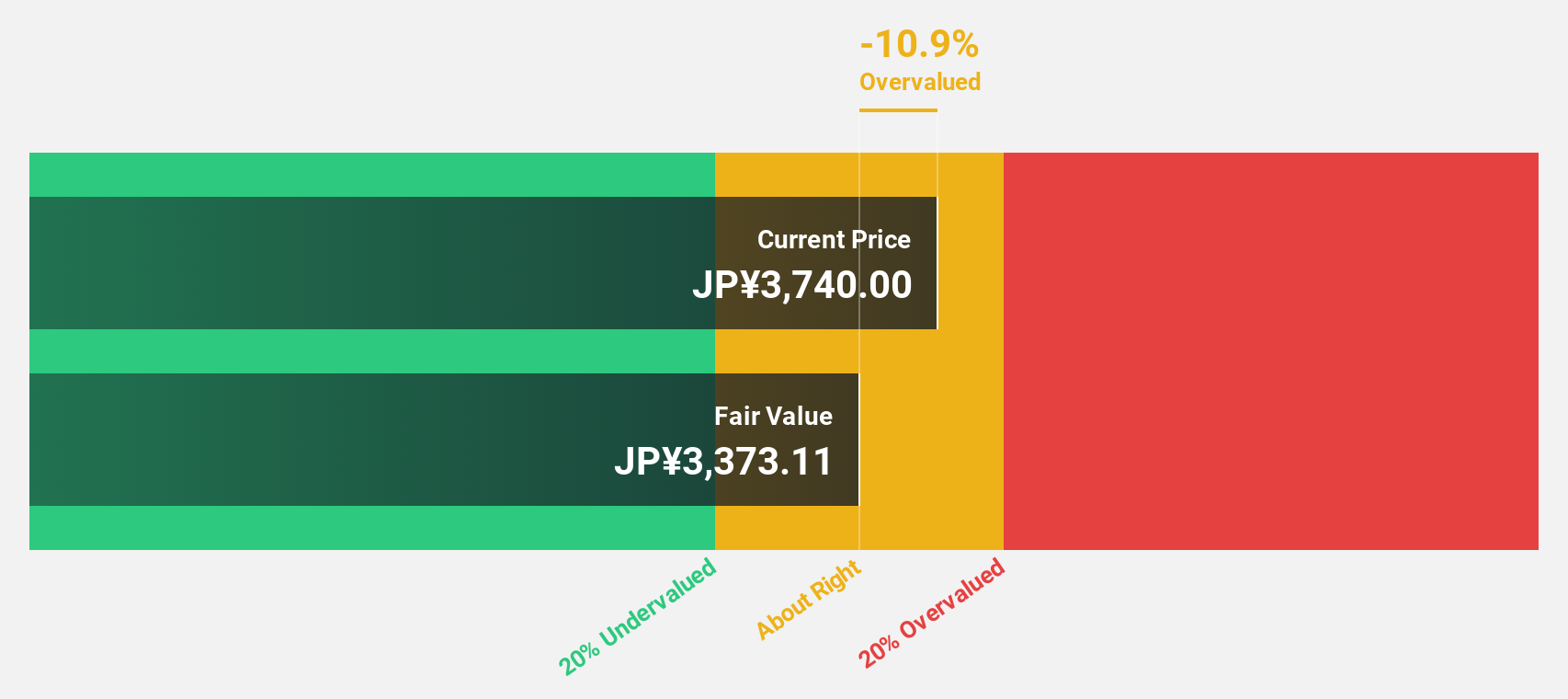

freee K.K (TSE:4478)

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan and has a market cap of ¥216.46 billion.

Operations: The company's revenue is primarily derived from its Platform Business segment, which generated ¥33.27 billion.

Estimated Discount To Fair Value: 34%

freee K.K. is trading at ¥3,635, over 20% below its estimated fair value of ¥5,508.41, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 37.05% annually, outpacing the Japanese market's growth rate of 8%. Despite recent volatility in share price and board decisions on restricted shares and compensation plans, its revenue is expected to rise by 16.7%, driven by SaaS business expansion.

- Our earnings growth report unveils the potential for significant increases in freee K.K's future results.

- Unlock comprehensive insights into our analysis of freee K.K stock in this financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 279 Undervalued Asian Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Construction Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A267270

HD Hyundai Construction Equipment

HD Hyundai Construction Equipment Co.,Ltd.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives