- South Korea

- /

- Biotech

- /

- KOSDAQ:A298380

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

In the wake of a significant political shift in the U.S., global markets have been buoyed by optimism surrounding potential economic growth, with major indices like the S&P 500 and Russell 2000 experiencing notable gains. As investors navigate these evolving conditions, identifying high-growth tech stocks that can capitalize on favorable regulatory and tax environments becomes crucial for those seeking to align their portfolios with current market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.94 trillion.

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, specifically focusing on startups, with reported earnings of ₩32.95 billion. The company is engaged in developing therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio's recent presentation at the World ADC Conference underscores its commitment to innovation, particularly in protein engineering—a critical segment in biotech. Despite current unprofitability, the company is poised for significant growth with expected revenue increases of 24.7% annually, outpacing the Korean market's 10.2%. This potential is further underscored by an anticipated earnings surge of 48.15% per year. However, challenges remain due to its volatile share price and ongoing cash flow concerns. ABL Bio’s focus on strategic R&D investments could catalyze its transition to profitability within three years, aligning with industry benchmarks for growth and offering a glimpse into its future prospects in high-growth biotechnology sectors.

- Get an in-depth perspective on ABL Bio's performance by reading our health report here.

Explore historical data to track ABL Bio's performance over time in our Past section.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

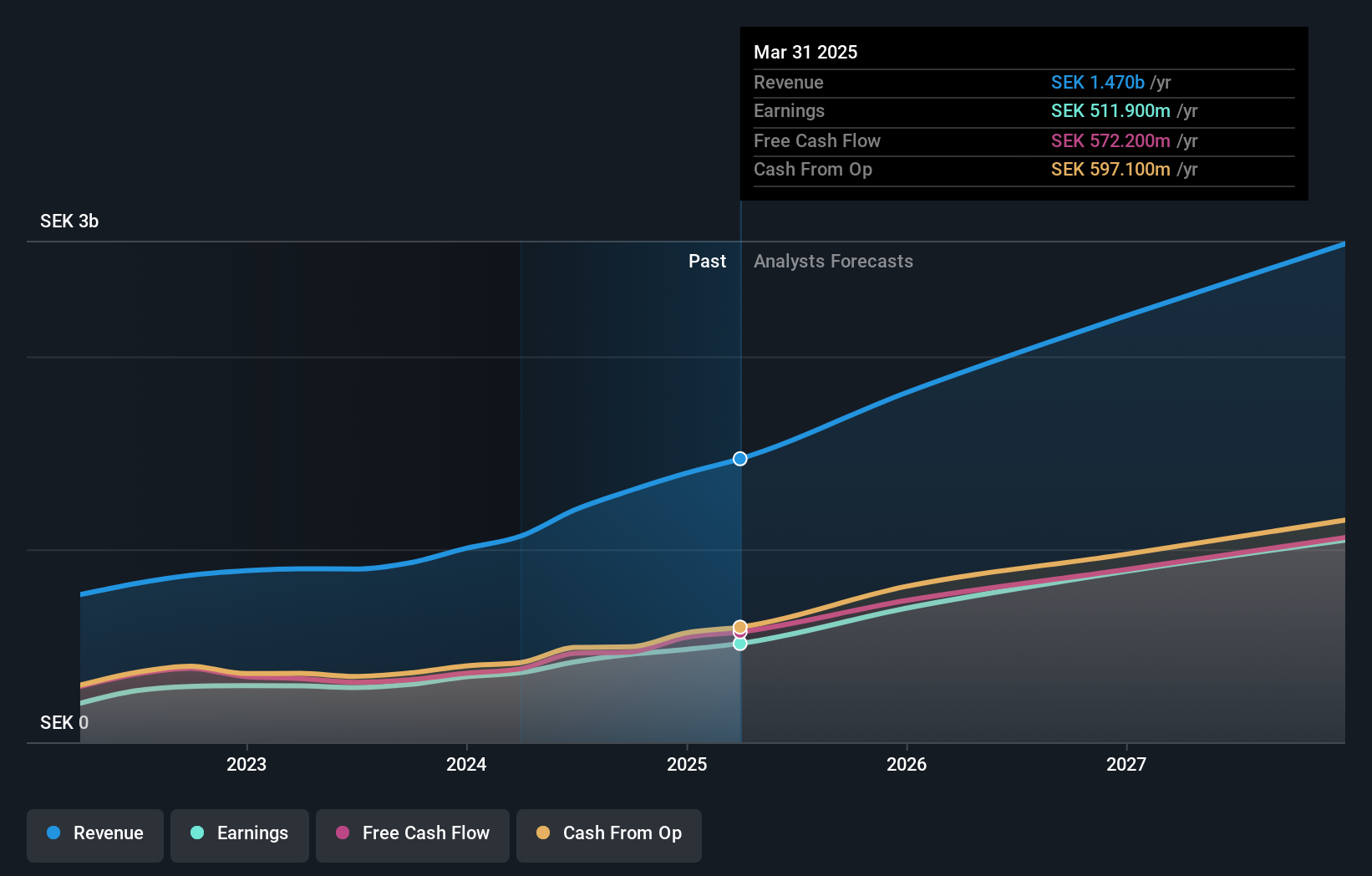

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market capitalization of approximately SEK33.93 billion.

Operations: Hemnet Group AB generates revenue primarily from its Internet Information Providers segment, amounting to SEK1.31 billion. The company operates a residential property platform in Sweden, focusing on digital services related to real estate listings and information.

With a robust 52% earnings growth over the past year, Hemnet Group AB significantly outperforms its industry average. This growth trajectory is supported by an impressive forecast of 24.7% annual earnings increase, surpassing the broader Swedish market's expectation of 15.6%. The company also reported a notable revenue upswing from SEK 272 million to SEK 372.6 million in its latest quarterly results, underlining a consistent upward trend with an anticipated annual revenue growth rate of 19.6%. The recent appointment of Jonas Gustafsson as CEO heralds potential strategic shifts and further digital transformation, positioning Hemnet at the forefront of Sweden's property platform sector amidst evolving market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Hemnet Group.

Gain insights into Hemnet Group's historical performance by reviewing our past performance report.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system and geospatial intelligence software products and services both in China and internationally, with a market cap of CN¥10.25 billion.

Operations: The company generates revenue primarily from its geographic information system (GIS) and geospatial intelligence software products and services. Its operations span both domestic and international markets, contributing to a market capitalization of CN¥10.25 billion.

Beijing SuperMap Software has demonstrated a notable resilience and adaptability in the tech sector, despite recent fluctuations in financial performance. The company's revenue growth forecast of 26.6% annually outpaces the broader Chinese market's 13.9%, highlighting its potential to capture more market share. Moreover, an aggressive earnings growth projection at 53.1% per year underscores its operational efficiency and innovation-driven approach, particularly in R&D where investments are keenly aligned with evolving market demands and technological advancements. This strategic focus on development is crucial as it navigates through a competitive landscape marked by rapid changes in technology and client needs. Recent buyback activities further reflect confidence in its strategic direction, with a completion of repurchasing approximately 2.02% of outstanding shares for CNY 140.21 million, signaling a proactive stance in enhancing shareholder value amidst market volatilities. However, it's essential to note that while these buybacks underscore management’s belief in the firm's intrinsic value, they also highlight the challenges faced during periods of significant income reductions as seen from recent earnings reports—net income plummeted from CNY 135.44 million to CNY 26.31 million year-over-year for the nine months ended September 2024.

Make It Happen

- Get an in-depth perspective on all 1278 High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A298380

ABL Bio

A biotech research company, focuses on the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases.

High growth potential with adequate balance sheet.