- South Korea

- /

- Biotech

- /

- KOSDAQ:A244460

Should OLIPASS (KOSDAQ:244460) Be Disappointed With Their 21% Profit?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the OLIPASS Corporation (KOSDAQ:244460) share price is up 21% in the last year, that falls short of the market return. We'll need to follow OLIPASS for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for OLIPASS

OLIPASS isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

OLIPASS grew its revenue by 242% last year. That's well above most other pre-profit companies. Let's face it the 21% share price gain in that time is underwhelming compared to the growth. It could be that the market is missing what growth investor Matt Joass calls 'the hidden power of inflection points'. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

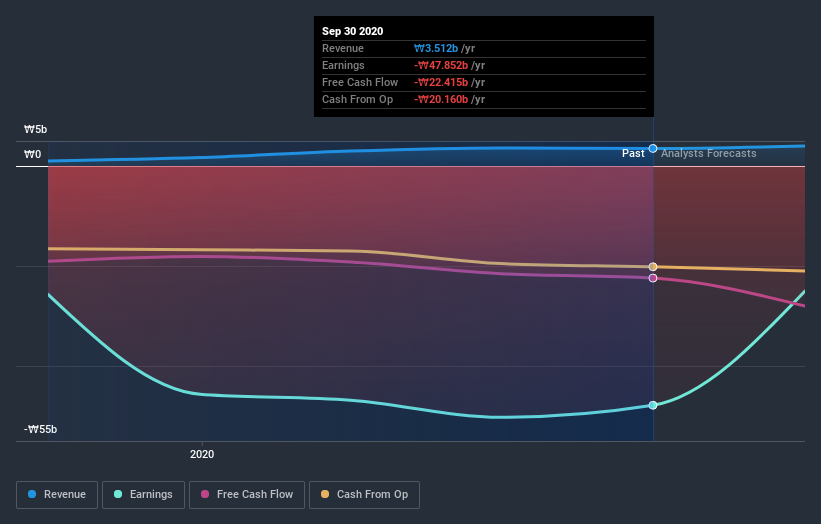

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

OLIPASS shareholders have gained 21% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 38%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 56% in just ninety days. The very recent increase in the share price could be evidence that the narrative is changing for the better due to fundamental improvements. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for OLIPASS that you should be aware of before investing here.

Of course OLIPASS may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade OLIPASS, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A244460

OLIPASS

A biotech company, focuses on developing therapeutic products in South Korea.

Moderate with mediocre balance sheet.