- South Korea

- /

- Pharma

- /

- KOSDAQ:A068760

Does Celltrion Pharm (KOSDAQ:068760) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Celltrion Pharm (KOSDAQ:068760), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Celltrion Pharm

Celltrion Pharm's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Celltrion Pharm has grown EPS by 54% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

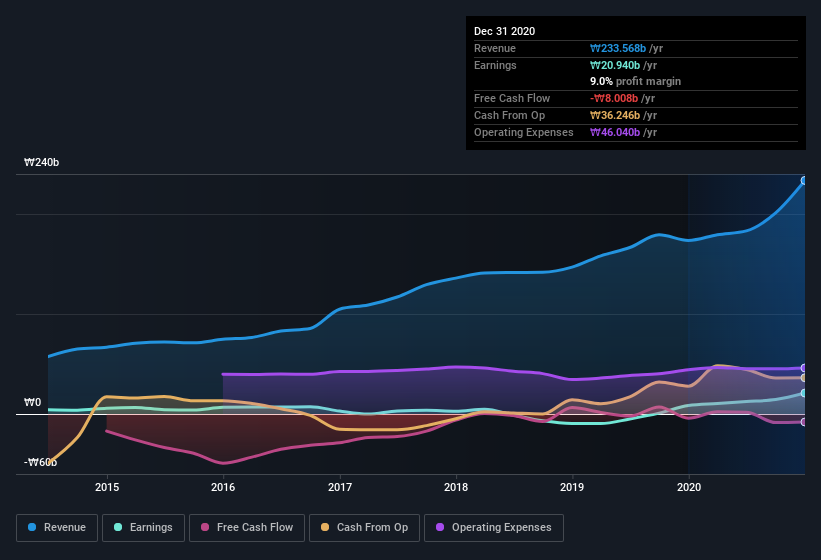

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Celltrion Pharm maintained stable EBIT margins over the last year, all while growing revenue 35% to ₩234b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Celltrion Pharm's balance sheet strength, before getting too excited.

Are Celltrion Pharm Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Celltrion Pharm shares worth a considerable sum. To be specific, they have ₩22b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Celltrion Pharm Deserve A Spot On Your Watchlist?

Celltrion Pharm's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Celltrion Pharm is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Before you take the next step you should know about the 2 warning signs for Celltrion Pharm (1 is potentially serious!) that we have uncovered.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Celltrion Pharm, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A068760

Celltrion Pharm

A pharmaceutical company, develops and sells biosimilars and over-the-counter drugs in South Korea.

Minimal with weak fundamentals.

Similar Companies

Market Insights

Community Narratives