- South Korea

- /

- Industrials

- /

- KOSE:A004990

3 Growth Companies With Insider Ownership Up To 32%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts in Europe and expectations of further monetary easing from the Federal Reserve, investors are keenly observing growth stocks that continue to outperform their value counterparts. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

LOTTE (KOSE:A004990)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LOTTE Corporation operates globally across various sectors including food, retail, tourism, chemical, construction, and finance with a market cap of ₩1.74 trillion.

Operations: The company's revenue is primarily derived from its food segment at ₩9.16 billion, followed by distribution at ₩5.42 billion, and computer system construction at ₩1.20 billion, with additional contributions from its advertising agency segment amounting to ₩297.45 million.

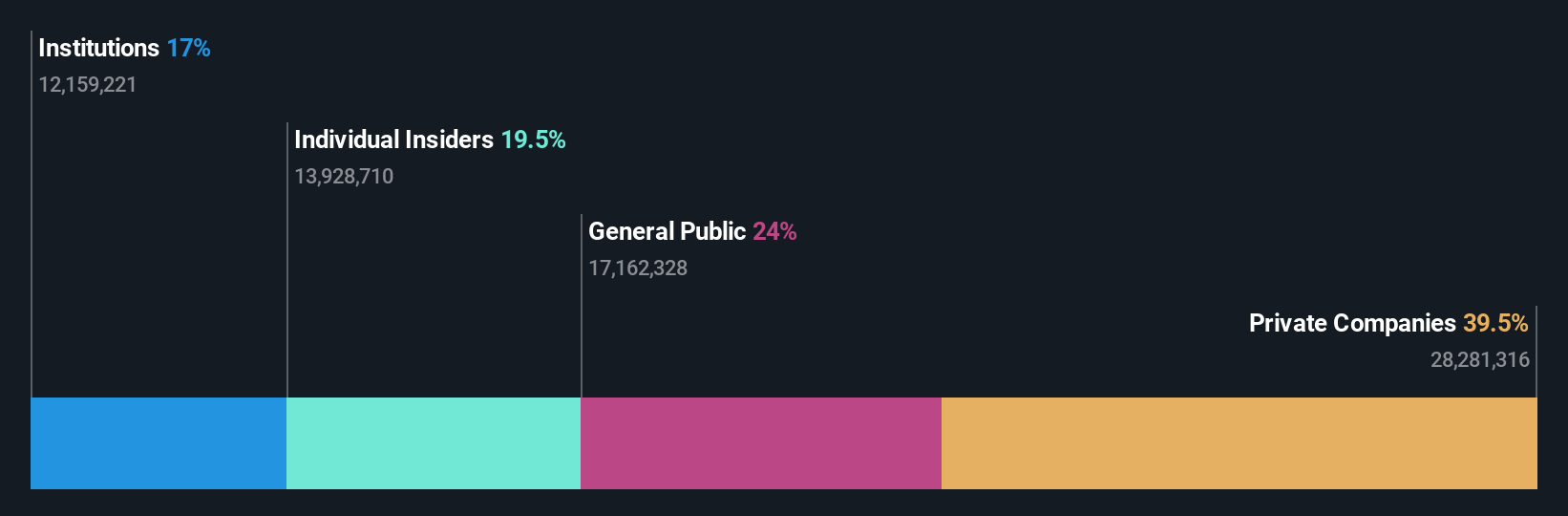

Insider Ownership: 22.5%

LOTTE Corporation's recent earnings report reveals a challenging financial position, with significant net losses despite increased sales. The company's dividend is not well covered by earnings or cash flows, raising sustainability concerns. However, LOTTE is trading at a substantial discount to its estimated fair value and offers good relative value compared to peers. Analysts forecast above-average profit growth over the next three years, although revenue growth is expected to be modestly higher than the market average.

- Get an in-depth perspective on LOTTE's performance by reading our analyst estimates report here.

- The analysis detailed in our LOTTE valuation report hints at an deflated share price compared to its estimated value.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

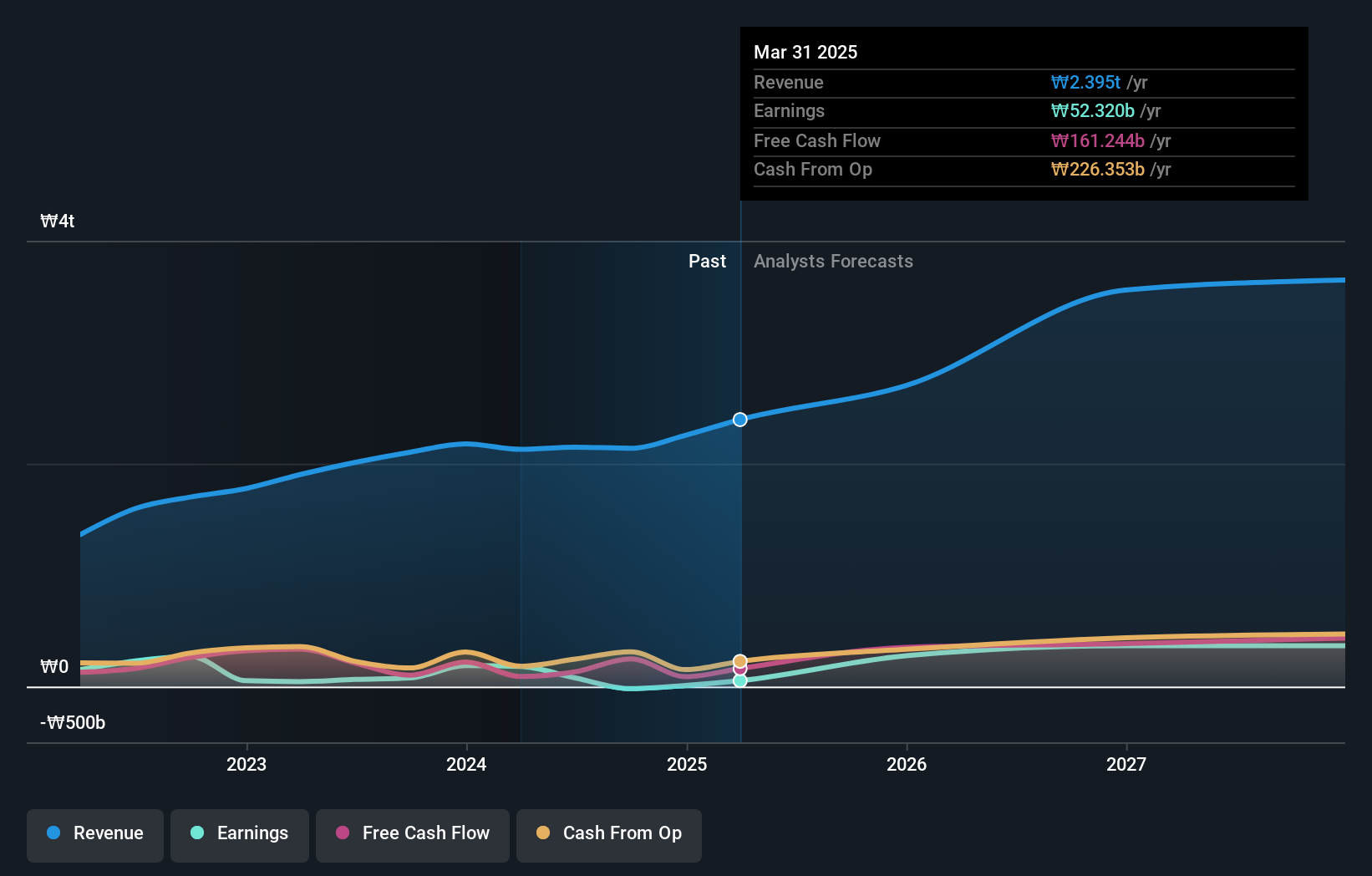

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩8.50 trillion.

Operations: The company's revenue segments include Label at ₩1.29 trillion, Platform at ₩337.18 million, and Solution at ₩1.21 trillion.

Insider Ownership: 32.5%

HYBE's recent leadership reshuffles aim to bolster sustainable growth and competitiveness, with key appointments reinforcing insider influence. Despite a challenging third quarter, with net income dropping significantly year-over-year, the company remains focused on expansion. Analysts expect HYBE's revenue to grow 16.1% annually, outpacing the market average of 5.2%, and forecast profitability within three years. The recent KRW 400 billion private placement indicates strategic financial maneuvers to support growth ambitions in the global music market.

- Click here to discover the nuances of HYBE with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that HYBE is priced higher than what may be justified by its financials.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Micro-Star International Co., Ltd. is engaged in the manufacturing and sale of motherboards, interface cards, notebook computers, and other electronic products across Asia, Europe, the United States, and globally with a market cap of NT$151.65 billion.

Operations: The company's revenue from the Computer and Peripherals Segment is NT$195.51 billion.

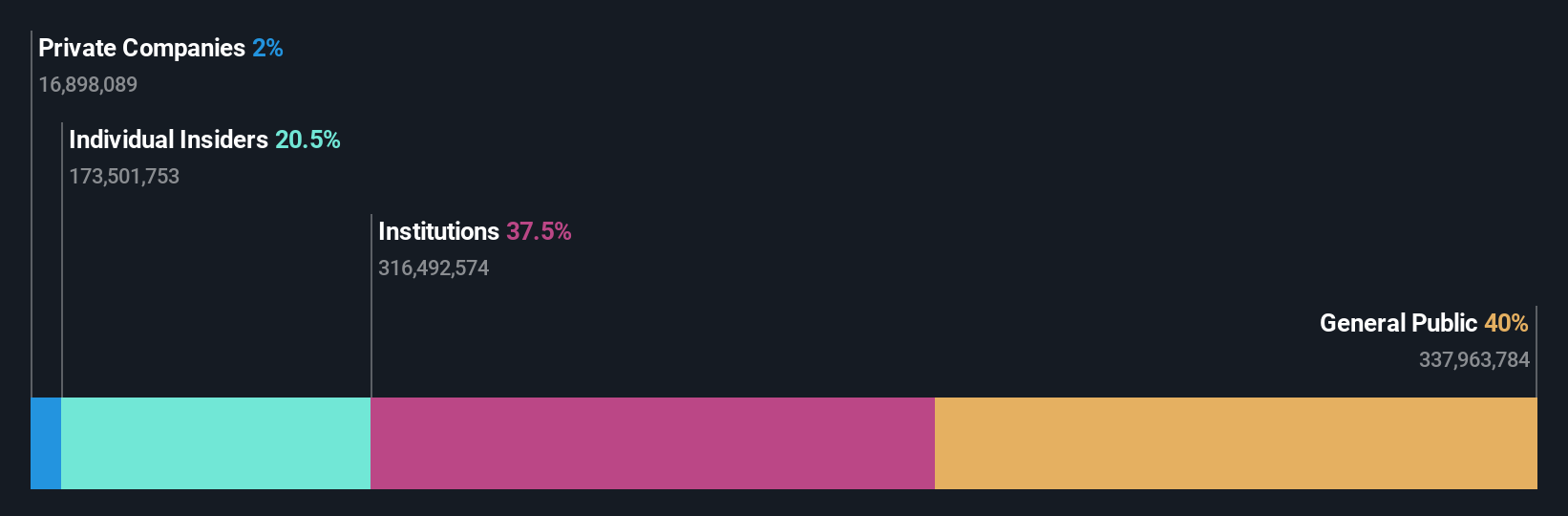

Insider Ownership: 20.5%

Micro-Star International's high insider ownership aligns with its growth trajectory, as analysts forecast earnings to grow significantly at 26.5% annually, surpassing the Taiwan market average. Despite a decline in recent quarterly net income to TWD 1.73 billion, MSI's strategic focus on AI and HPC solutions, including new server offerings with NVIDIA and Intel technologies, positions it well for future demand. Trading at a substantial discount to estimated fair value enhances its investment appeal amidst evolving tech landscapes.

- Take a closer look at Micro-Star International's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Micro-Star International's current price could be quite moderate.

Where To Now?

- Access the full spectrum of 1568 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004990

LOTTE

Engages in the food, retail, chemical, construction, manufacturing, tourism, service, and finance businesses worldwide.

Undervalued with moderate growth potential.

Market Insights

Community Narratives