As we enter January 2025, global markets have been marked by mixed performances, with the S&P 500 and Nasdaq Composite closing out a strong year despite recent economic concerns highlighted by a declining Chicago PMI and revised GDP forecasts. In this environment of fluctuating indices and cautious economic outlooks, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability in response to evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Studio Dragon (KOSDAQ:A253450)

Simply Wall St Growth Rating: ★★★★☆☆

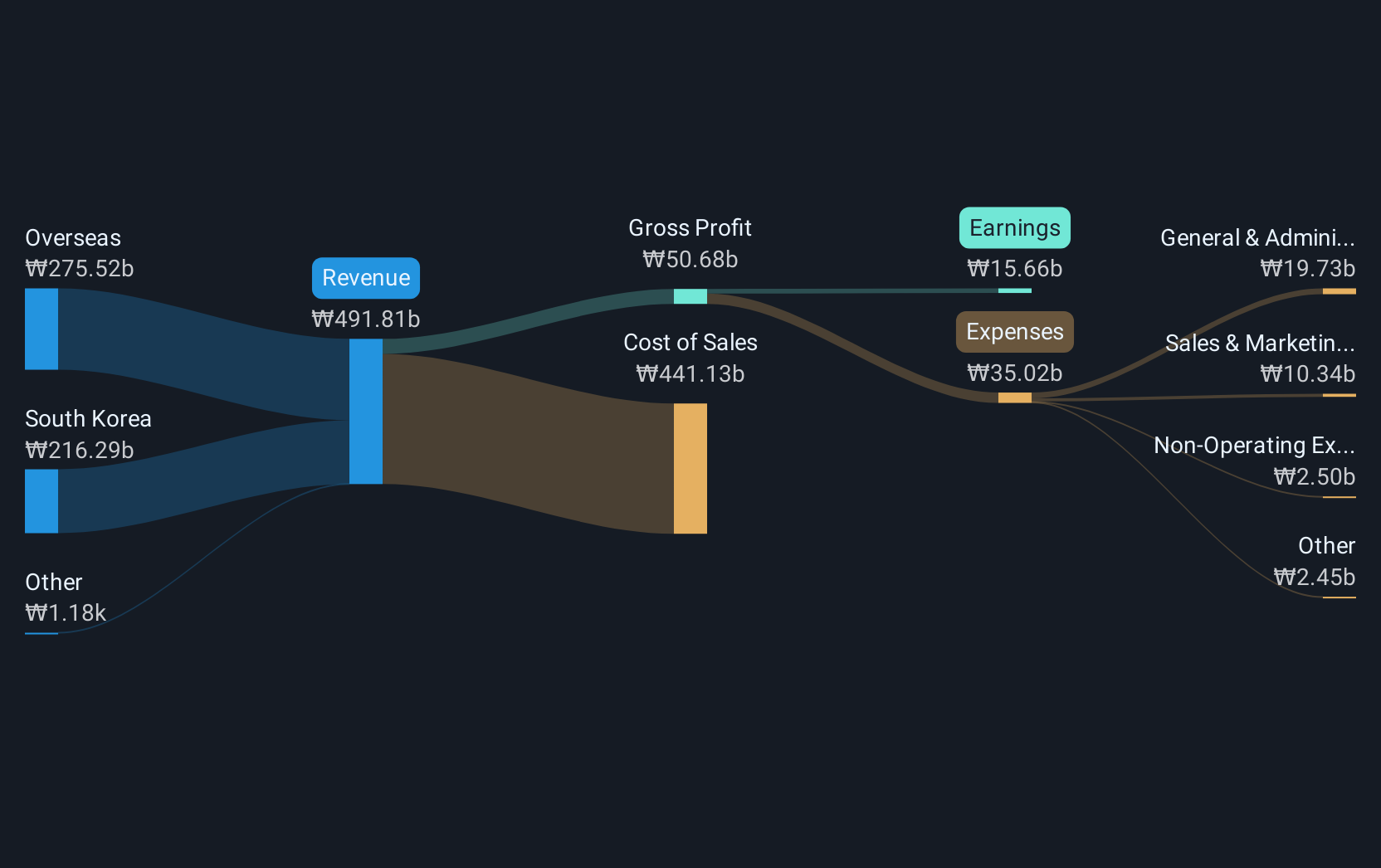

Overview: Studio Dragon Corporation is a drama studio that produces and distributes drama content globally, with a market cap of approximately ₩1.23 trillion.

Operations: The company generates revenue primarily through television programming and distribution, amounting to approximately ₩580.61 billion.

Studio Dragon's recent financial performance reveals a blend of challenges and growth prospects. Despite a significant one-off loss of ₩15.1 billion affecting its last year's results, the company has maintained a positive trajectory in revenue growth at 12.7% annually, outpacing the Korean market average of 9.2%. However, profit margins have dipped to 1% from last year’s 4.9%, reflecting some operational pressures. On a brighter note, earnings are expected to surge by an impressive 33.5% annually over the next three years, significantly above Korea's market average growth rate of 29.1%. This robust forecast is supported by Studio Dragon's strategic presentations and earnings calls that emphasize their ongoing adjustments and market adaptation strategies. The company’s commitment to innovation and adaptation was evident in their recent corporate events, including detailed discussions during Studio Dragon CEO Analyst Day and quarterly earnings calls which likely reassured investors about future directions despite current volatility in net profit margins and one-off financial impacts. With substantial expected growth in earnings coupled with strategic initiatives aimed at bolstering operational efficiencies, Studio Dragon appears poised for resilient future performance within the dynamic entertainment industry landscape.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

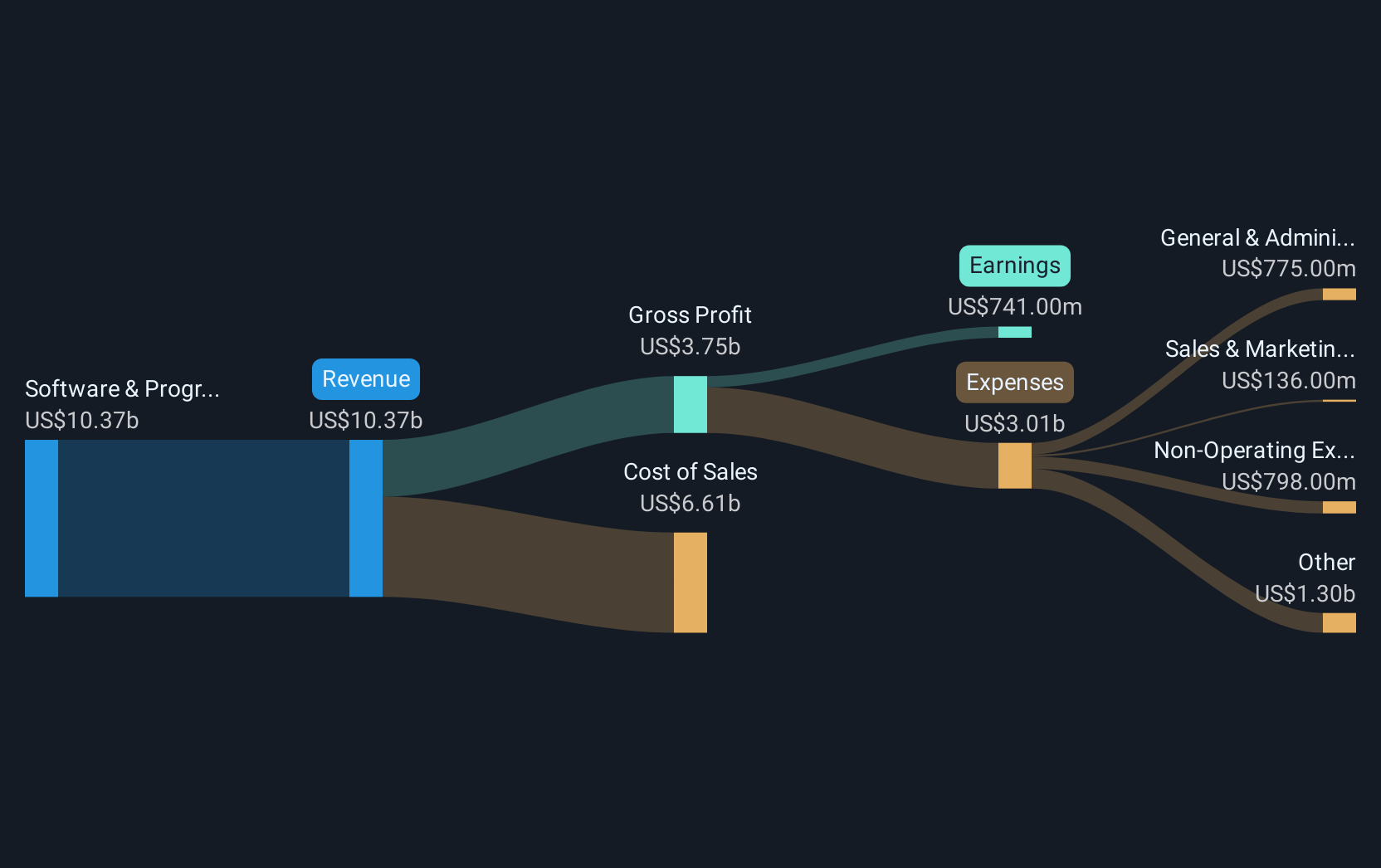

Overview: Constellation Software Inc. is a company that acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$91.65 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $9.68 billion. The focus on vertical market software businesses supports diverse industry needs across multiple regions.

Constellation Software's recent financial performance underscores its resilience and strategic positioning within the tech sector. With a reported revenue increase to USD 2.54 billion in Q3 2024, up from USD 2.13 billion the previous year, and a net income of USD 164 million, the company demonstrates robust operational capabilities despite market fluctuations. Notably, its commitment to R&D is evident with significant investments aimed at fostering innovation—crucial for maintaining competitiveness in the rapidly evolving software industry. This approach is complemented by a promising earnings forecast, expected to grow by an impressive 24.6% annually over the next three years, outpacing both industry and Canadian market averages significantly at 23.9% and 15.5%, respectively. Additionally, Constellation's strategic maneuvers include exploring acquisition opportunities as seen in their interest during recent M&A discussions around Linx S.A., potentially enhancing their market footprint further if realized successfully.

- Navigate through the intricacies of Constellation Software with our comprehensive health report here.

Understand Constellation Software's track record by examining our Past report.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

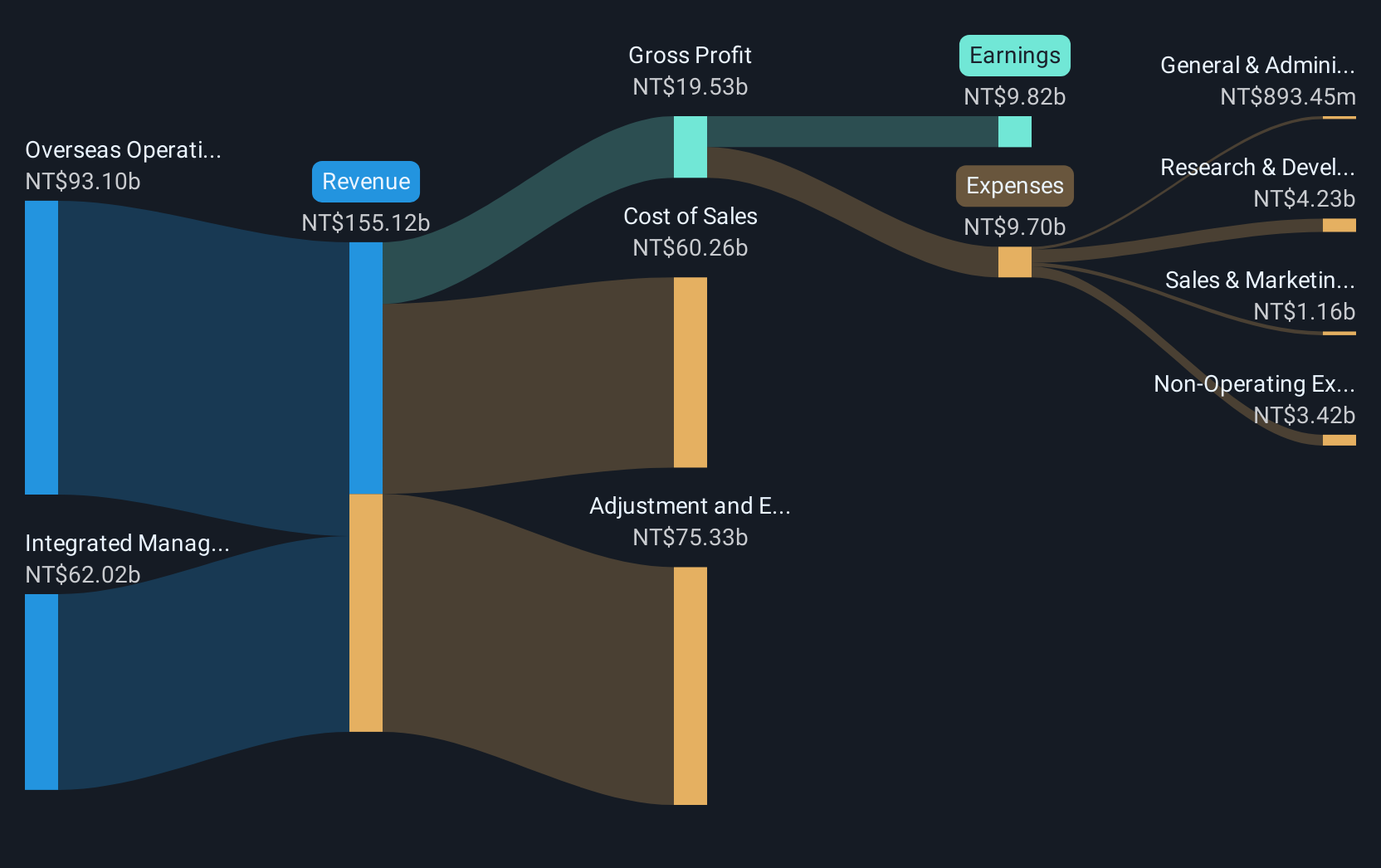

Overview: Asia Vital Components Co., Ltd. is a company that offers thermal solutions globally with a market capitalization of NT$220.02 billion.

Operations: The company generates revenue primarily from its Overseas Operating Department and Integrated Management Division, with the former contributing NT$72.11 billion and the latter NT$51.58 billion.

Asia Vital Components has demonstrated a compelling growth trajectory, with its revenue surging to TWD 19.06 billion in Q3 2024, up from TWD 15.77 billion the previous year, reflecting a robust annual growth rate of 25.4%. This performance is complemented by an even more impressive earnings increase, where net income soared by nearly 63% to TWD 2.32 billion. The company's commitment to innovation is underscored by its R&D investments which have been strategically scaled to align with its expanding market presence, ensuring it remains at the forefront of technological advancements in its sector. These financial and strategic initiatives suggest Asia Vital Components is well-positioned for sustained growth amidst the dynamic tech landscape.

- Click to explore a detailed breakdown of our findings in Asia Vital Components' health report.

Assess Asia Vital Components' past performance with our detailed historical performance reports.

Taking Advantage

- Embark on your investment journey to our 1258 High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

High growth potential and slightly overvalued.