- Canada

- /

- Metals and Mining

- /

- TSXV:RDS

Cartier Resources And 2 Promising Penny Stocks On TSX

Reviewed by Simply Wall St

As the Canadian market enters 2025, investors are reflecting on a stellar 2024, where the TSX gained 18% amidst strong economic growth and rising corporate profits. In this context of robust market performance, identifying promising investment opportunities becomes crucial. Although 'penny stocks' may seem like an outdated term, they continue to represent smaller or newer companies that can offer significant value when backed by solid financials. We'll explore three such penny stocks on the TSX that combine financial strength with potential for growth, providing investors with opportunities to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.14 | CA$370.94M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$970.33M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$583.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.24M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$31.7M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.05 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.95 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cartier Resources (TSXV:ECR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cartier Resources Inc. is involved in the acquisition and exploration of mining properties in Canada, with a market cap of CA$30.28 million.

Operations: Cartier Resources does not report any revenue segments.

Market Cap: CA$30.28M

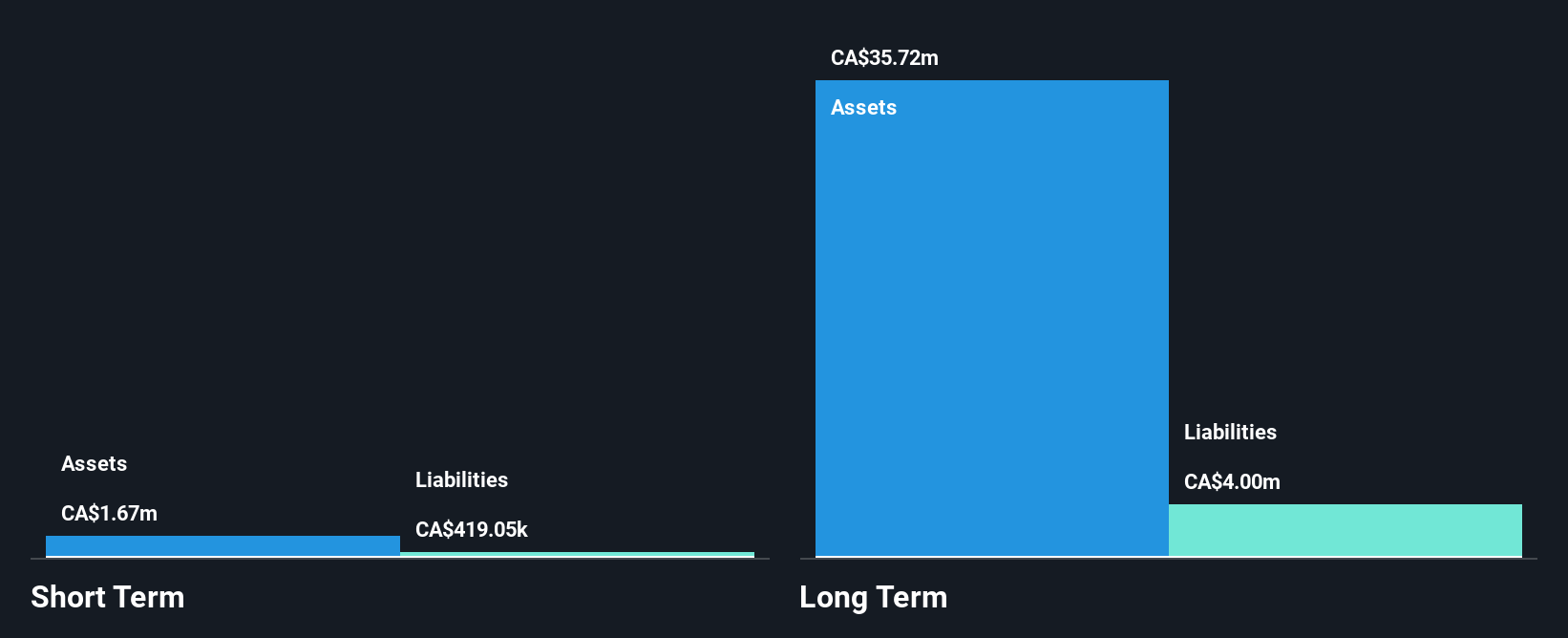

Cartier Resources, with a market cap of CA$30.28 million, remains pre-revenue and unprofitable but has shown promise through its exploration activities. Recent drilling at its East Cadillac property revealed multiple high-grade gold intersections, notably in the VG10 Zone with 173.6 g/t Au over 0.5 m, suggesting significant mineral potential. The company completed a private placement raising CA$1 million to support ongoing exploration efforts. Despite short-term liabilities being covered by assets of CA$2.4M, long-term liabilities remain uncovered at CA$5.1M, highlighting financial constraints amidst volatile share prices and limited cash runway improvements despite additional capital raised.

- Get an in-depth perspective on Cartier Resources' performance by reading our balance sheet health report here.

- Explore historical data to track Cartier Resources' performance over time in our past results report.

Radisson Mining Resources (TSXV:RDS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Radisson Mining Resources Inc. is a gold exploration company focused on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$114.64 million.

Operations: Radisson Mining Resources Inc. currently does not report any revenue segments.

Market Cap: CA$114.64M

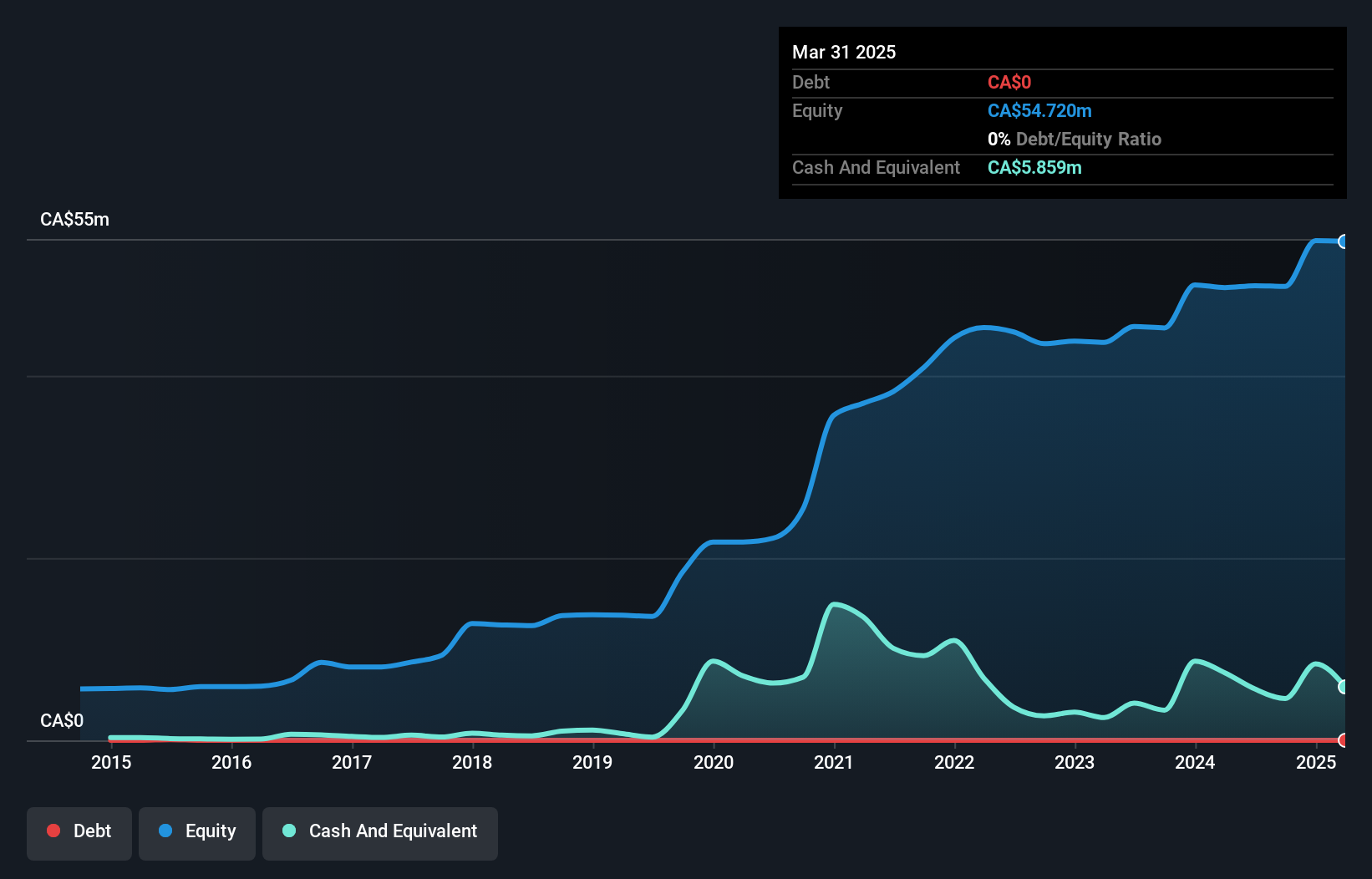

Radisson Mining Resources, with a market cap of CA$114.64 million, is pre-revenue and focused on its O'Brien Gold Project in Québec. Recent deep drilling has revealed high-grade gold mineralization well below existing resource estimates, with results such as 31.24 g/t Au over 8 metres and a peak of 242 g/t Au over 1 metre. Despite being debt-free, the company faces financial constraints as short-term assets do not cover long-term liabilities of CA$5.5M, and shareholders experienced dilution last year. The exploration program continues to expand potential resources while managing a limited cash runway extended by recent capital raises.

- Click here to discover the nuances of Radisson Mining Resources with our detailed analytical financial health report.

- Evaluate Radisson Mining Resources' historical performance by accessing our past performance report.

Tier One Silver (TSXV:TSLV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tier One Silver Inc. is involved in the acquisition, exploration, and development of mineral properties in Peru with a market cap of CA$13.68 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$13.68M

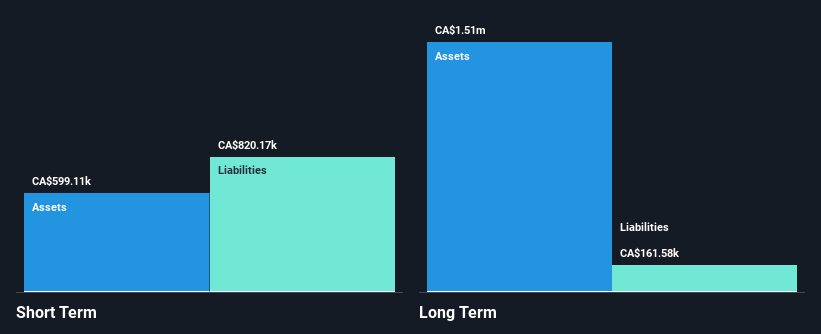

Tier One Silver Inc., with a market cap of CA$13.68 million, is pre-revenue and focused on mineral exploration in Peru. Recent channel sampling at Cambaya I and II revealed promising silver-gold mineralization, with high-grade samples reaching up to 8,950 g/t Ag and 4.13 g/t Au. The company remains debt-free but has faced shareholder dilution recently while managing a volatile share price. Despite short-term liabilities exceeding assets by CA$221K as of September 2024, Tier One Silver has secured additional capital through private placements to support its exploration activities and extend its limited cash runway beyond one month.

- Click to explore a detailed breakdown of our findings in Tier One Silver's financial health report.

- Review our historical performance report to gain insights into Tier One Silver's track record.

Key Takeaways

- Click this link to deep-dive into the 945 companies within our TSX Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RDS

Radisson Mining Resources

A gold exploration company, engages in the acquisition, exploration, and development of mining properties in Canada.

Excellent balance sheet moderate.