- China

- /

- Electronic Equipment and Components

- /

- SZSE:301389

High Growth Tech Stocks In Asia To Watch For Potential Expansion

Reviewed by Simply Wall St

Amidst global market fluctuations, the Asian tech sector has shown resilience, with key indices experiencing varied performances due to ongoing trade tensions and economic uncertainties. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong fundamentals and adaptability in navigating challenges such as tariffs and shifting consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.64% | 30.42% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| ALTEOGEN | 54.36% | 68.99% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We'll examine a selection from our screener results.

Studio Dragon (KOSDAQ:A253450)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Studio Dragon Corporation is a global drama studio specializing in the production and distribution of drama content, with a market cap of ₩1.39 trillion.

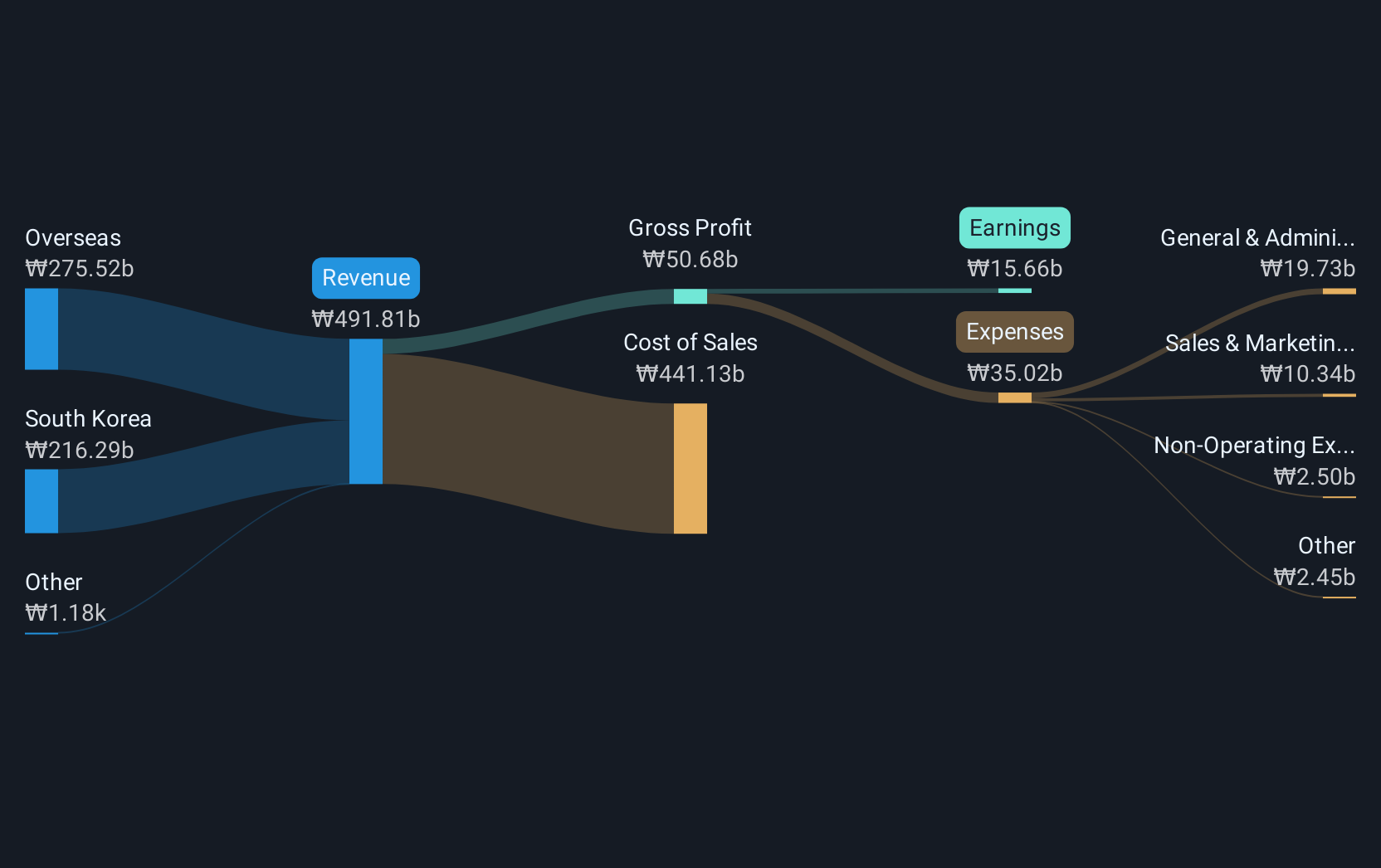

Operations: The company generates revenue primarily through television programming and distribution, amounting to ₩491.80 billion.

Studio Dragon's strategic presence in high-growth markets is underscored by its recent robust activities, including multiple presentations at significant financial conferences across Seoul. With an annual revenue growth rate of 15.4%, Studio Dragon surpasses the Korean market average of 7.4%, highlighting its competitive edge in content production. Additionally, the company's earnings are projected to surge by 29.2% annually, significantly outpacing the broader market forecast of 20.5%. This financial trajectory is complemented by a recent share repurchase initiative, where Studio Dragon bought back shares worth KRW 94.99 million, reinforcing shareholder value amidst expansive growth strategies.

- Click here and access our complete health analysis report to understand the dynamics of Studio Dragon.

Examine Studio Dragon's past performance report to understand how it has performed in the past.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. is a company focused on the packaging and containers industry, with a market capitalization of CN¥6.12 billion.

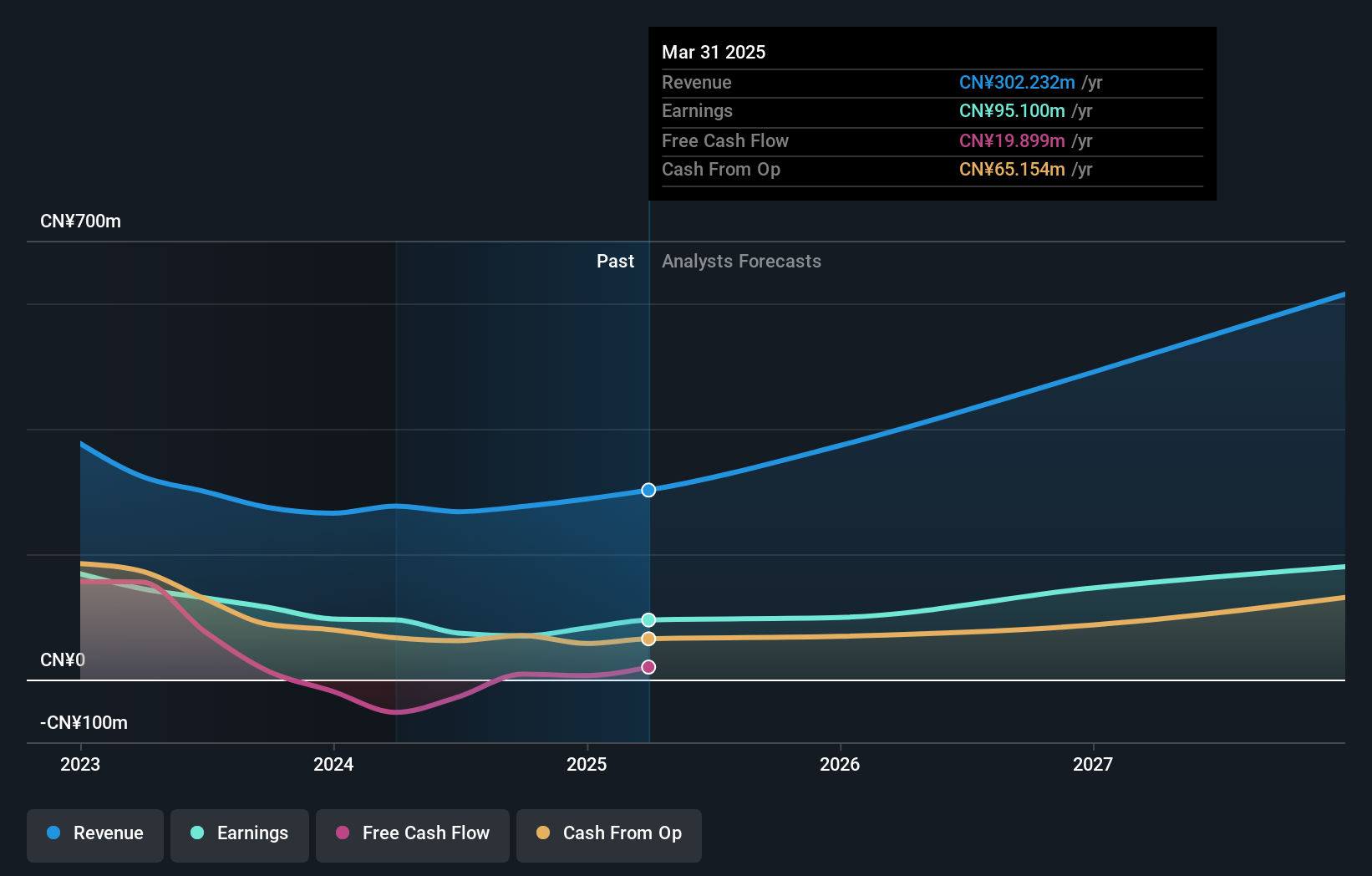

Operations: The company generates revenue primarily from its packaging and containers segment, amounting to CN¥302.23 million.

Long Young Electronic (Kunshan) demonstrates robust growth with a 25.7% annual increase in revenue, outpacing the Chinese market average of 12.3%. This performance is bolstered by an impressive earnings growth forecast of 25.4% per year, surpassing the broader market's expectation of 23.3%. The firm's commitment to innovation is evident from its significant investment in R&D, ensuring it remains at the forefront of technological advancements within the electronics sector. Recent financial results reflect this upward trajectory, with Q1 revenues rising to CNY 73.38 million from CNY 59.09 million year-over-year and net income more than doubling to CNY 30.68 million, showcasing effective strategy execution and market adaptation.

- Get an in-depth perspective on Long Young Electronic (Kunshan)'s performance by reading our health report here.

Learn about Long Young Electronic (Kunshan)'s historical performance.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

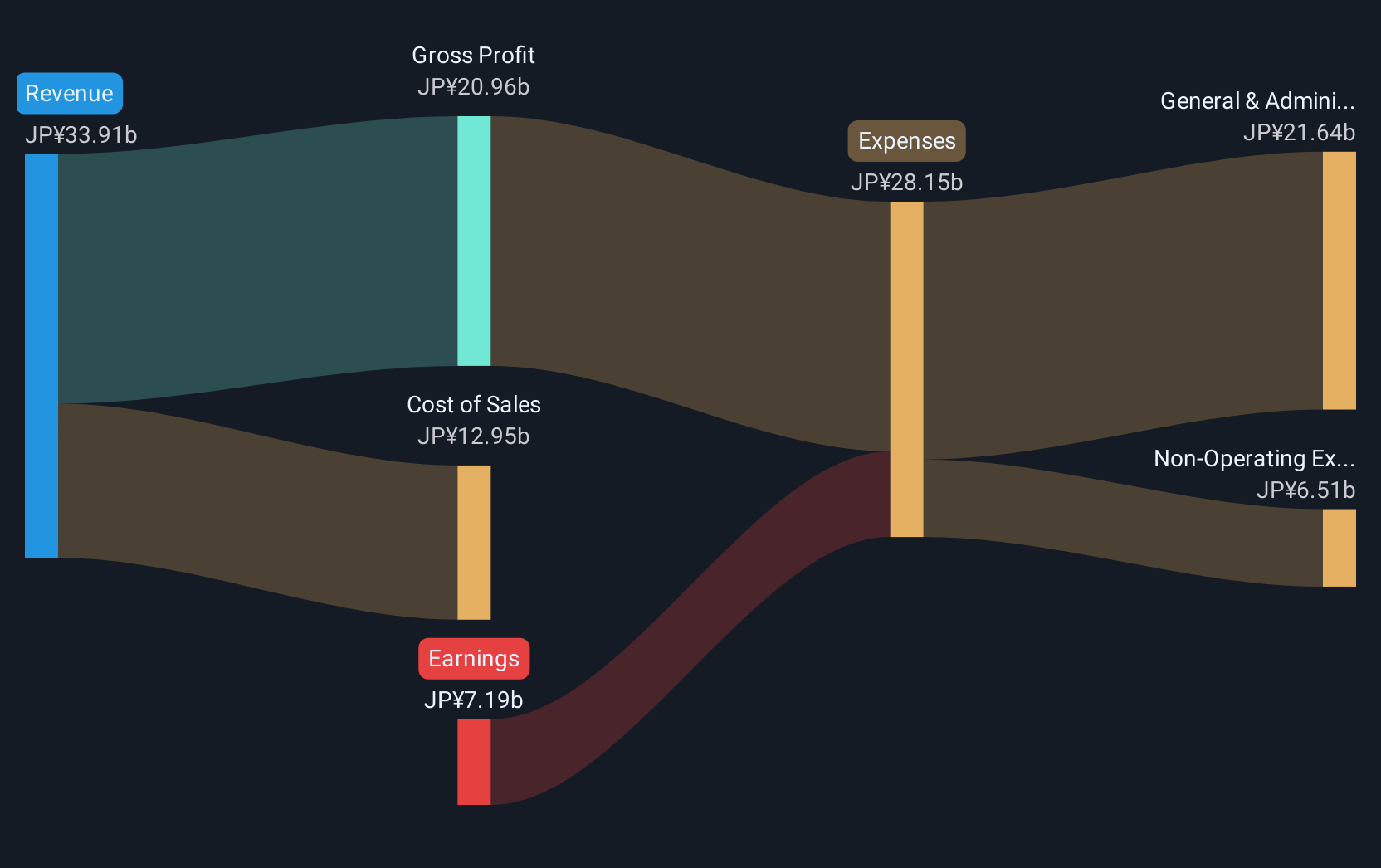

Overview: Digital Garage, Inc. is a context company that operates in Japan and internationally with a market capitalization of ¥205.05 billion.

Operations: Digital Garage, Inc. generates revenue through its operations in Japan and internationally. The company focuses on providing digital marketing solutions, payment processing services, and venture capital investments.

Digital Garage is poised for significant growth, with revenue expected to increase by 17.6% annually, outstripping Japan's market average of 3.6%. This surge is underpinned by a projected earnings growth of an impressive 119.2% per year over the next three years, signaling a robust upward trajectory as the company moves towards profitability. Recently, Digital Garage has demonstrated its commitment to shareholder value through increased dividends and special payments, reflecting confidence in its financial health and future prospects. These strategic moves, coupled with a strong focus on R&D investments which are crucial for maintaining technological leadership in the competitive tech landscape of Asia, suggest that Digital Garage is well-positioned to capitalize on market opportunities and drive sustained growth.

- Take a closer look at Digital Garage's potential here in our health report.

Gain insights into Digital Garage's past trends and performance with our Past report.

Next Steps

- Click this link to deep-dive into the 496 companies within our Asian High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301389

Long Young Electronic (Kunshan)

Long Young Electronic (Kunshan) Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives