3 Global Stocks Estimated To Be Trading Up To 39.6% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the complexities of fluctuating interest rates and economic uncertainties, investors are keenly observing how these factors impact stock valuations. With major indices experiencing mixed performances amid concerns over technology stock valuations and labor market risks, identifying stocks trading below their intrinsic value can offer potential opportunities in this environment. In such a climate, a good stock is often characterized by its strong fundamentals and resilience to market volatility, making it an attractive prospect for those looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.11 | HK$16.17 | 49.9% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.284 | €8.53 | 49.8% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.45 | €138.59 | 49.9% |

| Koskisen Oyj (HLSE:KOSKI) | €9.18 | €18.23 | 49.7% |

| JINS HOLDINGS (TSE:3046) | ¥5480.00 | ¥10935.00 | 49.9% |

| Jæren Sparebank (OB:JAREN) | NOK379.65 | NOK753.94 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.6% |

| Cowell e Holdings (SEHK:1415) | HK$28.02 | HK$55.59 | 49.6% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.34 | CN¥517.23 | 49.9% |

| Arriyadh Development (SASE:4150) | SAR23.79 | SAR47.20 | 49.6% |

Let's dive into some prime choices out of the screener.

Studio Dragon (KOSDAQ:A253450)

Overview: Studio Dragon Corporation is a drama studio that produces and distributes drama content globally, with a market cap of ₩1.18 trillion.

Operations: The company generates revenue from its Television Programming & Distribution segment, amounting to ₩515.37 billion.

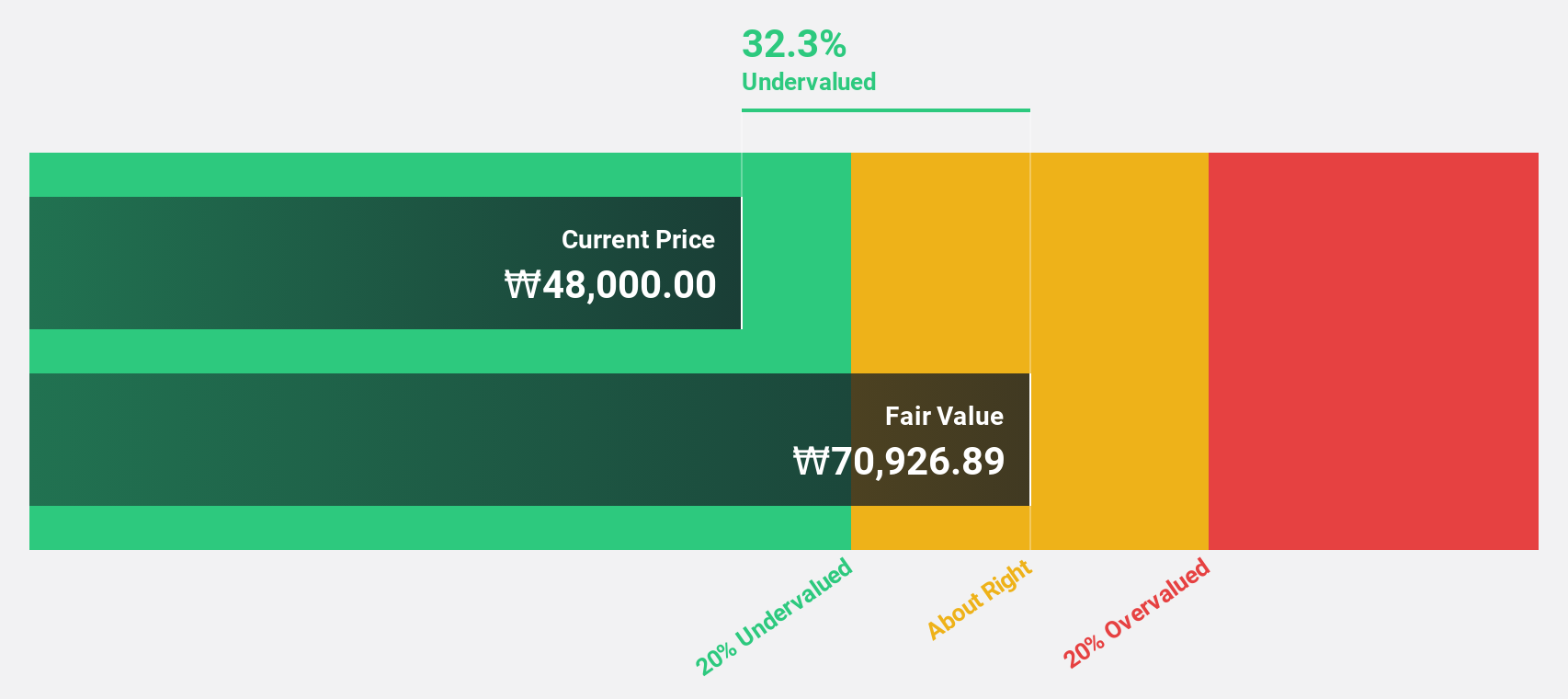

Estimated Discount To Fair Value: 31%

Studio Dragon is trading 31% below its estimated fair value of ₩58,698.83, indicating it may be undervalued based on cash flows. Despite recent fluctuations in revenue and net income, the company shows strong earnings growth potential at 33.15% annually over the next three years. Analysts expect a significant stock price increase of 32.5%. However, its return on equity is forecasted to remain low at 6.5%, suggesting some caution for investors.

- The analysis detailed in our Studio Dragon growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Studio Dragon's balance sheet health report.

BioGaia (OM:BIOG B)

Overview: BioGaia AB is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various regions including Europe and the United States, with a market cap of SEK10.22 billion.

Operations: The company's revenue is primarily derived from its Pediatrics segment, which accounts for SEK1.09 billion, followed by the Adult Health segment at SEK357.59 million.

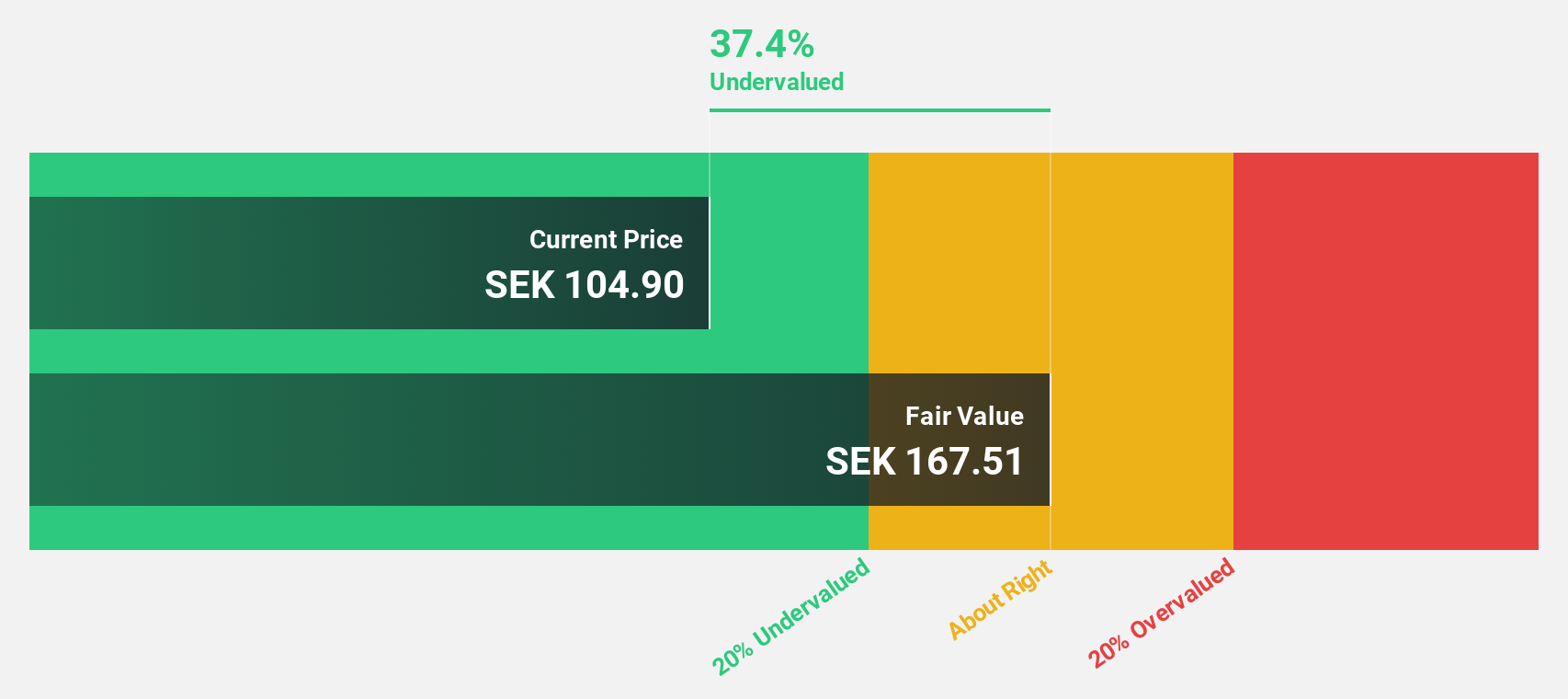

Estimated Discount To Fair Value: 39.6%

BioGaia is trading at SEK101, significantly below its estimated fair value of SEK167.28, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow annually by 21.9%, outpacing the Swedish market's growth rate. Despite this, its dividend yield of 6.83% isn't well-supported by free cash flows. Recent product innovations like serotonin-producing bacteria and oral care probiotics may bolster future revenue streams but require cautious optimism due to slower revenue growth forecasts.

- Our comprehensive growth report raises the possibility that BioGaia is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of BioGaia.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector and has a market cap of CN¥8.63 billion.

Operations: Unfortunately, the revenue segment details for Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. are not provided in the text you shared. Please provide specific revenue segment information if available, and I can help summarize it for you.

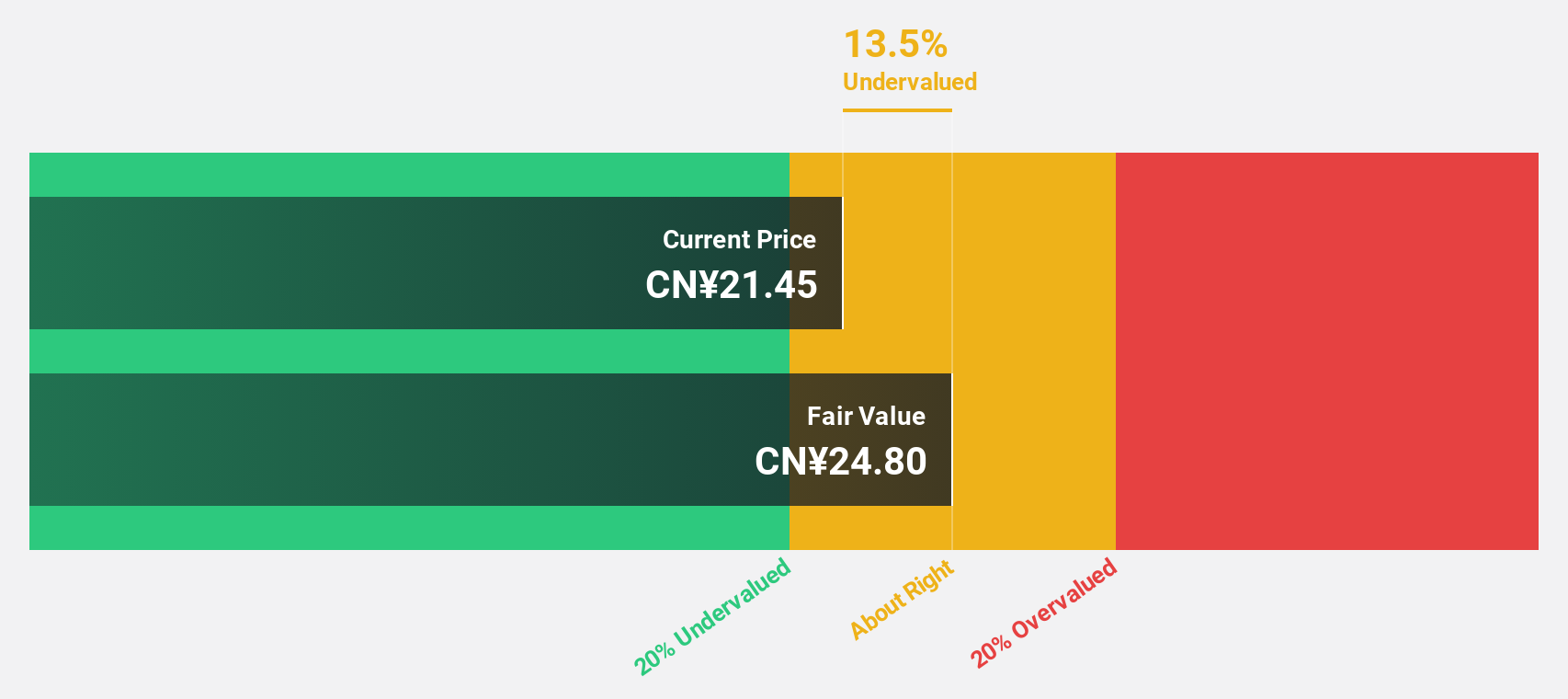

Estimated Discount To Fair Value: 14.9%

Shandong Bailong Chuangyuan Bio-Tech is trading at CN¥21.1, below its estimated fair value of CN¥24.79, suggesting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow significantly at 23.7% and 23% annually, respectively, outpacing the Chinese market average for revenue growth. However, its dividend yield of 1% isn't well-supported by free cash flows, necessitating careful consideration of financial sustainability despite recent profit increases.

- Our growth report here indicates Shandong Bailong Chuangyuan Bio-Tech may be poised for an improving outlook.

- Dive into the specifics of Shandong Bailong Chuangyuan Bio-Tech here with our thorough financial health report.

Where To Now?

- Click here to access our complete index of 503 Undervalued Global Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)