- South Korea

- /

- Chemicals

- /

- KOSE:A093370

Foosung Co., Ltd.'s (KRX:093370) Share Price Is Still Matching Investor Opinion Despite 29% Slump

The Foosung Co., Ltd. (KRX:093370) share price has fared very poorly over the last month, falling by a substantial 29%. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

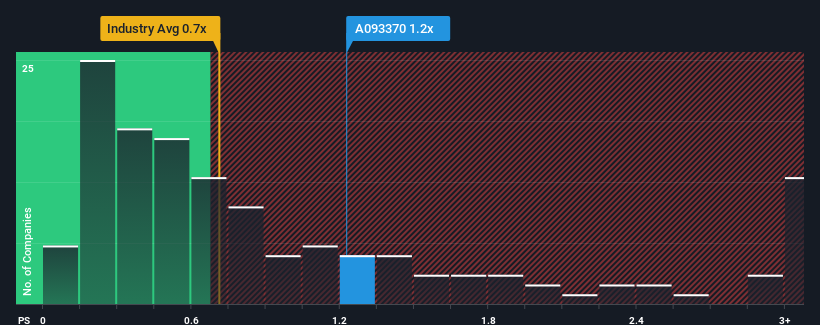

In spite of the heavy fall in price, when almost half of the companies in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Foosung as a stock probably not worth researching with its 1.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Foosung

What Does Foosung's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Foosung has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Foosung.Is There Enough Revenue Growth Forecasted For Foosung?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Foosung's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. Still, the latest three year period has seen an excellent 81% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 15% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.4% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Foosung's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Foosung's P/S

Despite the recent share price weakness, Foosung's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Foosung shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Foosung (of which 1 can't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A093370

Foosung

Engages in the manufacture and sale of chemical products for automotive, iron and steel, semiconductor, construction, and environmental industries in South Korea.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives