- South Korea

- /

- Metals and Mining

- /

- KOSE:A071090

It Might Not Be A Great Idea To Buy Histeel Co.,Ltd. (KRX:071090) For Its Next Dividend

Histeel Co.,Ltd. (KRX:071090) is about to trade ex-dividend in the next three days. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 10th of April.

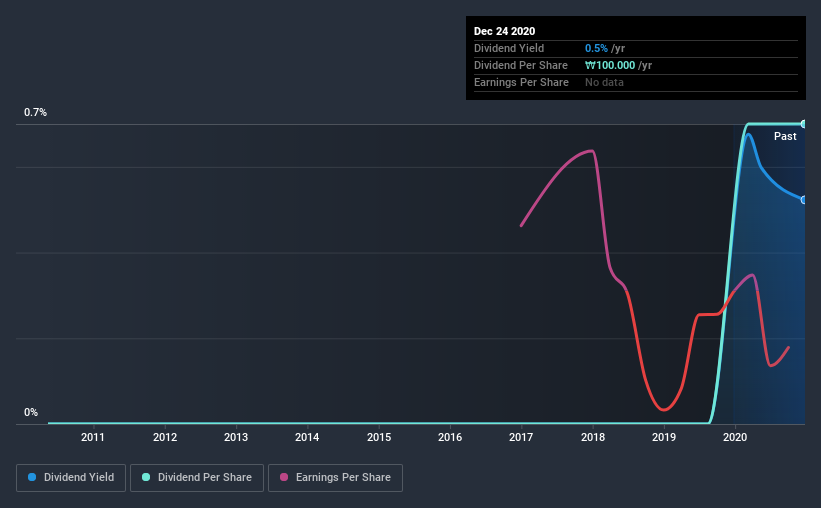

HisteelLtd's next dividend payment will be ₩100.00 per share, and in the last 12 months, the company paid a total of ₩100.00 per share. Based on the last year's worth of payments, HisteelLtd has a trailing yield of 0.5% on the current stock price of ₩19100. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for HisteelLtd

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. HisteelLtd reported a loss last year, so it's not great to see that it has continued paying a dividend. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If HisteelLtd didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. The good news is it paid out just 3.3% of its free cash flow in the last year.

Click here to see how much of its profit HisteelLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. HisteelLtd was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Unfortunately HisteelLtd has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Remember, you can always get a snapshot of HisteelLtd's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Is HisteelLtd an attractive dividend stock, or better left on the shelf? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. It's not that we think HisteelLtd is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that in mind though, if the poor dividend characteristics of HisteelLtd don't faze you, it's worth being mindful of the risks involved with this business. We've identified 2 warning signs with HisteelLtd (at least 1 which is concerning), and understanding them should be part of your investment process.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade HisteelLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HisteelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A071090

HisteelLtd

Engages in the manufacture and sale of steel pipes in South Korea.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)