- South Korea

- /

- Building

- /

- KOSE:A000970

Top KRX Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 1.0%, while remaining flat overall over the past 12 months. With earnings forecast to grow by 29% annually, identifying strong dividend stocks can provide stability and income in a fluctuating market.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.28% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.80% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.15% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.01% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.12% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.31% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.00% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.21% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.05% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.56% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Koryo Credit Information (KOSDAQ:A049720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koryo Credit Information Co., Ltd. operates in debt collection, credit investigation, and civil complaint agency services both in South Korea and internationally, with a market cap of ₩145.66 billion.

Operations: Koryo Credit Information Co., Ltd. generates revenue primarily from debt collection (₩162.40 billion) and lending (₩3.67 billion).

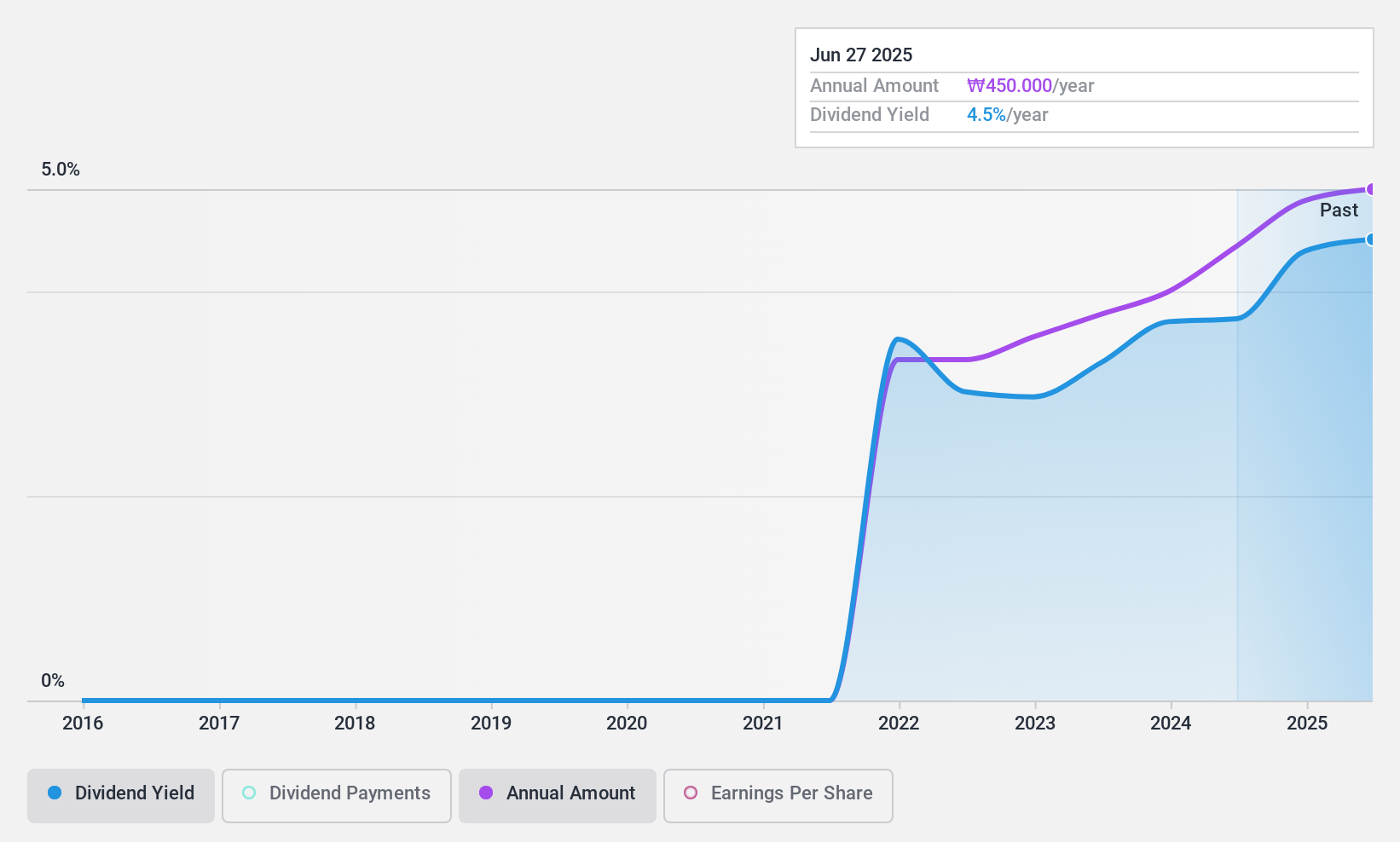

Dividend Yield: 5.7%

Koryo Credit Information is trading at 79.2% below its estimated fair value, with a dividend yield of 5.74%, placing it in the top 25% of dividend payers in South Korea. The company's dividends are well covered by both earnings (43%) and cash flows (42.7%), although it has only paid dividends for three years, showing reliability but limited history. Recent earnings reports indicate significant growth, with net income for Q2 2024 reaching KRW 3.48 billion from KRW 2.49 billion a year ago.

- Unlock comprehensive insights into our analysis of Koryo Credit Information stock in this dividend report.

- The valuation report we've compiled suggests that Koryo Credit Information's current price could be quite moderate.

Korea Cast Iron Pipe Ind (KOSE:A000970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korea Cast Iron Pipe Ind. Co., Ltd. manufactures and sells pipes both in South Korea and internationally, with a market cap of ₩143.05 billion.

Operations: Korea Cast Iron Pipe Ind. Co., Ltd.'s revenue segments (in millions of ₩) include:

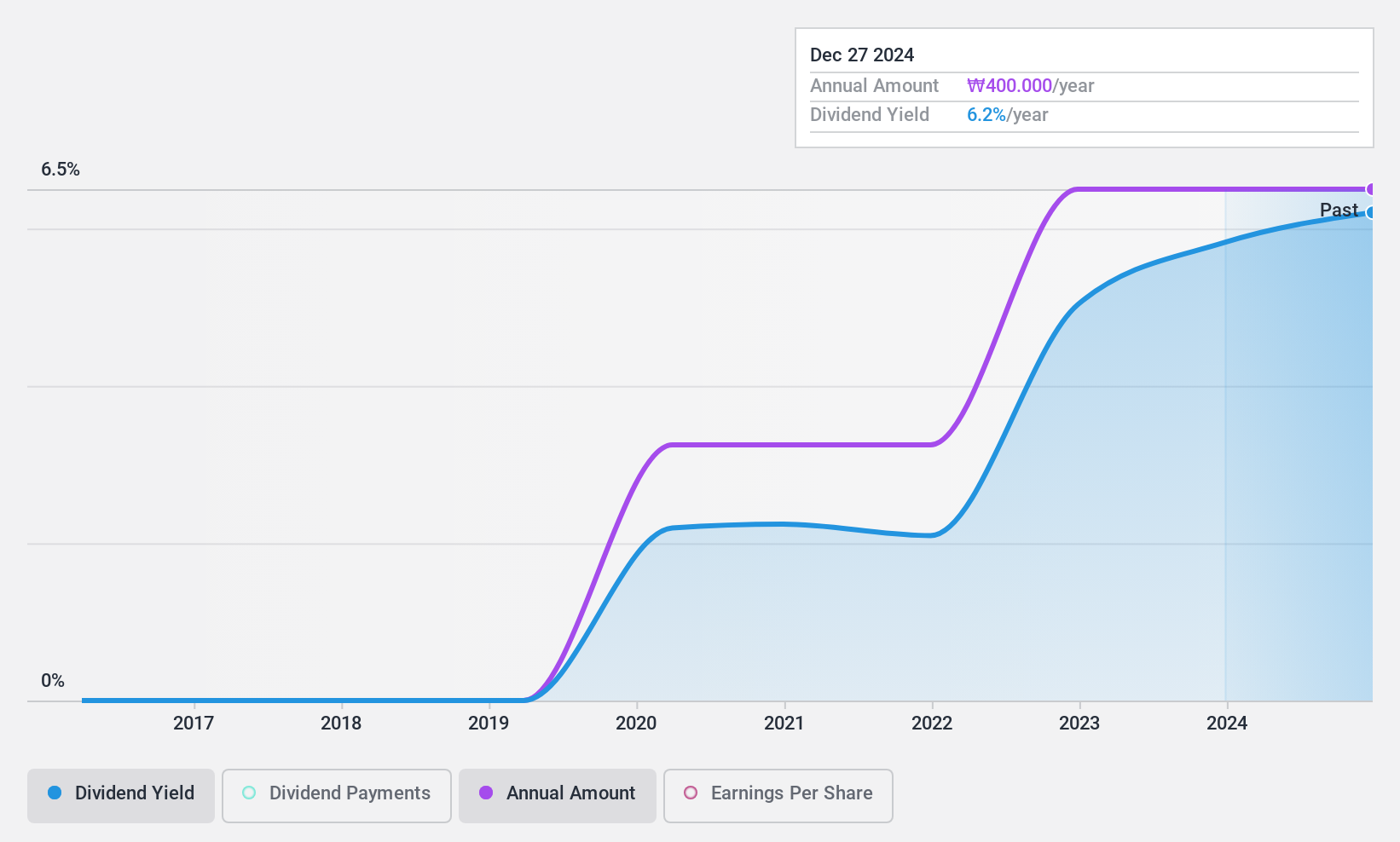

Dividend Yield: 6%

Korea Cast Iron Pipe Ind. has been paying dividends for less than 10 years, with a current yield of 6.02%, placing it in the top 25% of South Korean dividend payers. Dividends are well-covered by earnings (53.4%) and cash flows (23.8%), although the company has an unstable dividend track record despite recent earnings growth of 87%. The stock trades at 58.3% below its estimated fair value, offering potential value for investors seeking income and growth prospects.

- Click to explore a detailed breakdown of our findings in Korea Cast Iron Pipe Ind's dividend report.

- Upon reviewing our latest valuation report, Korea Cast Iron Pipe Ind's share price might be too pessimistic.

POSCO STEELEON (KOSE:A058430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POSCO STEELEON Co., Ltd. manufactures, processes, and sells steel products in South Korea and internationally, with a market cap of ₩249.21 billion.

Operations: POSCO STEELEON Co., Ltd. generates revenue primarily from its Metal Processors and Fabrication segment, amounting to ₩1.21 trillion.

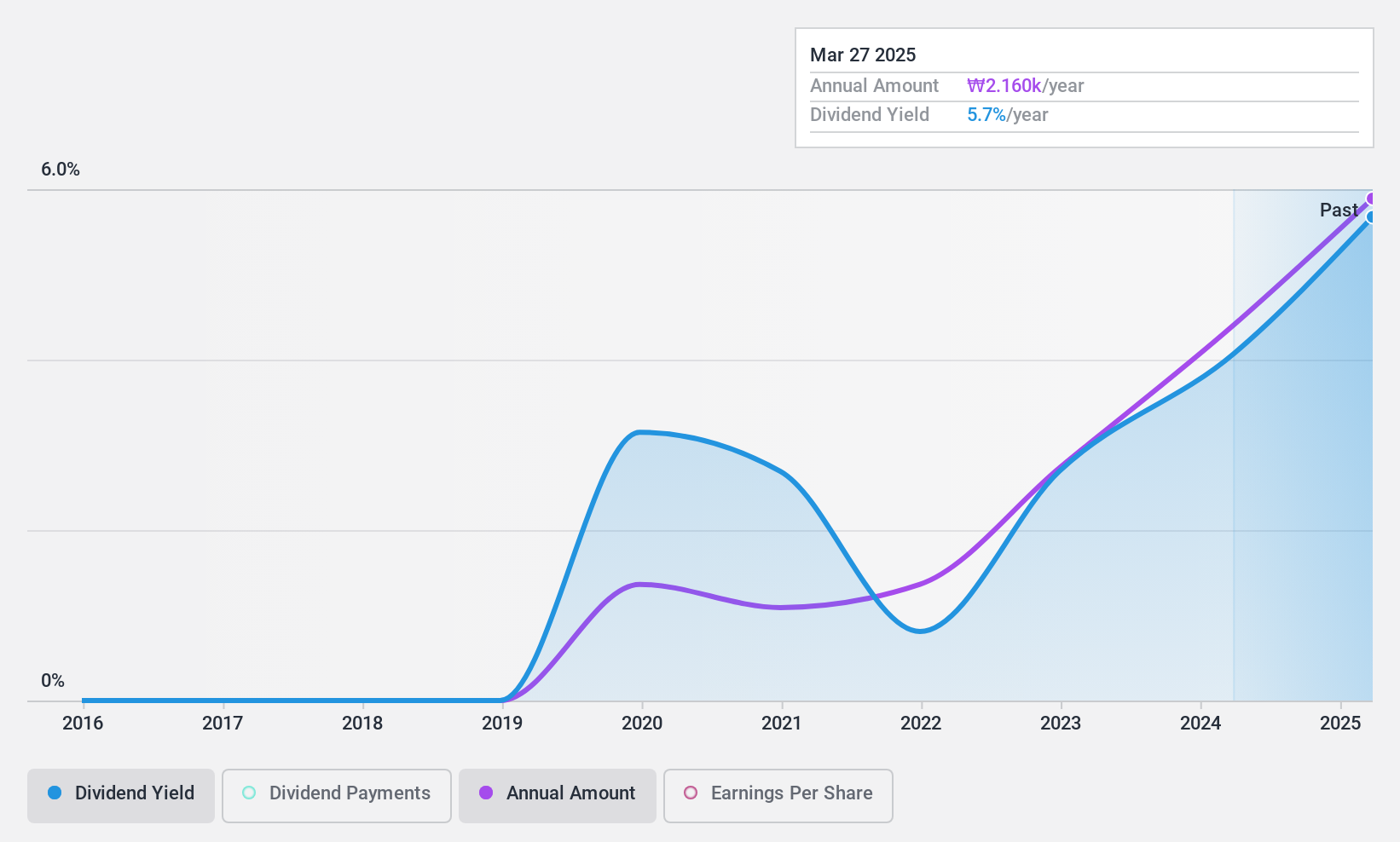

Dividend Yield: 3.9%

POSCO STEELEON's dividend yield of 3.88% ranks in the top 25% of South Korean payers, but its five-year dividend history has been volatile. Despite this, dividends are well-covered by earnings (30.9%) and cash flows (12.4%). The company became profitable this year and trades at a price-to-earnings ratio of 8x, below the KR market average of 11.8x, suggesting potential value for income-focused investors despite an unstable track record.

- Take a closer look at POSCO STEELEON's potential here in our dividend report.

- The valuation report we've compiled suggests that POSCO STEELEON's current price could be inflated.

Where To Now?

- Click through to start exploring the rest of the 71 Top KRX Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korea Cast Iron Pipe Ind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000970

Korea Cast Iron Pipe Ind

Manufactures and sells pipes in South Korea and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives