- Taiwan

- /

- Real Estate

- /

- TWSE:5533

3 Leading Dividend Stocks Yielding Up To 5.6%

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to notable fluctuations across various sectors, with financials and energy seeing gains while healthcare and electric vehicle stocks have faced setbacks. Amid these shifts, investors are increasingly looking towards dividend stocks as a potential source of steady income in a volatile environment. A good dividend stock often combines a reliable payout history with strong fundamentals, providing investors with both income and stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.65% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.74% | ★★★★★☆ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

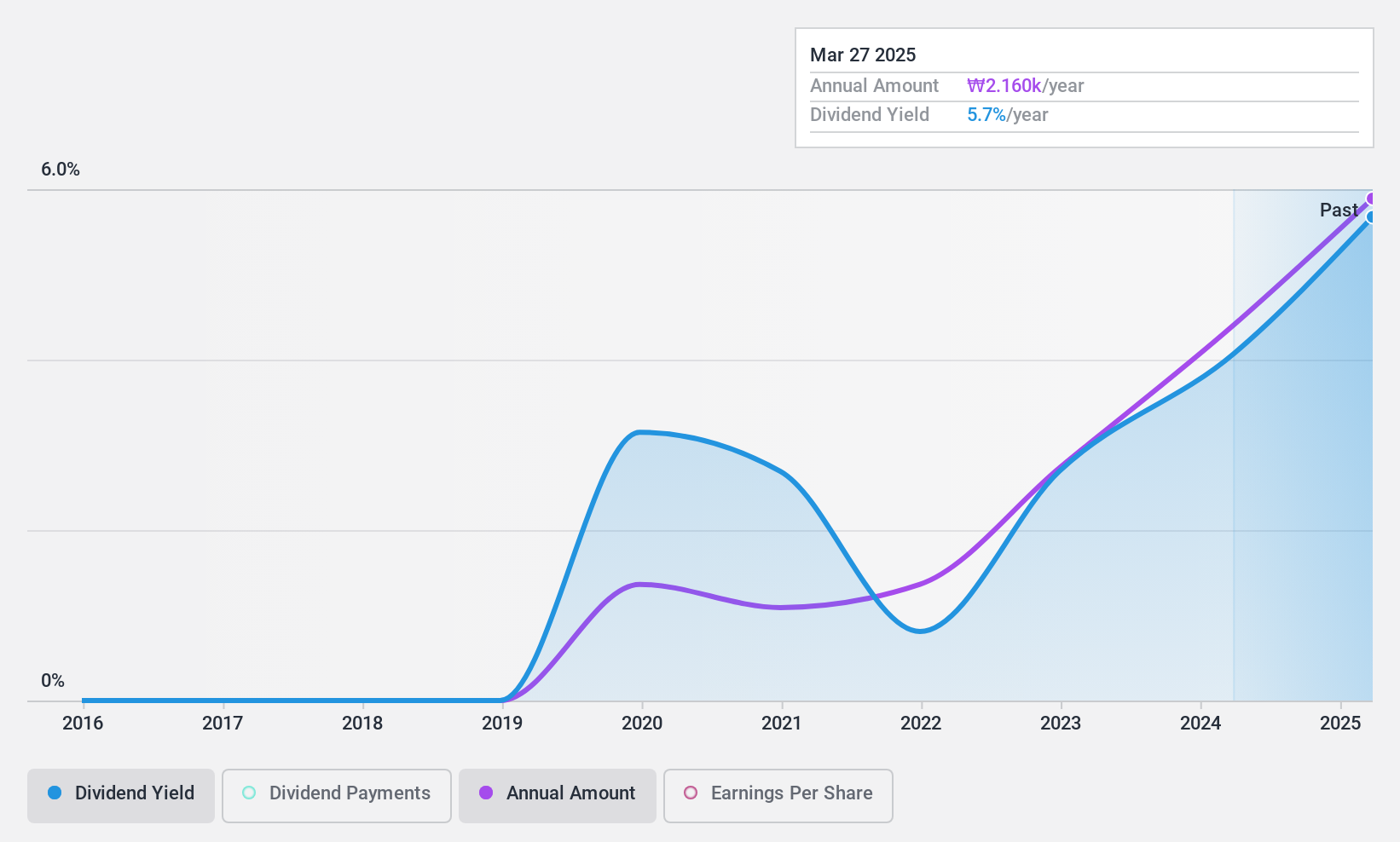

POSCO STEELEON (KOSE:A058430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: POSCO STEELEON Co., Ltd. manufactures, processes, and sells steel products both in South Korea and internationally, with a market cap of ₩189 billion.

Operations: POSCO STEELEON Co., Ltd.'s revenue primarily comes from its Metal Processors and Fabrication segment, amounting to ₩1.21 billion.

Dividend Yield: 5.1%

POSCO STEELEON's dividend yield is in the top 25% of the KR market, supported by a low payout ratio of 30.9% and a cash payout ratio of 12.4%, indicating strong coverage by earnings and cash flows. However, its dividend history is less than ten years old with volatility, including annual drops over 20%. While profitability has been achieved recently, the company's dividends have not shown consistent growth or reliability over the past five years.

- Navigate through the intricacies of POSCO STEELEON with our comprehensive dividend report here.

- According our valuation report, there's an indication that POSCO STEELEON's share price might be on the cheaper side.

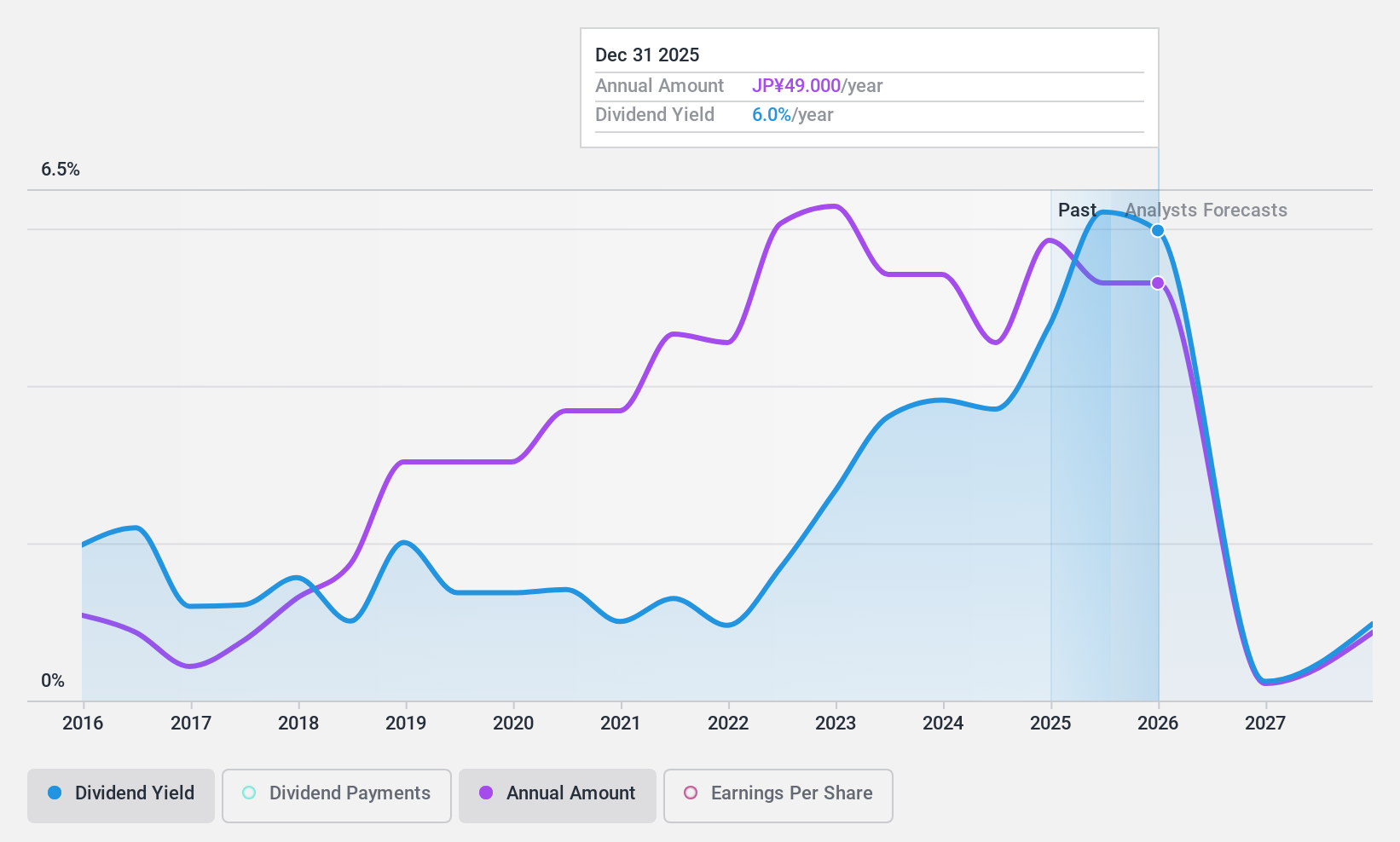

ValueCommerce (TSE:2491)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ValueCommerce Co., Ltd. offers marketing solutions in Japan and internationally, with a market cap of ¥24.54 billion.

Operations: ValueCommerce Co., Ltd. generates revenue through its EC Solutions segment, which accounts for ¥17.76 billion, and its Marketing Solutions segment, contributing ¥12.12 billion.

Dividend Yield: 4.8%

ValueCommerce's dividend yield ranks in the top 25% of the JP market, supported by a reasonable payout ratio of 51.7% and a cash payout ratio of 33.3%, indicating solid coverage by earnings and cash flows. Despite these strengths, its dividend history over the past decade has been volatile with significant annual drops, affecting reliability. The stock is trading significantly below estimated fair value, suggesting potential for price appreciation amidst forecasts of earnings growth at 7.6% annually.

- Get an in-depth perspective on ValueCommerce's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that ValueCommerce is trading behind its estimated value.

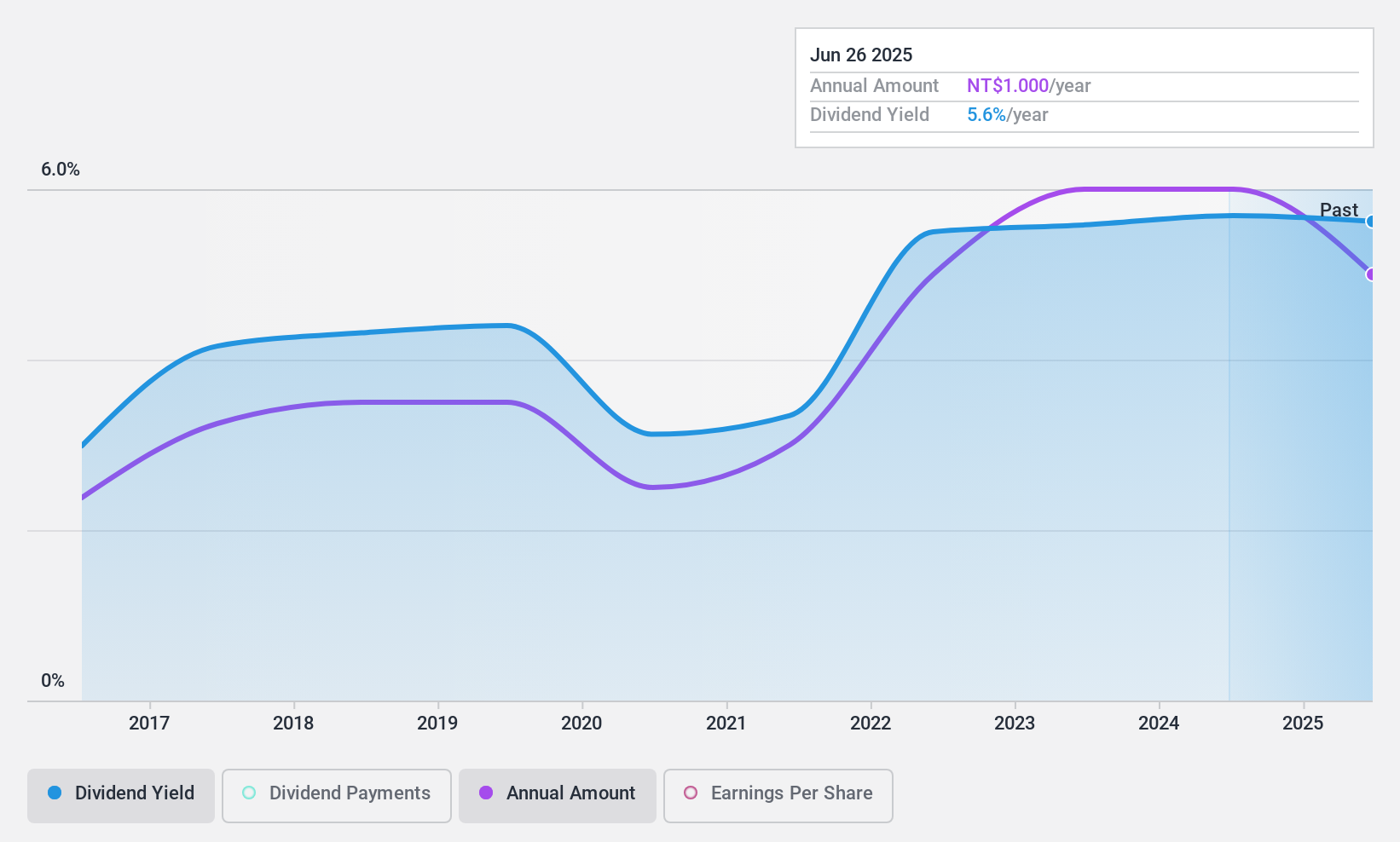

Founding Construction Development (TWSE:5533)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Founding Construction Development Corp. focuses on developing public housing and commercial buildings for leasing and selling in Taiwan, with a market cap of NT$6.02 billion.

Operations: Founding Construction Development Corp.'s revenue primarily stems from its activities in the development and leasing of public housing and commercial buildings in Taiwan.

Dividend Yield: 5.7%

Founding Construction Development's dividend yield is among the top 25% in the TW market, with a high payout ratio of 81.8% and a low cash payout ratio of 37.5%, indicating strong coverage by earnings and cash flows. Despite consistent growth over the past decade, dividends have been volatile and unreliable, experiencing significant annual drops. The stock's price-to-earnings ratio is below the market average, suggesting it may be undervalued relative to peers.

- Dive into the specifics of Founding Construction Development here with our thorough dividend report.

- Our valuation report here indicates Founding Construction Development may be overvalued.

Seize The Opportunity

- Explore the 1970 names from our Top Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5533

Founding Construction Development

Engages in the development of public housings and commercial buildings for leasing and selling in Taiwan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives