- South Korea

- /

- Metals and Mining

- /

- KOSE:A010130

Korea Zinc Company, Ltd.'s (KRX:010130) 41% Price Boost Is Out Of Tune With Earnings

Korea Zinc Company, Ltd. (KRX:010130) shares have continued their recent momentum with a 41% gain in the last month alone. The annual gain comes to 113% following the latest surge, making investors sit up and take notice.

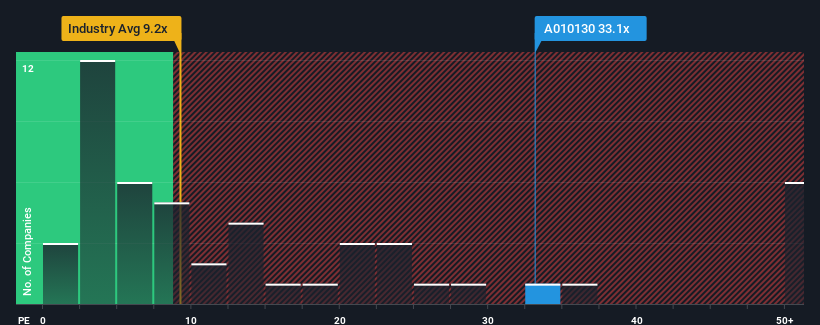

After such a large jump in price, Korea Zinc Company may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 33.1x, since almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Korea Zinc Company hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Korea Zinc Company

Is There Enough Growth For Korea Zinc Company?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Korea Zinc Company's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the analysts watching the company. With the market predicted to deliver 16% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Korea Zinc Company is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Korea Zinc Company's P/E

The strong share price surge has got Korea Zinc Company's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Korea Zinc Company currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Korea Zinc Company you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Korea Zinc Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010130

Korea Zinc Company

Operates as a general non-ferrous metal smelting company primarily in South Korea.

Excellent balance sheet with acceptable track record.