- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

Amidst a backdrop of cautious Federal Reserve commentary and political uncertainty, global markets have experienced notable fluctuations, with U.S. stocks recently declining despite some recovery efforts. As investors navigate these turbulent waters, dividend stocks can offer a measure of stability and income potential through regular payouts, making them an attractive consideration in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

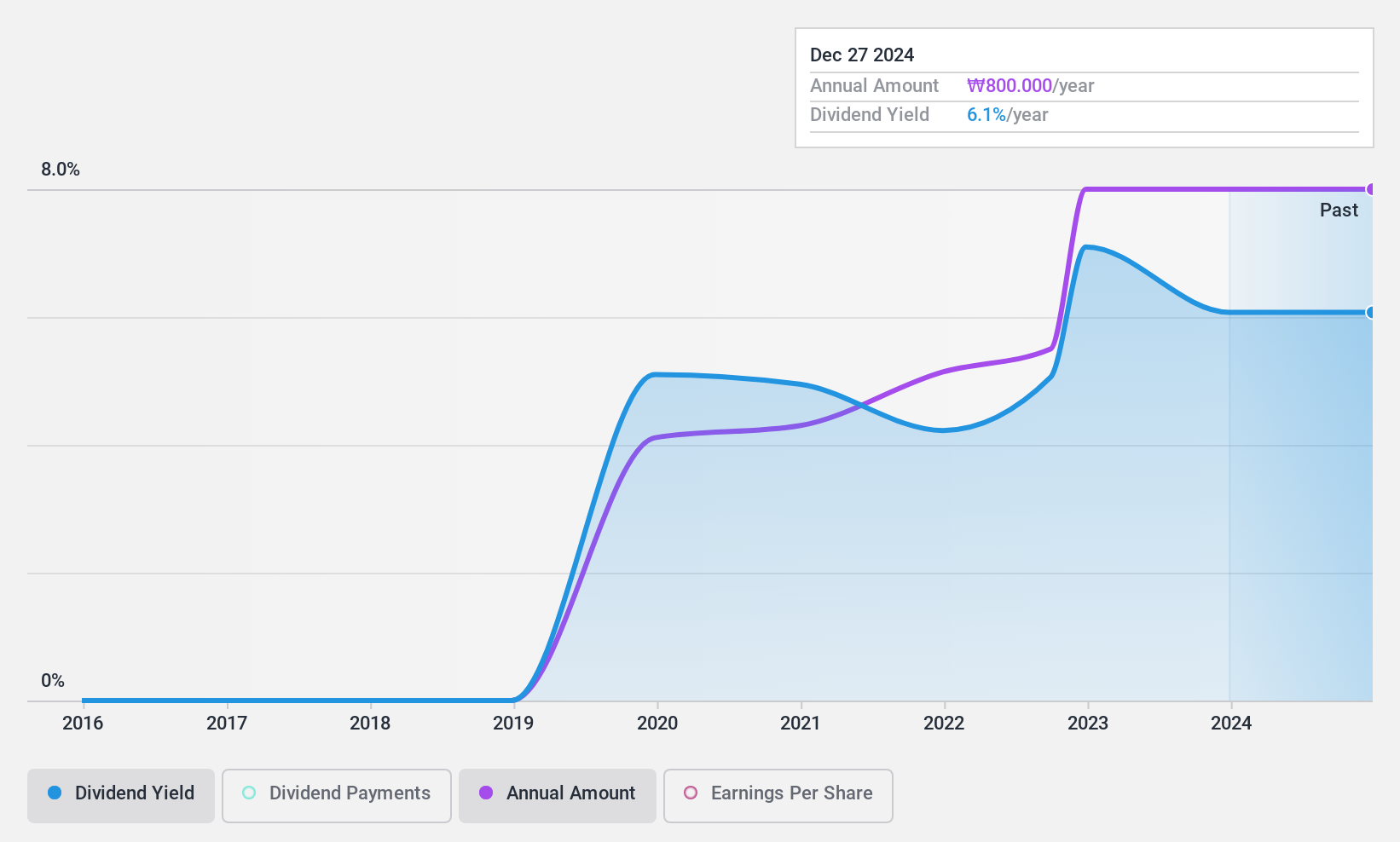

Hanil Holdings (KOSE:A003300)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanil Holdings Co., Ltd. and its subsidiaries manufacture and sell construction materials in South Korea, with a market cap of ₩487.14 billion.

Operations: Hanil Holdings Co., Ltd.'s revenue is primarily derived from its Cement Segment (₩917.97 million), Remittal Division (₩468.26 million), and Ready-Mixed Concrete Sector (₩482.45 million).

Dividend Yield: 5.1%

Hanil Holdings' recent earnings report highlights a net income increase to KRW 30.54 billion for Q3, up from KRW 27.69 billion the previous year, indicating strong profitability growth of 16.6%. The company trades significantly below its estimated fair value and offers a dividend yield of 5.06%, placing it in the top quartile of Korean dividend payers. While dividends have grown steadily over five years with stable payouts covered by earnings and cash flows, their short history may concern some investors.

- Dive into the specifics of Hanil Holdings here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Hanil Holdings is trading behind its estimated value.

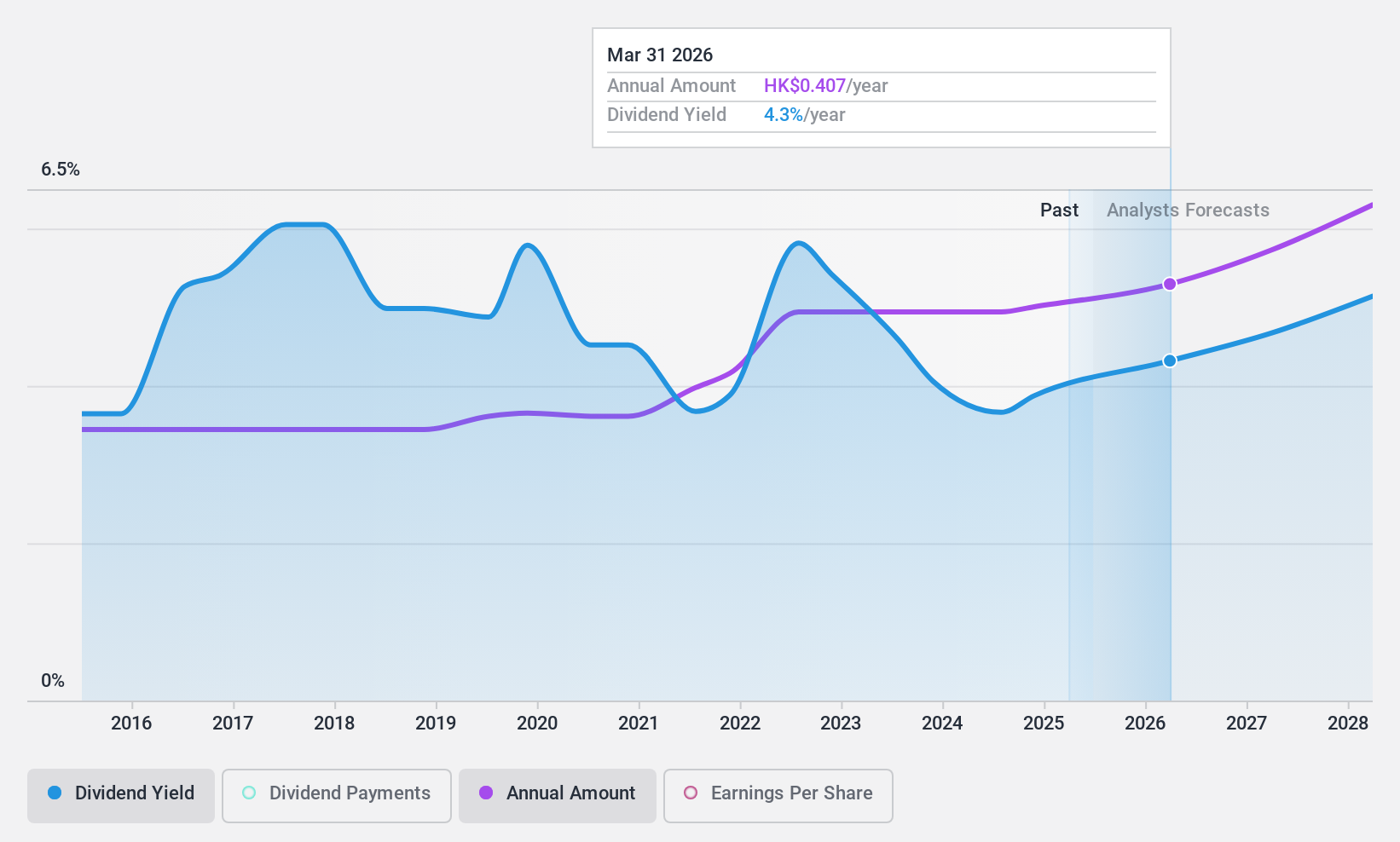

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market cap of approximately HK$119.95 billion.

Operations: Lenovo Group Limited generates revenue primarily from its Intelligent Devices Group (IDG) at $47.76 billion, followed by the Infrastructure Solutions Group (ISG) at $11.47 billion, and the Solutions and Services Group (SSG) at $7.89 billion.

Dividend Yield: 4%

Lenovo Group's dividend payments have been reliable and growing over the past decade, supported by a reasonable payout ratio of 50.6% and cash payout ratio of 40.2%, ensuring dividends are well covered by earnings and cash flows. The recent interim dividend announcement reinforces its commitment to shareholders, though its yield of 3.97% is lower than top-tier payers in the Hong Kong market. Lenovo's strategic initiatives, including collaborations with Motorola and Cisco, aim to drive sustainable growth and profitability.

- Click here and access our complete dividend analysis report to understand the dynamics of Lenovo Group.

- Our comprehensive valuation report raises the possibility that Lenovo Group is priced lower than what may be justified by its financials.

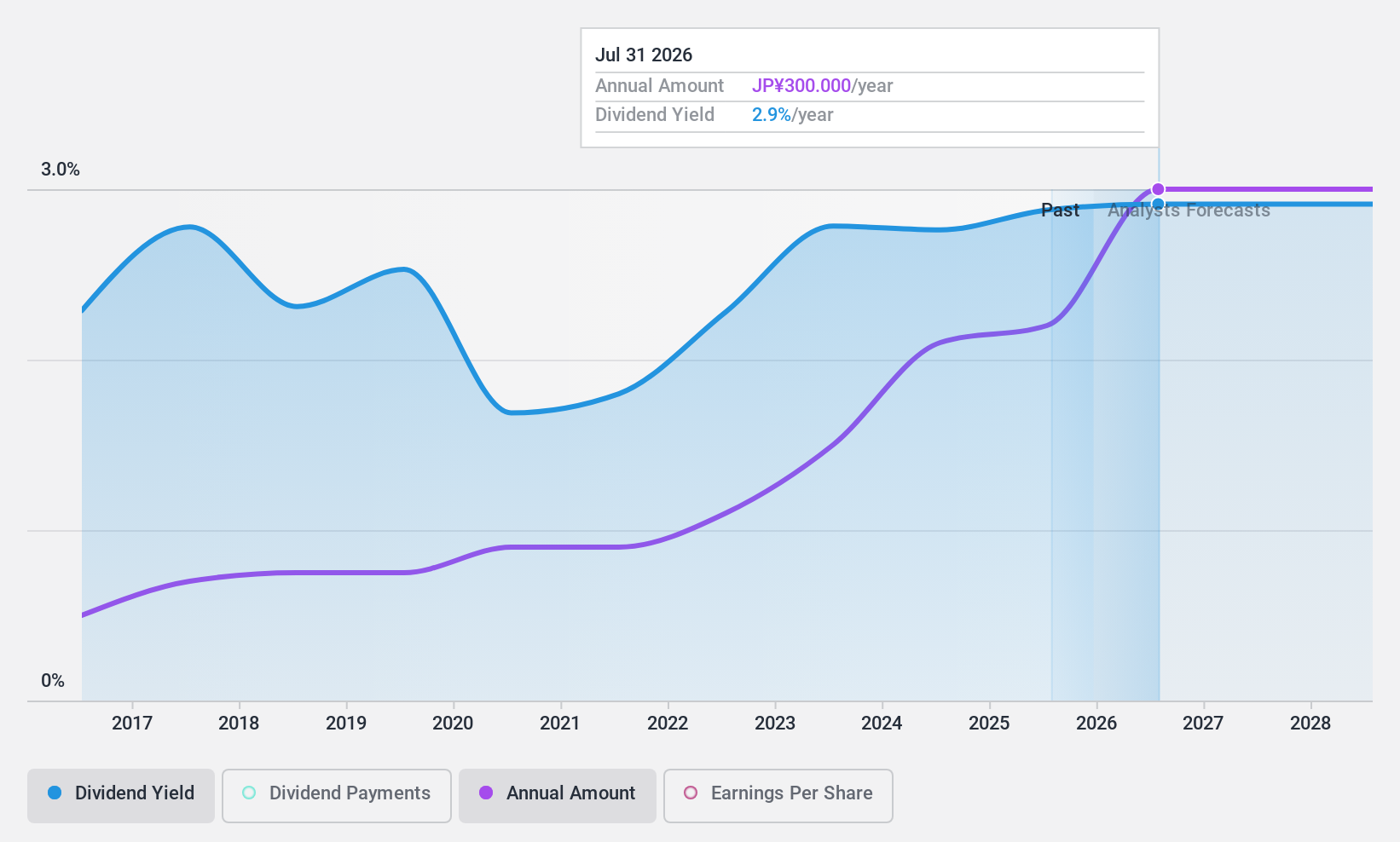

Uchida Yoko (TSE:8057)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uchida Yoko Co., Ltd. offers government and education, office, and information system solutions both in Japan and internationally, with a market cap of ¥65.92 billion.

Operations: Uchida Yoko Co., Ltd. generates revenue from office-related solutions (¥57.58 billion), information-related solutions (¥142.23 billion), and public-related business (¥77.10 billion).

Dividend Yield: 3.3%

Uchida Yoko offers a stable dividend profile, with dividends reliably growing over the past decade. Its payout ratio of 36.3% ensures dividends are well covered by earnings, while a cash payout ratio of 75.5% indicates coverage by cash flows. Although its dividend yield of 3.29% is lower than the top tier in Japan, it trades at good value with a P/E ratio below the market average, suggesting potential appeal for value-conscious investors.

- Take a closer look at Uchida Yoko's potential here in our dividend report.

- Our expertly prepared valuation report Uchida Yoko implies its share price may be lower than expected.

Seize The Opportunity

- Navigate through the entire inventory of 1953 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Very undervalued with outstanding track record and pays a dividend.