- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Exploring High Growth Tech Stocks This December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have faced notable challenges, reflecting broader investor sentiment. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability to economic shifts while maintaining strong innovation potential.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

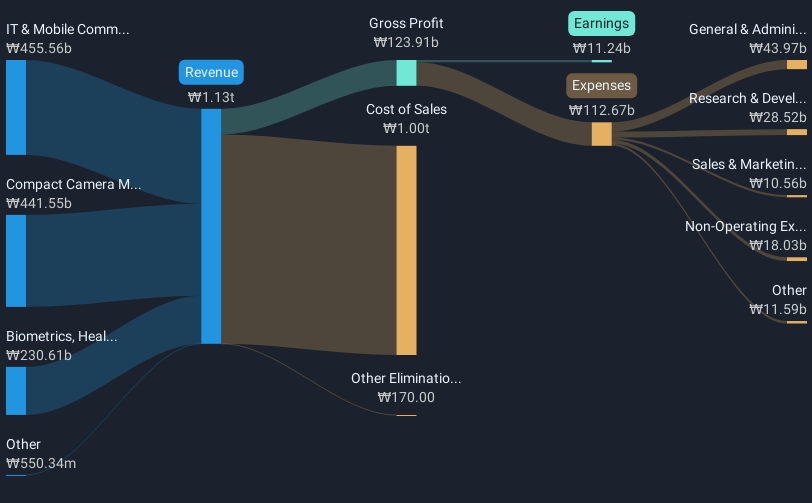

Overview: DREAMTECH Co., Ltd. is involved in the design, development, and manufacture of modules both domestically in South Korea and internationally, with a market capitalization of approximately ₩500 billion.

Operations: DREAMTECH Co., Ltd. generates revenue primarily from IT & Mobile Communications and Compact Camera Module (CCM) segments, with contributions of approximately ₩455.56 billion and ₩441.55 billion, respectively. The Biometrics, Healthcare & Convergence segment also plays a significant role in its revenue model, contributing around ₩230.61 billion.

DREAMTECH, amidst a robust tech landscape, showcases a promising trajectory with its earnings expected to surge by 36.5% annually, outpacing the broader Korean market's 29.2%. This growth is complemented by a significant revenue increase of 14.7% per year, which also exceeds the market average of 8.9%. The firm's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in the high-stakes electronic industry where it recently adjusted its buyback plan to extend until February 2025, reflecting confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of DREAMTECH.

Gain insights into DREAMTECH's past trends and performance with our Past report.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

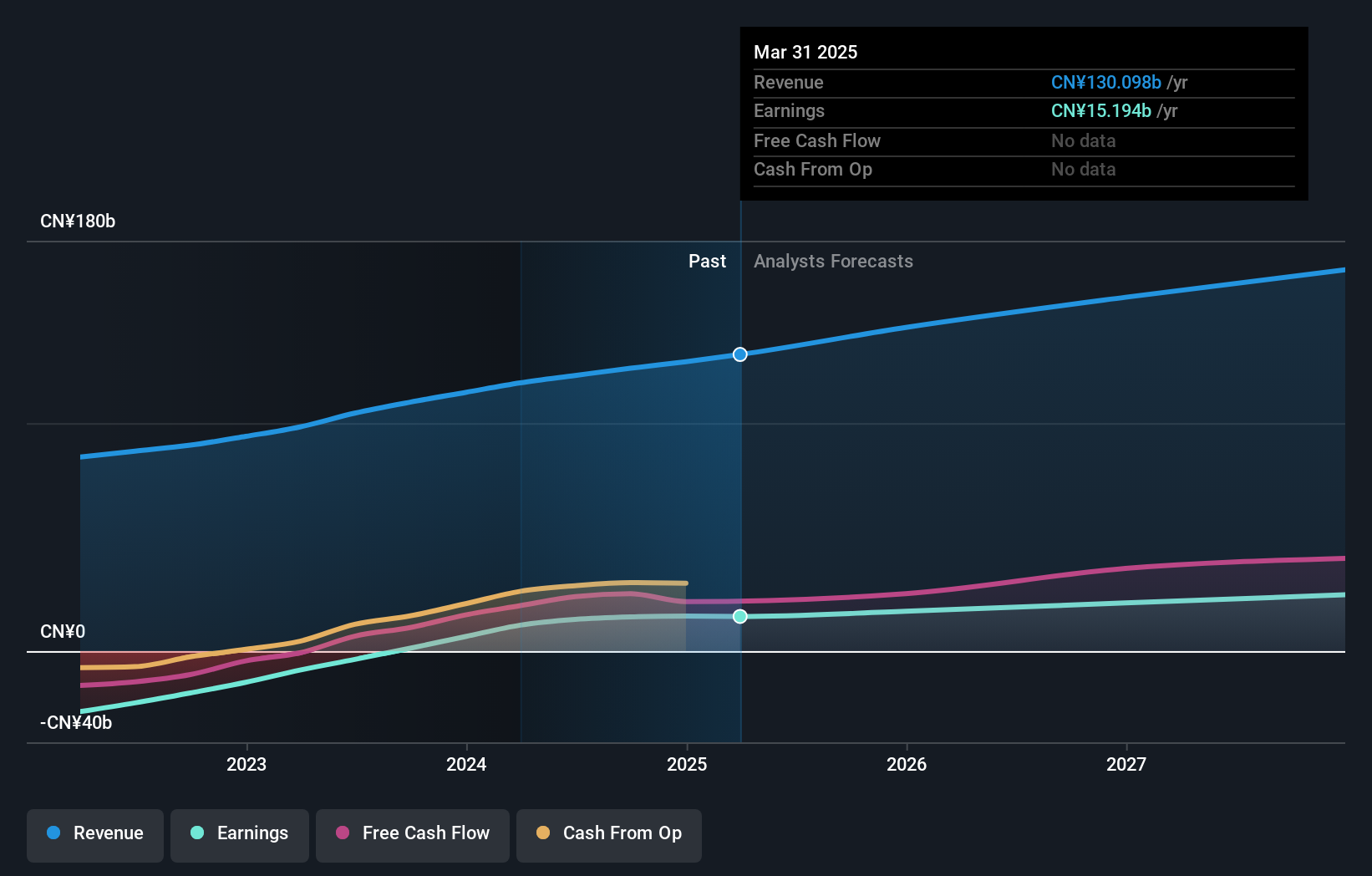

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People's Republic of China, with a market cap of HK$184.90 billion.

Operations: Kuaishou Technology generates revenue primarily from its domestic operations, amounting to CN¥119.83 billion, with a smaller contribution of CN¥4.25 billion from overseas markets.

Kuaishou Technology, recently added to the Hang Seng Index, demonstrates robust growth with a 1106.6% increase in earnings over the past year, significantly outpacing its industry's average of 5.8%. This performance is supported by an 8.7% annual revenue growth forecast, surpassing Hong Kong's market average of 7.8%. The company's strategic focus on R&D is evident as it channels substantial investments into innovation—key to sustaining its competitive edge in the dynamic Interactive Media and Services sector.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive health report here.

Explore historical data to track Kuaishou Technology's performance over time in our Past section.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

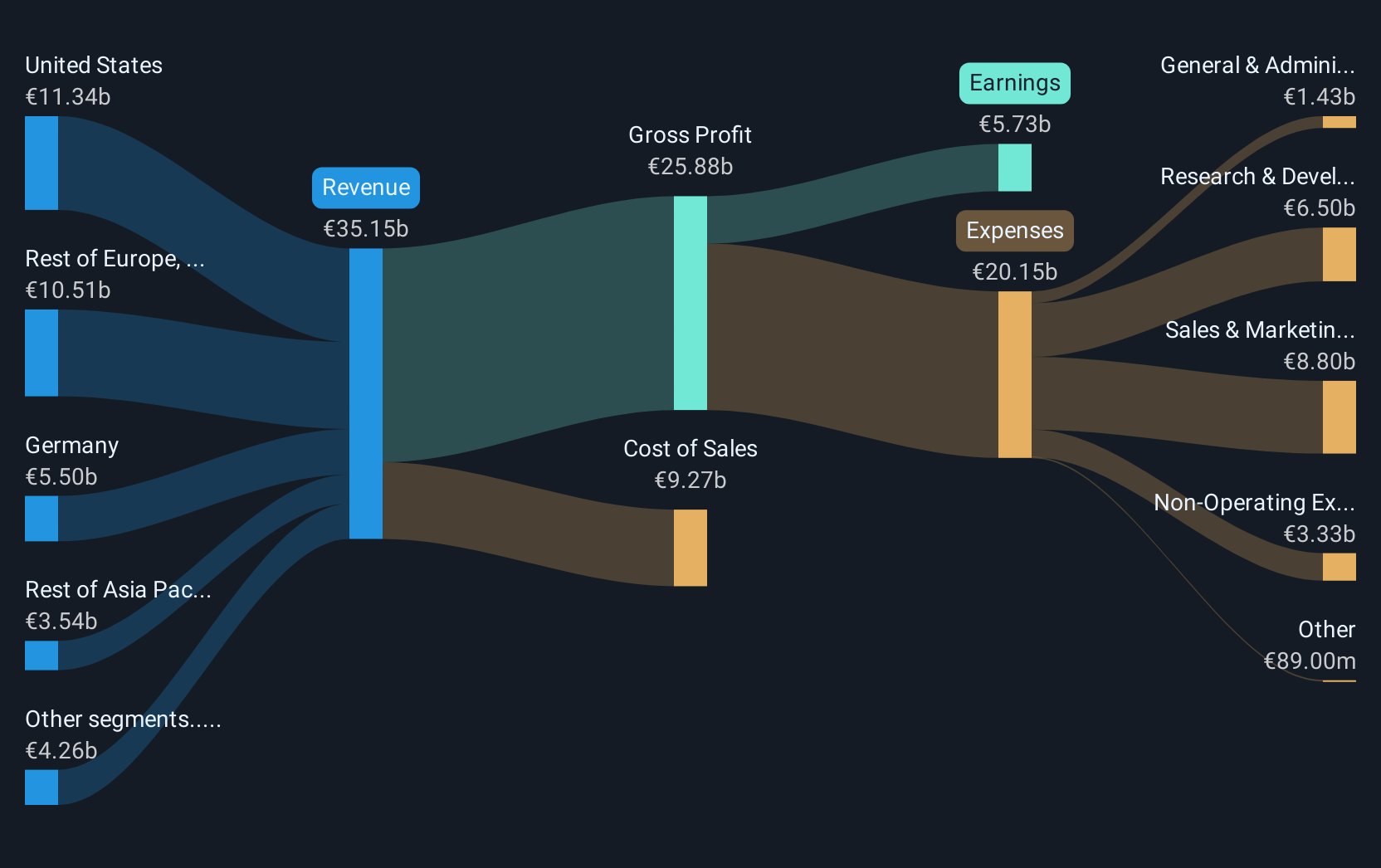

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services globally and has a market capitalization of approximately €274.96 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which accounts for €33.27 billion.

SAP's recent strategic initiatives, such as the collaboration with AWS to deploy GROW with SAP on AWS, highlight its commitment to enhancing cloud ERP solutions that leverage AI innovations. This partnership is set to simplify and accelerate ERP deployments, offering scalability and security while fostering generative AI-powered innovations for diverse customer needs. Furthermore, SAP's focus on R&D is underscored by its significant investment in this area; the company has consistently allocated substantial resources towards innovation, ensuring it remains at the forefront of technological advancements in software solutions. These efforts are reflected in SAP's robust projected annual revenue growth of 10.3% and earnings growth of 41.4%, indicating a strong trajectory compared to the broader German market's averages of 5.7% and 20.6%, respectively.

- Click here and access our complete health analysis report to understand the dynamics of SAP.

Evaluate SAP's historical performance by accessing our past performance report.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1273 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.