- South Korea

- /

- Packaging

- /

- KOSDAQ:A251970

Only Three Days Left To Cash In On Pum-Tech Korea's (KOSDAQ:251970) Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Pum-Tech Korea Co., Ltd (KOSDAQ:251970) is about to trade ex-dividend in the next three days. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 24th of April.

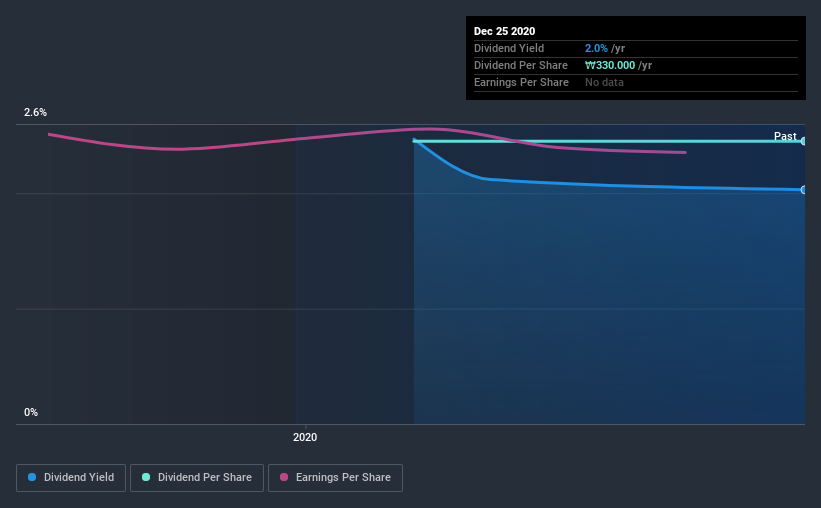

Pum-Tech Korea's next dividend payment will be ₩430 per share, which looks like a nice increase on last year, when the company distributed a total of ₩330 to shareholders. If you buy this business for its dividend, you should have an idea of whether Pum-Tech Korea's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Pum-Tech Korea

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Pum-Tech Korea paid out just 20% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether Pum-Tech Korea generated enough free cash flow to afford its dividend.

Click here to see how much of its profit Pum-Tech Korea paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Earnings per share are basically flat over the past 12 months. Growth is a prerequisite for an outstanding dividend company over the long term, but we wouldn't read too much into flat numbers over any one year time frame.

Given that Pum-Tech Korea has only been paying a dividend for a year, there's not much of a past history to draw insight from.

To Sum It Up

Is Pum-Tech Korea an attractive dividend stock, or better left on the shelf? It's disappointing to see earnings per share have fallen slightly, even though Pum-Tech Korea is paying out less than half its income as dividends. It's also paying out an uncomfortably high percentage of its cash flow, which makes us wonder just how sustainable the dividend really is. It's not that we think Pum-Tech Korea is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that in mind though, if the poor dividend characteristics of Pum-Tech Korea don't faze you, it's worth being mindful of the risks involved with this business. We've identified 3 warning signs with Pum-Tech Korea (at least 1 which is concerning), and understanding them should be part of your investment process.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Pum-Tech Korea, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A251970

Pum-Tech Korea

Engages in the manufacturing and sale of in cosmetics dispensers and containers in South Korea and internationally.

Undervalued with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026