- South Korea

- /

- Chemicals

- /

- KOSDAQ:A170920

Positive Sentiment Still Eludes LTC Co.,Ltd (KOSDAQ:170920) Following 30% Share Price Slump

LTC Co.,Ltd (KOSDAQ:170920) shares have had a horrible month, losing 30% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

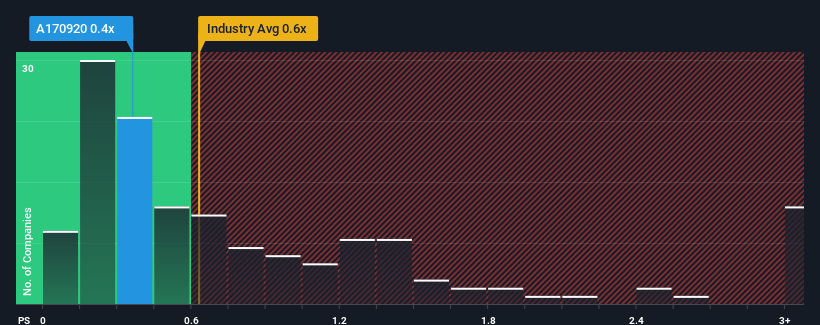

Even after such a large drop in price, it's still not a stretch to say that LTCLtd's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Korea, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for LTCLtd

How LTCLtd Has Been Performing

Revenue has risen firmly for LTCLtd recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on LTCLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like LTCLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The strong recent performance means it was also able to grow revenue by 171% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

In light of this, it's curious that LTCLtd's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does LTCLtd's P/S Mean For Investors?

Following LTCLtd's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that LTCLtd currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 3 warning signs for LTCLtd (1 is potentially serious!) that you need to take into consideration.

If these risks are making you reconsider your opinion on LTCLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A170920

LTCLtd

Provides FPD and semiconductor chemical solutions in Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives