- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A092070

We Think DNFLtd (KOSDAQ:092070) Can Manage Its Debt With Ease

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, DNF Co.,Ltd. (KOSDAQ:092070) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for DNFLtd

How Much Debt Does DNFLtd Carry?

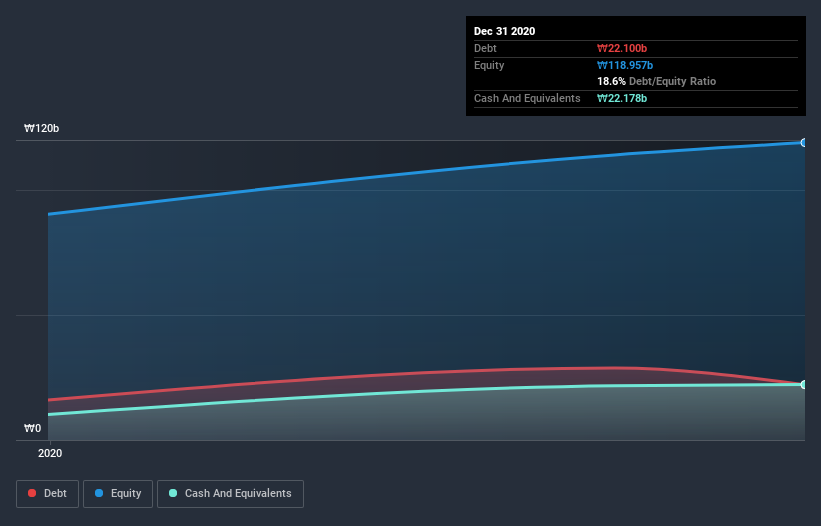

You can click the graphic below for the historical numbers, but it shows that as of December 2020 DNFLtd had ₩22.1b of debt, an increase on ₩16.0b, over one year. But it also has ₩22.2b in cash to offset that, meaning it has ₩78.3m net cash.

How Strong Is DNFLtd's Balance Sheet?

The latest balance sheet data shows that DNFLtd had liabilities of ₩32.7b due within a year, and liabilities of ₩4.75b falling due after that. Offsetting these obligations, it had cash of ₩22.2b as well as receivables valued at ₩8.82b due within 12 months. So its liabilities total ₩6.42b more than the combination of its cash and short-term receivables.

Given DNFLtd has a market capitalization of ₩226.0b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, DNFLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, DNFLtd grew its EBIT by 124% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is DNFLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. DNFLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent two years, DNFLtd recorded free cash flow worth 66% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

We could understand if investors are concerned about DNFLtd's liabilities, but we can be reassured by the fact it has has net cash of ₩78.3m. And we liked the look of last year's 124% year-on-year EBIT growth. So we don't think DNFLtd's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 3 warning signs we've spotted with DNFLtd .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading DNFLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A092070

DNFLtd

Engages in the semiconductor and display businesses in South Korea and internationally.

Very low with weak fundamentals.

Market Insights

Community Narratives