- Japan

- /

- Trade Distributors

- /

- TSE:8103

3 Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets react to the Trump administration's emerging policies and AI-related optimism, major indices like the S&P 500 have reached new highs, reflecting positive investor sentiment. With this backdrop of market enthusiasm and shifting economic dynamics, dividend stocks present a compelling option for investors seeking stable income streams amid potential volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.94% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.90% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.12% | ★★★★☆☆ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

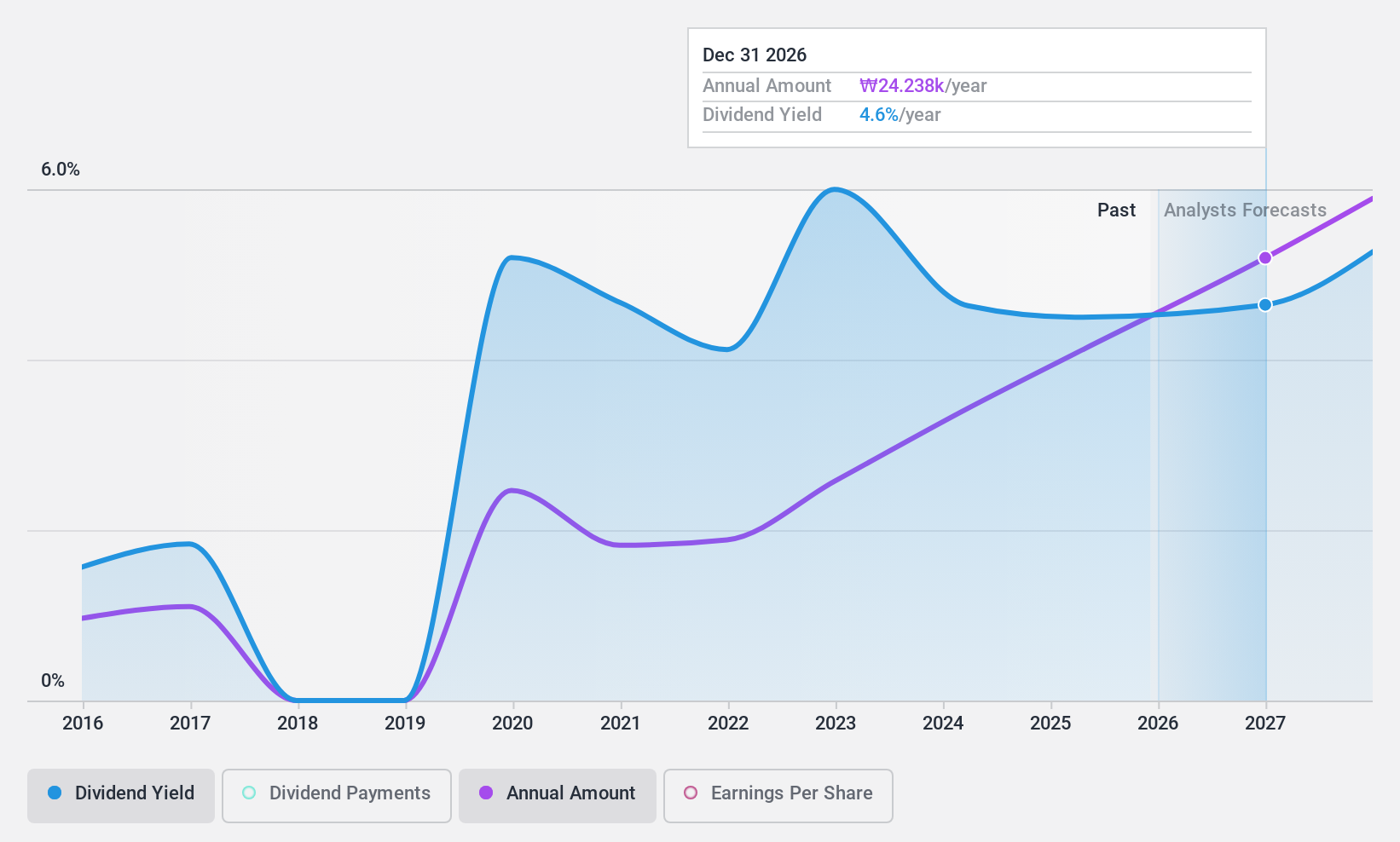

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. provides non-life insurance products and services across Korea, China, the United States, Indonesia, Vietnam, Singapore, and the United Kingdom with a market cap of approximately ₩14.31 trillion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenue primarily from its insurance business, amounting to approximately ₩19.31 billion.

Dividend Yield: 4.2%

Samsung Fire & Marine Insurance's dividend payments have been volatile over the past decade, despite increasing overall. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 37.5% and 39.7% respectively, suggesting sustainability from a financial standpoint. Trading significantly below fair value estimates, it offers a competitive dividend yield in the top 25% of the Korean market. Recent earnings growth supports potential future stability in payouts.

- Take a closer look at Samsung Fire & Marine Insurance's potential here in our dividend report.

- The valuation report we've compiled suggests that Samsung Fire & Marine Insurance's current price could be quite moderate.

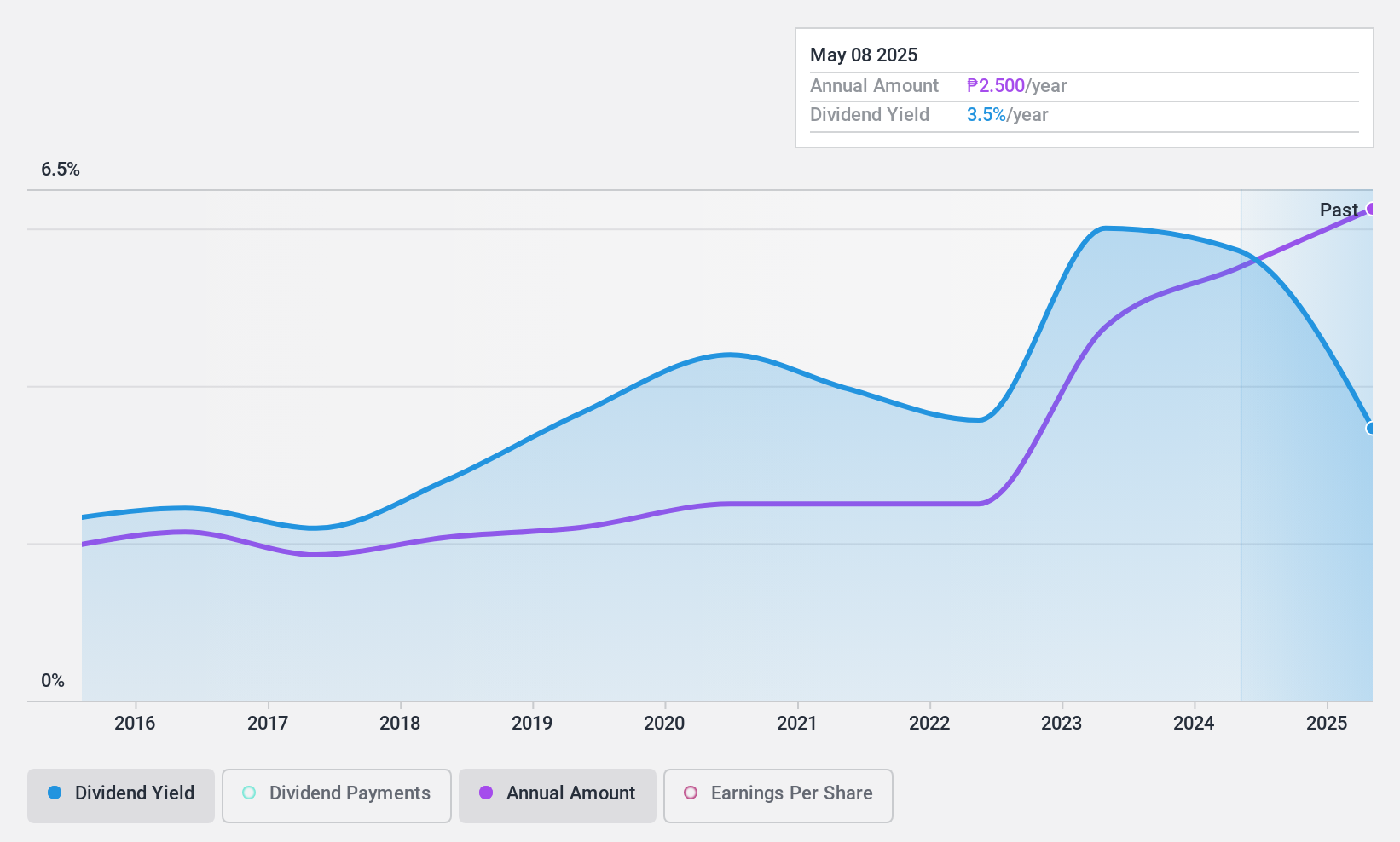

China Banking (PSE:CBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Banking Corporation offers a range of banking and financial products and services to individuals and businesses in the Philippines, with a market cap of ₱180.19 billion.

Operations: China Banking Corporation's revenue segments include interest income of ₱37.25 billion, service charges and fees of ₱5.13 billion, trading and securities gains of ₱2.47 billion, and foreign exchange gains of ₱1.08 billion.

Dividend Yield: 2.4%

China Banking Corporation's dividends have been stable and reliable over the past decade, supported by a low payout ratio of 13.3%, indicating strong coverage by earnings. However, its dividend yield of 2.37% is relatively low compared to top-tier payers in the Philippine market. Despite this, CBC has seen consistent earnings growth at 18.3% annually over five years, although it faces challenges with a high bad loans ratio of 2.4%.

- Dive into the specifics of China Banking here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of China Banking shares in the market.

Meiwa (TSE:8103)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiwa Corporation operates in the chemicals, lubricants, battery materials, automotive and mineral resource, and environmental sectors both domestically in Japan and internationally, with a market cap of ¥26.41 billion.

Operations: Meiwa Corporation's revenue segments include First Business at ¥42.86 billion, Third Business at ¥59.98 billion, Second Business at ¥47.67 billion, and Automobile/Battery Materials Business at ¥11.34 billion.

Dividend Yield: 4.7%

Meiwa's dividend yield of 4.66% ranks in the top 25% of payers in Japan, though its dividends have been volatile over the past decade, with drops exceeding 20%. Despite this instability, dividend payments are well-supported by a low payout ratio of 45.2% and a cash payout ratio of 25.9%. The company's earnings surged by 94.6% last year, and it trades at a significant discount to its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Meiwa.

- In light of our recent valuation report, it seems possible that Meiwa is trading behind its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1938 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8103

Meiwa

Engages in the chemicals, lubricants, battery materials, automotive and mineral resources, and environmental businesses in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)