- South Korea

- /

- Personal Products

- /

- KOSE:A192820

Cosmax, Inc.'s (KRX:192820) Share Price Matching Investor Opinion

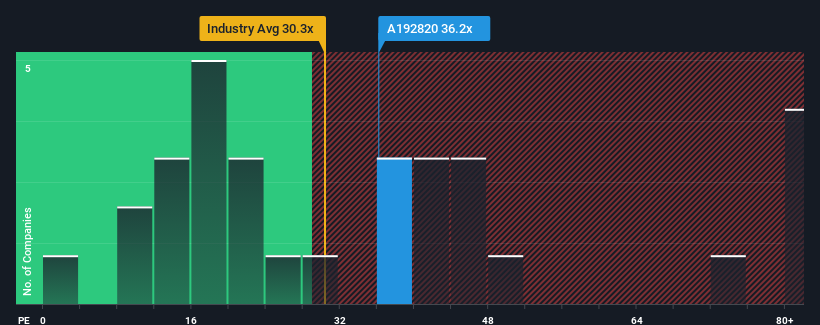

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 14x, you may consider Cosmax, Inc. (KRX:192820) as a stock to avoid entirely with its 36.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Cosmax has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Cosmax

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Cosmax's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. This means it has also seen a slide in earnings over the longer-term as EPS is down 23% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 64% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 21% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Cosmax is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Cosmax maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Cosmax, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Cosmax, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A192820

Cosmax

Researches, develops, produces, and manufactures cosmetic and health function food products in Korea and internationally.

High growth potential with proven track record.