- South Korea

- /

- Personal Products

- /

- KOSDAQ:A352480

C&C International Co., Ltd.'s (KOSDAQ:352480) 27% Jump Shows Its Popularity With Investors

Despite an already strong run, C&C International Co., Ltd. (KOSDAQ:352480) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

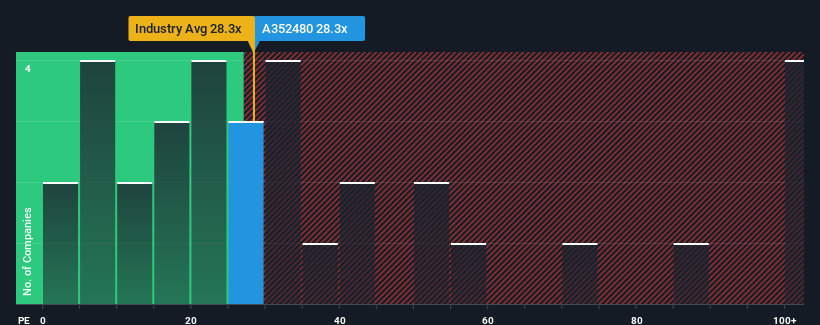

Since its price has surged higher, C&C International's price-to-earnings (or "P/E") ratio of 28.3x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

C&C International certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for C&C International

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like C&C International's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 78% gain to the company's bottom line. Pleasingly, EPS has also lifted 240% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader market.

With this information, we can see why C&C International is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

C&C International's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of C&C International's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - C&C International has 1 warning sign we think you should be aware of.

If you're unsure about the strength of C&C International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A352480

C&C International

C&C International Co.,Ltd engages in the research and development, manufacture, and sale of cosmetics in Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives