Diversification is a key tool for dealing with stock price volatility. But if you're going to beat the market overall, you need to have individual stocks that outperform. One such company is ChunLab, Inc. (KOSDAQ:311690), which saw its share price increase 40% in the last year, slightly above the market return of around 35% (not including dividends). Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for ChunLab

ChunLab wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

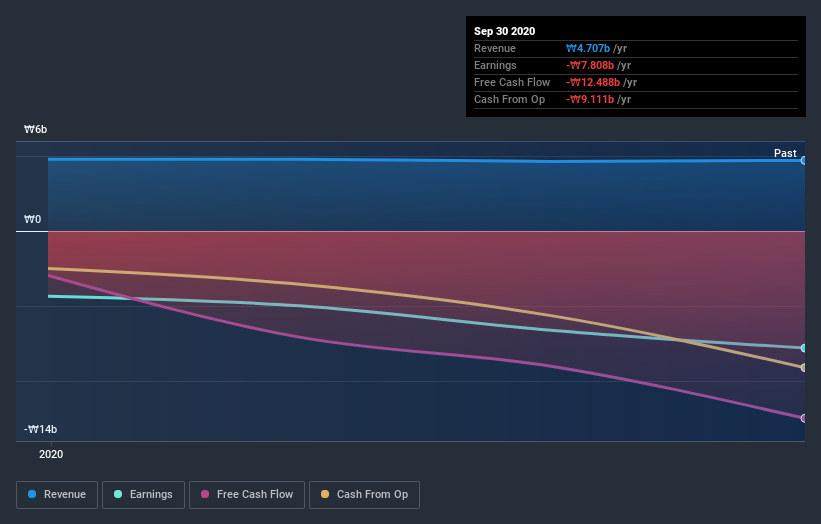

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

ChunLab shareholders have gained 40% over twelve months, which isn't far from the market return of 38%. A substantial portion of that gain has come in the last three months, with the stock up 13% in that time. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. It's always interesting to track share price performance over the longer term. But to understand ChunLab better, we need to consider many other factors. Even so, be aware that ChunLab is showing 3 warning signs in our investment analysis , you should know about...

Of course ChunLab may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade ChunLab, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A311690

CJ Bioscience

Provides microbiome solutions to address unmet medical needs in South Korea and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives