- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

What Type Of Shareholders Own The Most Number of CLASSYS Inc. (KOSDAQ:214150) Shares?

Every investor in CLASSYS Inc. (KOSDAQ:214150) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

CLASSYS has a market capitalization of ₩971b, so we would expect some institutional investors to have noticed the stock. In the chart below, we can see that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholders can tell us about CLASSYS.

Check out our latest analysis for CLASSYS

What Does The Lack Of Institutional Ownership Tell Us About CLASSYS?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

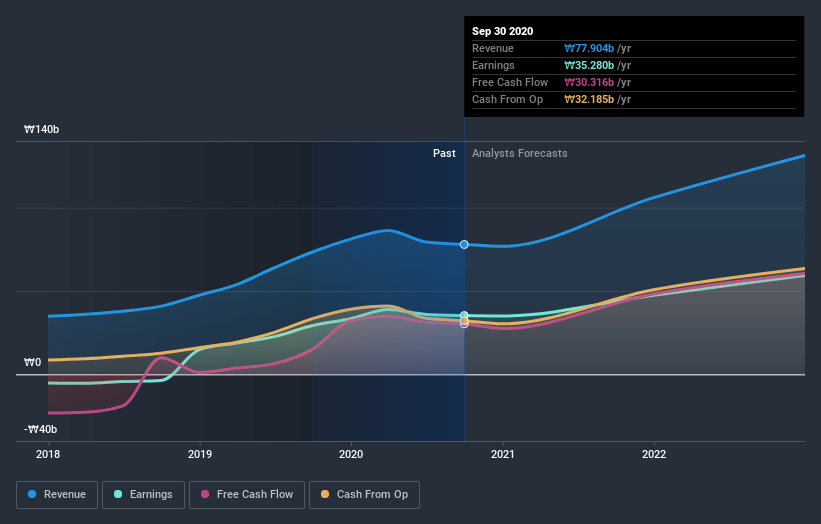

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. CLASSYS' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

CLASSYS is not owned by hedge funds. Sung-Jae Jung is currently the largest shareholder, with 85% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. With 0.1% and 0.1% of the shares outstanding respectively, Changho Choi and Kwangtaek Jung are the second and third largest shareholders.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of CLASSYS

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems that insiders own more than half the CLASSYS Inc. stock. This gives them a lot of power. So they have a ₩826b stake in this ₩971b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 14% stake in CLASSYS. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading CLASSYS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A214150

Exceptional growth potential with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026