- South Korea

- /

- Personal Products

- /

- KOSDAQ:A352480

KRX Value Stocks With Estimated Discounts For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.4%, driven by declines in every sector, and it has fallen 3.8% over the past year despite earnings being forecast to grow by 29% annually. In this environment, identifying undervalued stocks with strong fundamentals can offer promising opportunities for investors looking to capitalize on potential market rebounds.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HD Hyundai Electric (KOSE:A267260) | ₩245500.00 | ₩464395.71 | 47.1% |

| C&C International (KOSDAQ:A352480) | ₩96500.00 | ₩192741.27 | 49.9% |

| APR (KOSE:A278470) | ₩290500.00 | ₩520386.98 | 44.2% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩170600.00 | ₩305936.66 | 44.2% |

| Oscotec (KOSDAQ:A039200) | ₩34650.00 | ₩65583.14 | 47.2% |

| Intellian Technologies (KOSDAQ:A189300) | ₩48850.00 | ₩91272.91 | 46.5% |

| Global Tax Free (KOSDAQ:A204620) | ₩3370.00 | ₩6419.18 | 47.5% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1568.00 | ₩2947.00 | 46.8% |

| Hanall Biopharma (KOSE:A009420) | ₩37850.00 | ₩70271.91 | 46.1% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45200.00 | ₩82954.13 | 45.5% |

Let's uncover some gems from our specialized screener.

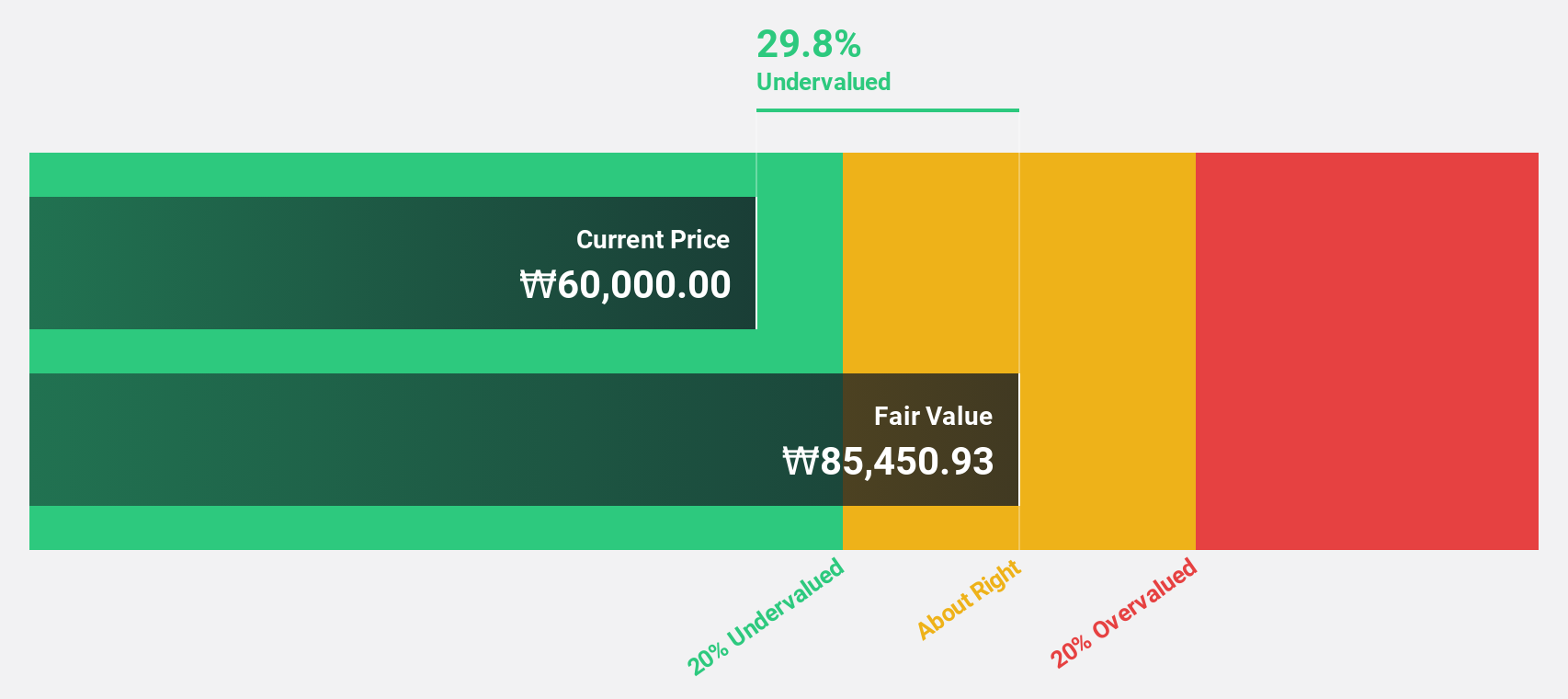

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.49 billion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, which accounted for ₩204.37 million.

Estimated Discount To Fair Value: 15.1%

CLASSYS is trading at ₩54,600, 15.1% below its estimated fair value of ₩64,343.11. Despite slower forecasted revenue growth (19.3% per year) compared to the Korean market (10.3%), earnings are expected to grow significantly at 22.5% annually over the next three years, albeit slower than the market average of 28.6%. Recent presentations at major conferences indicate active investor engagement and transparency about business performance and future prospects.

- Our earnings growth report unveils the potential for significant increases in CLASSYS' future results.

- Click to explore a detailed breakdown of our findings in CLASSYS' balance sheet health report.

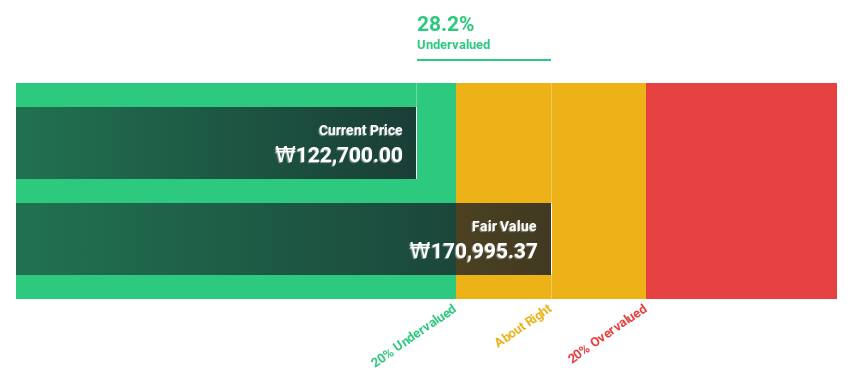

C&C International (KOSDAQ:A352480)

Overview: C&C International Co., Ltd. engages in the research and development, manufacture, and sale of cosmetics in Korea with a market cap of ₩964.72 billion.

Operations: The company's revenue from personal products is ₩269.52 billion.

Estimated Discount To Fair Value: 49.9%

C&C International is trading at ₩96,500, significantly below its estimated fair value of ₩192,741.27. Despite high volatility in its share price over the past three months, the company has shown strong earnings growth of 82.1% over the past year and is expected to continue growing revenue at 24.3% annually, outpacing the Korean market's average of 10.3%. However, its forecasted annual profit growth of 21.8% lags behind the market's 28.6%.

- The analysis detailed in our C&C International growth report hints at robust future financial performance.

- Dive into the specifics of C&C International here with our thorough financial health report.

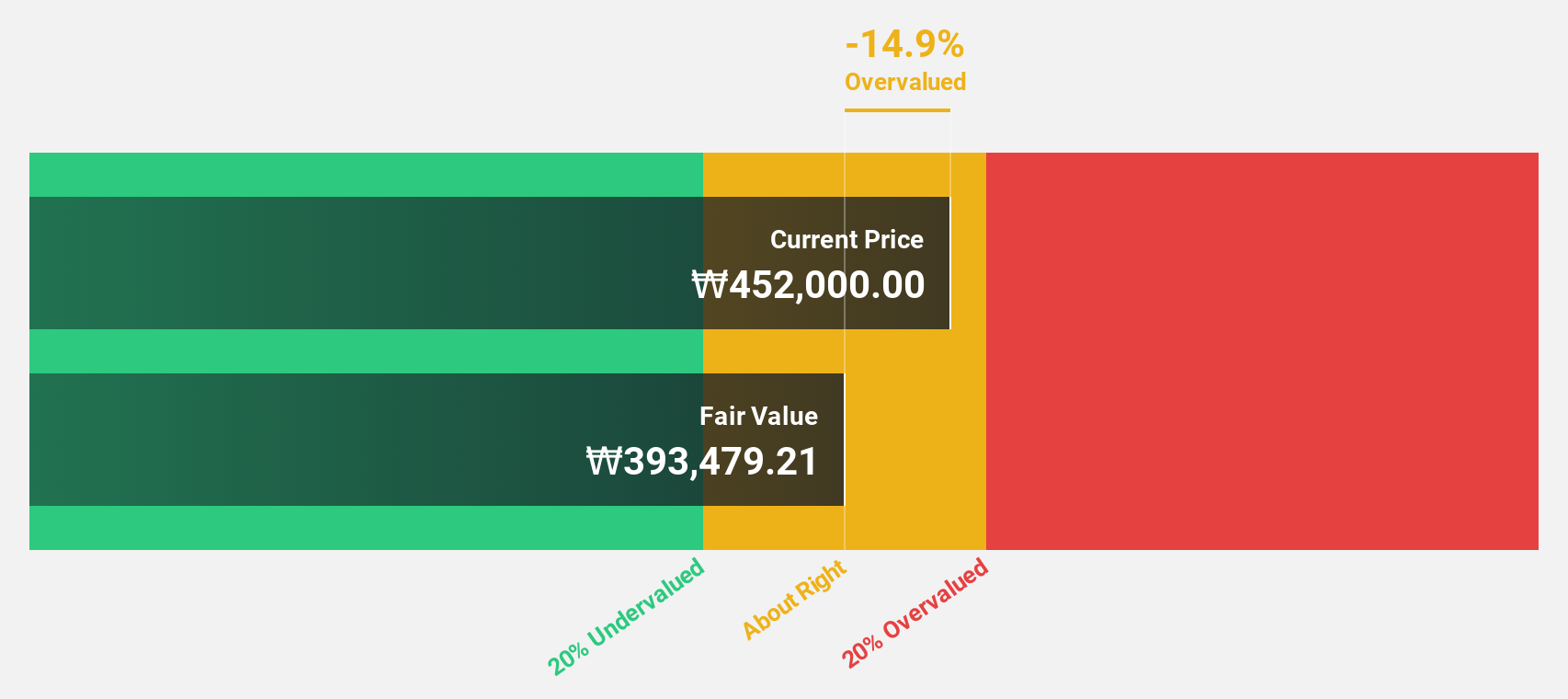

HD Hyundai Electric (KOSE:A267260)

Overview: HD Hyundai Electric Co., Ltd. manufactures and sells electrical equipment in South Korea and has a market cap of ₩8.84 trillion.

Operations: HD Hyundai Electric's revenue from the electric equipment segment is ₩3.21 trillion.

Estimated Discount To Fair Value: 47.1%

HD Hyundai Electric reported significant earnings growth for Q2 2024, with net income rising to ₩161.5 billion from ₩37.7 billion a year ago. The stock is trading at ₩245,500, well below its estimated fair value of ₩464,395.71 and 47.1% under our fair value estimate. Despite recent share price volatility, analysts agree on a potential price increase of 76.4%. Revenue and earnings are forecast to grow faster than the market average over the next few years.

- In light of our recent growth report, it seems possible that HD Hyundai Electric's financial performance will exceed current levels.

- Take a closer look at HD Hyundai Electric's balance sheet health here in our report.

Turning Ideas Into Actions

- Click here to access our complete index of 34 Undervalued KRX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A352480

C&C International

C&C International Co.,Ltd engages in the research and development, manufacture, and sale of cosmetics in Korea.

Flawless balance sheet and undervalued.