- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A131030

There's Reason For Concern Over OPTUS Pharmaceutical Co., Ltd.'s (KOSDAQ:131030) Massive 28% Price Jump

OPTUS Pharmaceutical Co., Ltd. (KOSDAQ:131030) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 40% in the last year.

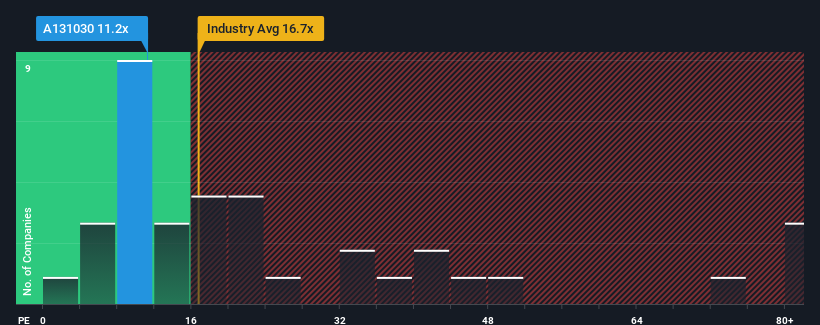

Although its price has surged higher, it's still not a stretch to say that OPTUS Pharmaceutical's price-to-earnings (or "P/E") ratio of 11.2x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, OPTUS Pharmaceutical has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for OPTUS Pharmaceutical

How Is OPTUS Pharmaceutical's Growth Trending?

In order to justify its P/E ratio, OPTUS Pharmaceutical would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 137% gain to the company's bottom line. Still, incredibly EPS has fallen 8.3% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's somewhat alarming that OPTUS Pharmaceutical's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

OPTUS Pharmaceutical's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of OPTUS Pharmaceutical revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 4 warning signs for OPTUS Pharmaceutical you should be aware of, and 1 of them is a bit unpleasant.

You might be able to find a better investment than OPTUS Pharmaceutical. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade OPTUS Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A131030

Flawless balance sheet low.

Market Insights

Community Narratives