- South Korea

- /

- Food

- /

- KOSE:A145990

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by fluctuating indices and mixed economic signals, global markets experienced a downturn with major indexes like the Nasdaq Composite and S&P 500 seeing declines after reaching record highs. Amidst this backdrop of cautious earnings reports and economic uncertainties, investors may find stability in dividend stocks, which can offer consistent income streams irrespective of market volatility. A good dividend stock typically combines a solid track record of payouts with strong fundamentals, making it an attractive option for those seeking to navigate the current complex market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

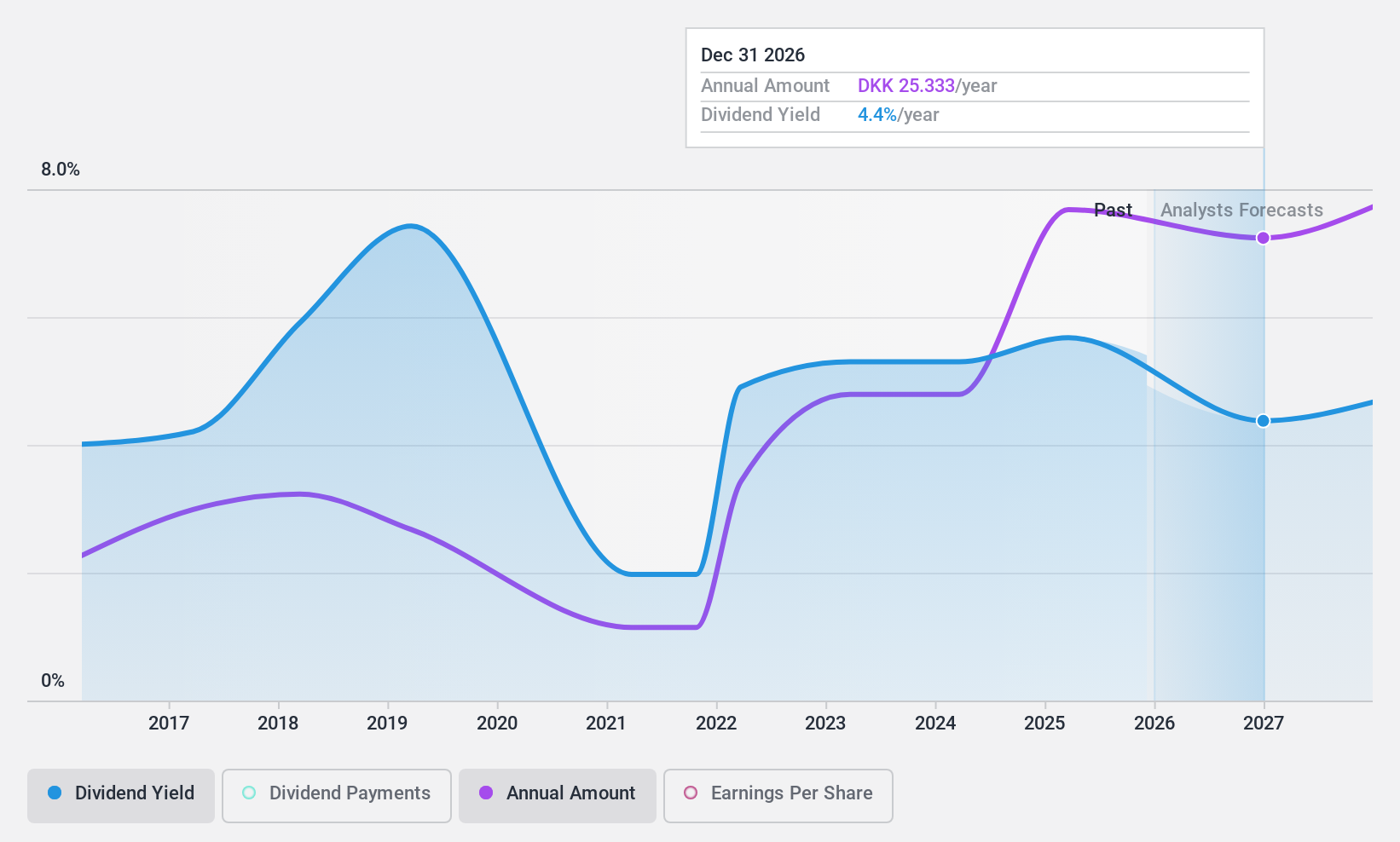

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sydbank A/S, along with its subsidiaries, offers a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally, with a market cap of DKK17.22 billion.

Operations: Sydbank A/S generates its revenue through diverse banking products and services tailored for corporate, private, retail, and institutional clients across Denmark and international markets.

Dividend Yield: 9%

Sydbank's dividend yield is among the top 25% in Denmark, supported by a payout ratio of approximately 50%, indicating dividends are covered by earnings. Despite an unstable dividend history, payments have increased over the past decade. However, recent earnings reports show a decline in net income and EPS compared to last year. A share buyback program was completed recently, enhancing shareholder value. The bank trades at a significant discount relative to its fair value estimate.

- Get an in-depth perspective on Sydbank's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sydbank's current price could be quite moderate.

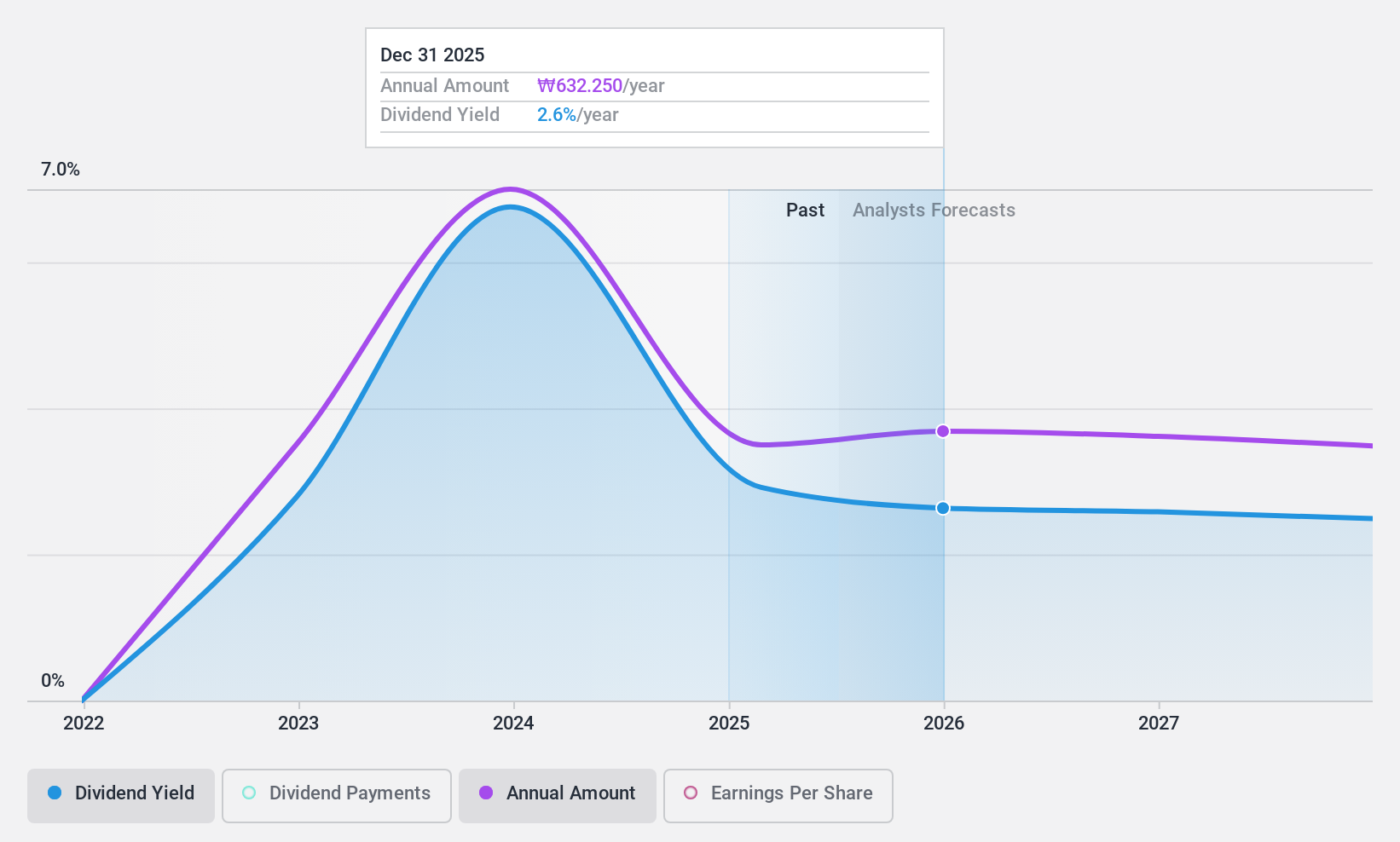

HMMLtd (KOSE:A011200)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HMM Co., Ltd is an integrated logistics company offering shipping and logistics services globally, with a market capitalization of approximately ₩13.38 billion.

Operations: HMM Co., Ltd generates revenue primarily from its Container segment with ₩7.62 billion, followed by Tankers & Dry Bulkers at ₩1.35 billion.

Dividend Yield: 3.9%

HMM Ltd's dividend yield is in the top 25% of the Korean market, with a low payout ratio of 30.9%, suggesting dividends are well covered by earnings and cash flows. However, its dividend history is short and unreliable, with volatile payments over two years. Despite recent strong earnings growth, profit margins have decreased compared to last year. Additionally, shareholders experienced significant dilution recently, though the stock trades at a favorable price-to-earnings ratio below market average.

- Take a closer look at HMMLtd's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that HMMLtd is trading beyond its estimated value.

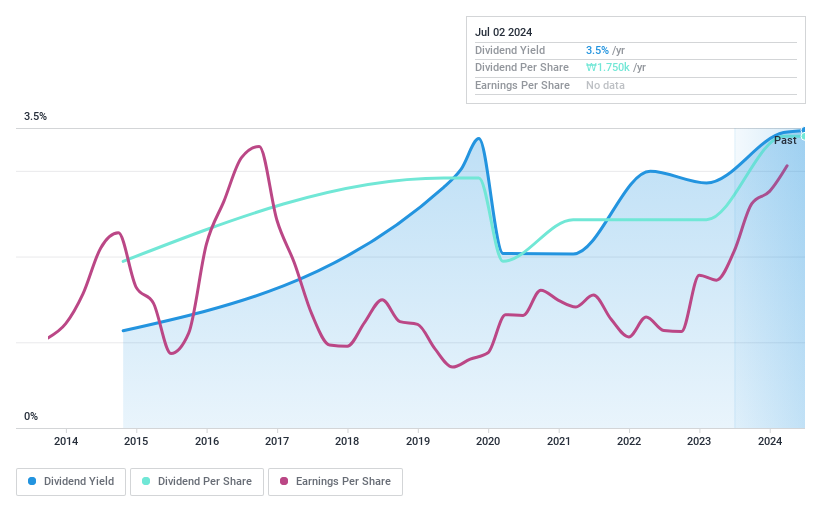

Samyang (KOSE:A145990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Corporation operates in the chemicals and food industries across Korea, China, Japan, other parts of Asia, Europe, and internationally with a market cap of ₩506.43 billion.

Operations: Samyang Corporation's revenue is primarily derived from its food segment, contributing ₩1.60 trillion, and its chemicals segment, which adds ₩1.11 trillion.

Dividend Yield: 3.4%

Samyang's dividend yield of 3.42% is below the top quartile in Korea, and its dividends have been volatile over the past decade despite some growth. The payout ratios are low, with earnings at 14.5% and cash flow at 18.7%, indicating strong coverage for dividend payments. Recent business expansion includes a KRW 140 billion investment in a large allulose plant, potentially enhancing revenue streams by tapping into North American and Asian markets.

- Click here to discover the nuances of Samyang with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Samyang is trading behind its estimated value.

Taking Advantage

- Embark on your investment journey to our 2030 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A145990

Samyang

Engages in the chemicals and food business in Korea, China, Japan, rest of Asia, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.