- Hong Kong

- /

- Entertainment

- /

- SEHK:136

Asian Market Value Picks Featuring 3 Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian markets have mirrored this cautious sentiment, particularly in China where investor worries about frothy valuations in AI-focused stocks have dampened risk appetite. In such an environment, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.76 | CN¥9.38 | 49.3% |

| Shengda ResourcesLtd (SZSE:000603) | CN¥25.16 | CN¥49.94 | 49.6% |

| PharmaResearch (KOSDAQ:A214450) | ₩442500.00 | ₩870185.20 | 49.1% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.11 | CN¥26.01 | 49.6% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.25 | CN¥20.17 | 49.2% |

| JINS HOLDINGS (TSE:3046) | ¥6260.00 | ¥12344.48 | 49.3% |

| EROAD (NZSE:ERD) | NZ$1.50 | NZ$2.95 | 49.1% |

| China Ruyi Holdings (SEHK:136) | HK$2.42 | HK$4.81 | 49.7% |

| Beijing Roborock Technology (SHSE:688169) | CN¥153.30 | CN¥300.82 | 49% |

We're going to check out a few of the best picks from our screener tool.

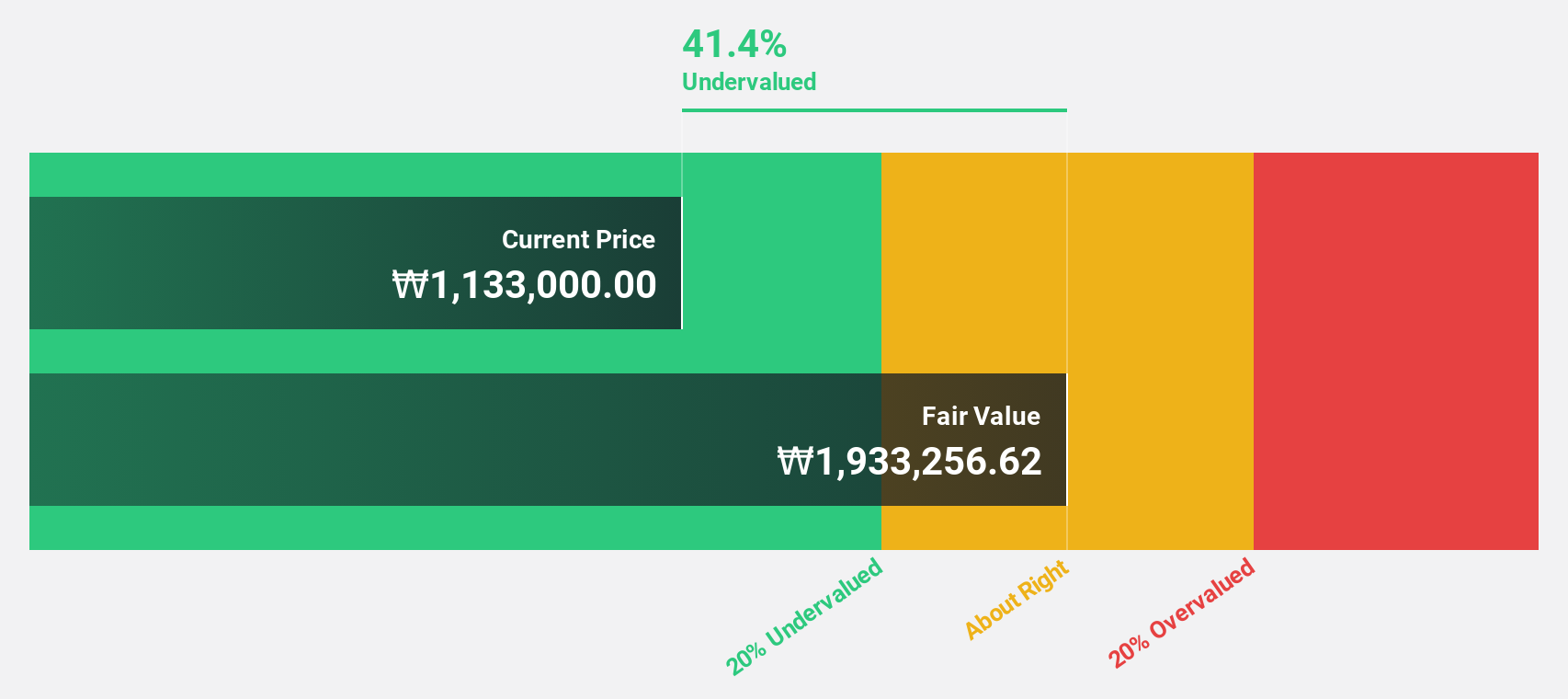

Samyang Foods (KOSE:A003230)

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both domestically in South Korea and internationally, with a market cap of ₩10.86 billion.

Operations: I'm sorry, but it appears that the revenue segment details are missing from the provided text. If you have that information, I can help summarize it for you.

Estimated Discount To Fair Value: 48%

Samyang Foods is trading at ₩1.46 million, significantly below its estimated fair value of ₩2.8 million, suggesting it may be undervalued based on cash flows. With earnings forecasted to grow 27.52% annually and revenue expected to increase by 22.3% per year, the company shows strong growth potential despite slower earnings growth compared to the Korean market. Recent collaborations in the U.S., like with bb.q Chicken, could enhance its global brand presence and revenue streams.

- The analysis detailed in our Samyang Foods growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Samyang Foods.

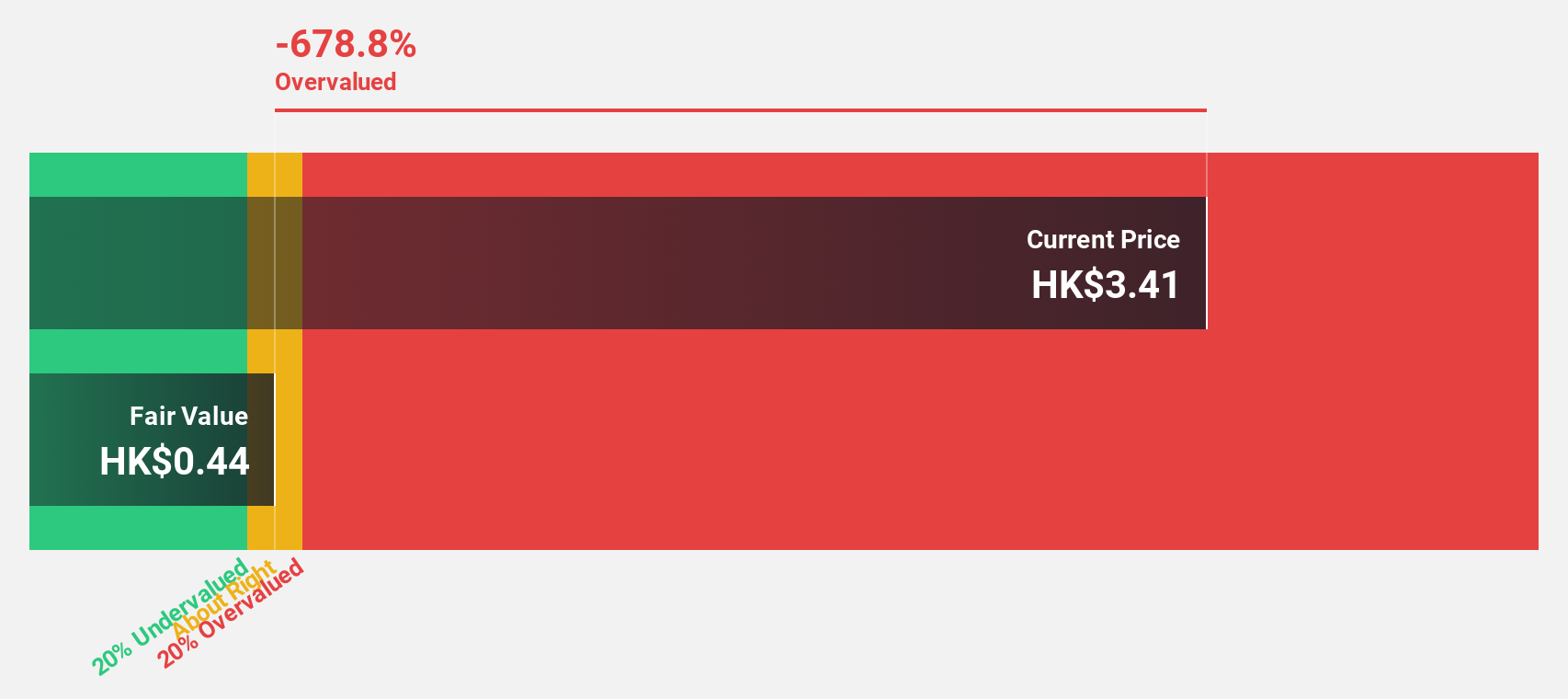

China Ruyi Holdings (SEHK:136)

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and internationally with a market cap of HK$39.69 billion.

Operations: The company's revenue is primarily derived from its content production business, which generated CN¥648.86 million, and its online streaming and online gaming businesses, which together contributed CN¥3.44 billion.

Estimated Discount To Fair Value: 49.7%

China Ruyi Holdings is trading at HK$2.42, well below its estimated fair value of HK$4.81, indicating potential undervaluation based on cash flows. Earnings are projected to grow 25.54% annually, outpacing the Hong Kong market's growth rate of 11.6%. Despite recent shareholder dilution, analysts agree on a potential price increase of 72.5%. However, the forecasted return on equity remains modest at 11.9% over three years.

- The growth report we've compiled suggests that China Ruyi Holdings' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of China Ruyi Holdings stock in this financial health report.

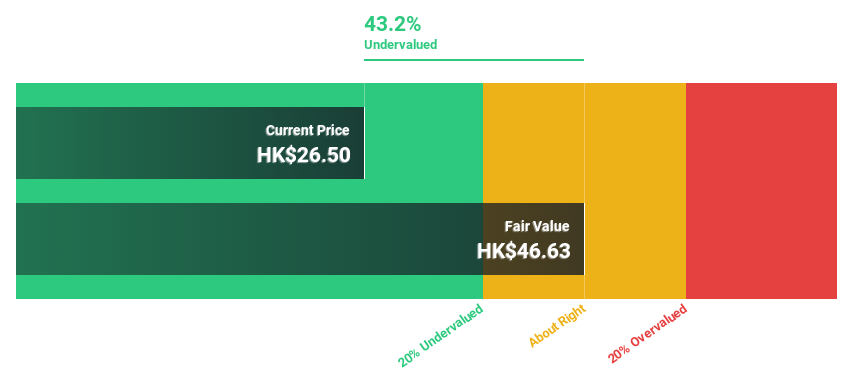

RemeGen (SEHK:9995)

Overview: RemeGen Co., Ltd. is a biopharmaceutical company that focuses on discovering, developing, producing, and commercializing biological drugs for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$55.54 billion.

Operations: RemeGen generates revenue of approximately CN¥2.23 billion from its biopharmaceutical research, service, production, and sales activities.

Estimated Discount To Fair Value: 17.2%

RemeGen Co., Ltd. reported CNY 1.72 billion in sales for the first nine months of 2025, up from CNY 1.21 billion a year earlier, while reducing its net loss to CNY 550.7 million from CNY 1.07 billion. Trading at HK$90, below its fair value estimate of HK$108.73, RemeGen is undervalued based on cash flows with expected revenue growth of 27.4% annually over the next three years and a high forecasted return on equity of 42.6%.

- Our expertly prepared growth report on RemeGen implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of RemeGen.

Seize The Opportunity

- Click this link to deep-dive into the 277 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:136

China Ruyi Holdings

An investment holding company, engages in content production and online streaming business in the People's Republic of Mainland China, Hong Kong, Europe, and internationally.

Solid track record and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.