- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A307930

The Company K Partners (KOSDAQ:307930) Share Price Has Gained 96% And Shareholders Are Hoping For More

One way to deal with stock volatility is to ensure you have a properly diverse portfolio. Of course, the aim of the game is to pick stocks that do better than an index fund. One such company is Company K Partners Limited (KOSDAQ:307930), which saw its share price increase 96% in the last year, slightly above the market return of around 84% (not including dividends). Company K Partners hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Company K Partners

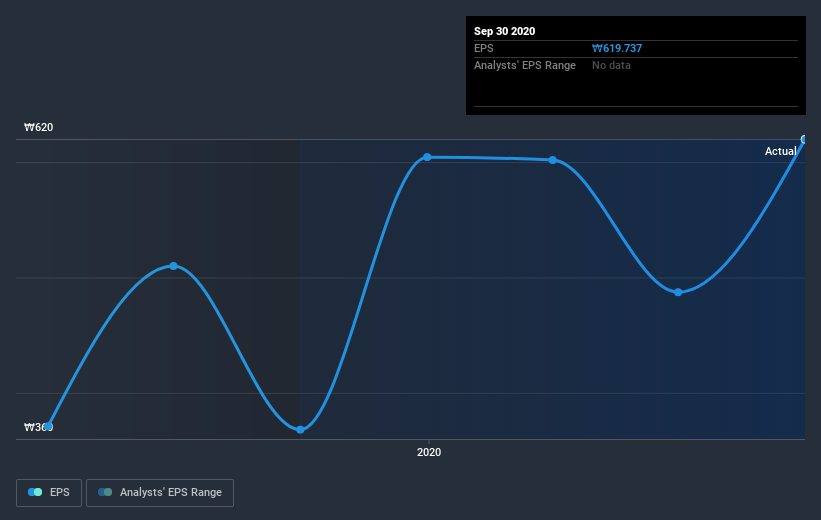

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Company K Partners grew its earnings per share (EPS) by 67%. The share price gain of 96% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Company K Partners' key metrics by checking this interactive graph of Company K Partners's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Company K Partners' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Company K Partners hasn't been paying dividends, but its TSR of 102% exceeds its share price return of 96%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Company K Partners boasts a total shareholder return of 102% for the last year. And the share price momentum remains respectable, with a gain of 68% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Company K Partners you should be aware of, and 1 of them is a bit unpleasant.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Company K Partners, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A307930

Company K Partners

A venture capital firm specializing in start-ups and companies at early-stage operating in emerging industries.

Excellent balance sheet slight.

Market Insights

Community Narratives