- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A307930

If You Had Bought Company K Partners' (KOSDAQ:307930) Shares A Year Ago You Would Be Down 22%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Company K Partners Limited (KOSDAQ:307930) shareholders over the last year, as the share price declined 22%. That falls noticeably short of the market return of around 32%. Because Company K Partners hasn't been listed for many years, the market is still learning about how the business performs. Unhappily, the share price slid 1.0% in the last week.

Check out our latest analysis for Company K Partners

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Company K Partners share price fell, it actually saw its earnings per share (EPS) improve by 67%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Company K Partners managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

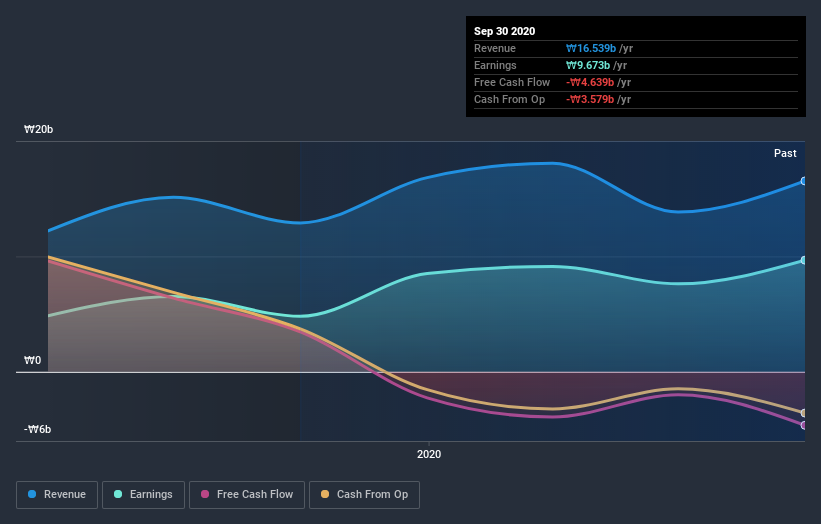

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Company K Partners shareholders are down 21% for the year, the market itself is up 32%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 6.1%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Company K Partners (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Company K Partners, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A307930

Company K Partners

A venture capital firm specializing in start-ups and companies at early-stage operating in emerging industries.

Excellent balance sheet slight.

Market Insights

Community Narratives