- South Korea

- /

- Hospitality

- /

- KOSE:A039130

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating interest rate expectations, investors are keenly observing sector performances and policy impacts. Amidst these dynamics, dividend stocks offer a compelling option for those seeking steady income streams, as they often provide resilience during volatile market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

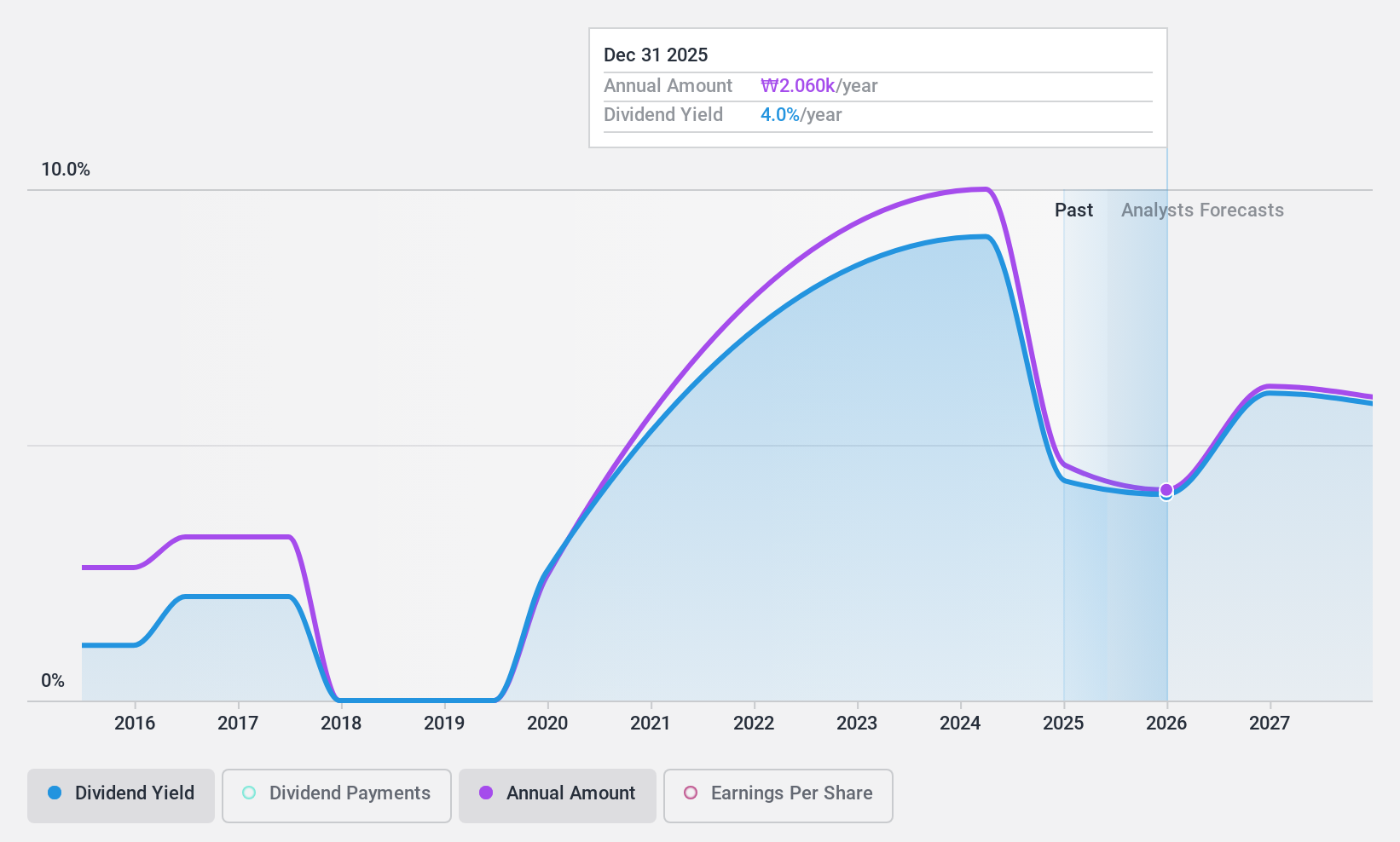

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market cap of ₩765.20 billion.

Operations: Hanatour Service Inc.'s revenue segments include Trip services at ₩250.87 billion and Hotel services at ₩23.89 billion.

Dividend Yield: 9.8%

Hanatour Service's dividend yield of 9.77% places it among the top 25% of KR market payers, but its sustainability is questionable due to a high payout ratio of 140.3%, not covered by earnings. Although dividends have grown over the past decade, they remain volatile and unreliable with annual drops over 20%. Despite trading at a significant discount to fair value and analysts predicting price growth, caution is advised for dividend stability concerns.

- Take a closer look at Hanatour Service's potential here in our dividend report.

- Upon reviewing our latest valuation report, Hanatour Service's share price might be too pessimistic.

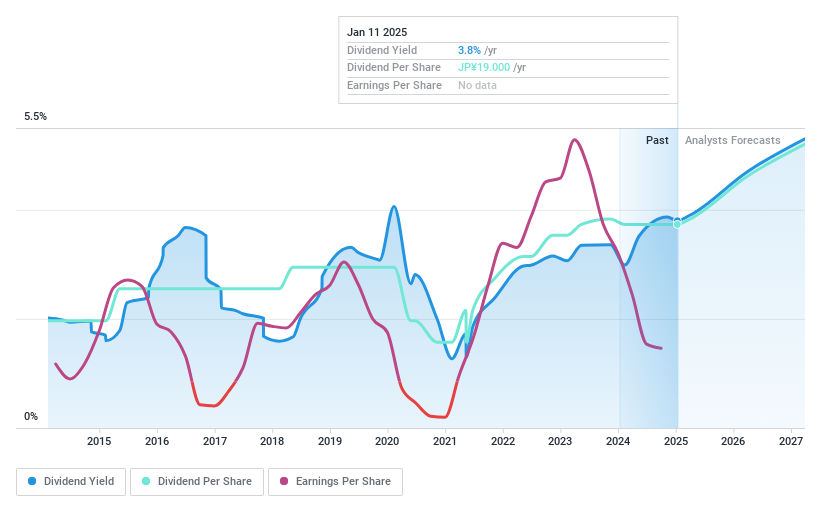

Nippon Thompson (TSE:6480)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Thompson Co., Ltd. operates under the IKO brand, focusing on the development, manufacturing, and sale of needle roller bearings, linear motion rolling guides, precision positioning tables, and machine components both in Japan and internationally; it has a market cap of ¥32.72 billion.

Operations: Nippon Thompson Co., Ltd.'s revenue is primarily derived from its Bearings, Etc. segment, which generated ¥46.71 billion, and its Machine Components segment, contributing ¥6.56 billion.

Dividend Yield: 4%

Nippon Thompson's dividend yield of 3.96% ranks it in the top 25% of JP market payers, yet sustainability concerns arise due to dividends not being covered by free cash flows and a volatile history with annual drops over 20%. While the payout ratio of 65.2% suggests coverage by earnings, profit margins have declined from last year, and no free cash flow is available to support payments. The stock trades at a significant discount to its estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Thompson.

- According our valuation report, there's an indication that Nippon Thompson's share price might be on the cheaper side.

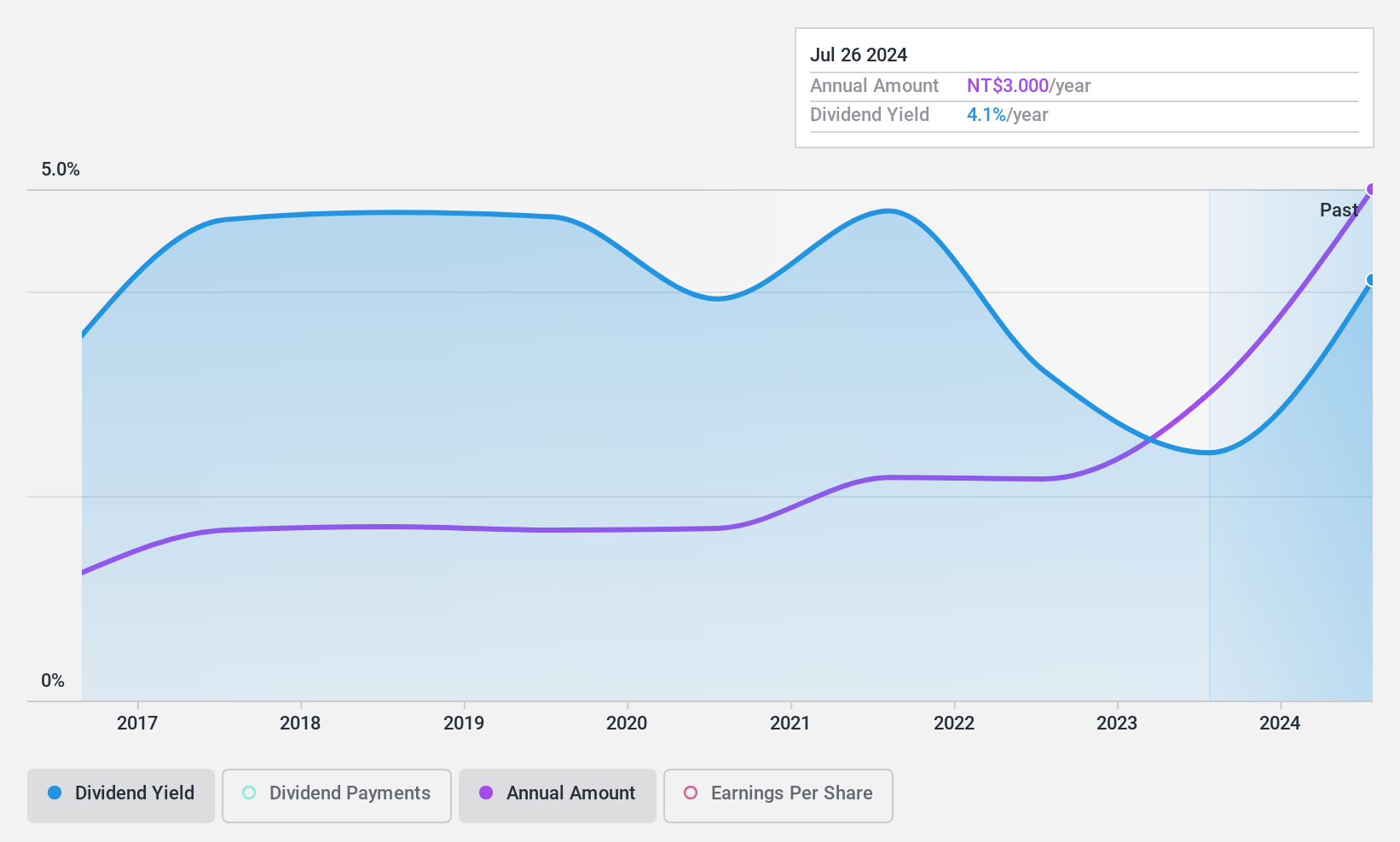

Sanyang Motor (TWSE:2206)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanyang Motor Co., Ltd. manufactures and sells automobiles, locomotives, and their parts across Taiwan, China, Asia, Europe, and internationally with a market cap of NT$55.21 billion.

Operations: Sanyang Motor Co., Ltd. generates its revenue from the manufacturing and sale of automobiles, locomotives, and their parts across various regions including Taiwan, China, Asia, Europe, and other international markets.

Dividend Yield: 4.2%

Sanyang Motor's dividend yield of 4.17% falls short of the top 25% in the TW market. Despite a low payout ratio of 46.4%, indicating earnings coverage, dividends have been volatile over the past decade without consistent growth. The cash payout ratio stands at 77.2%, suggesting coverage by cash flows, yet high debt levels and an unstable dividend history raise sustainability concerns. The stock's P/E ratio is below the TW market average, indicating potential value.

- Get an in-depth perspective on Sanyang Motor's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Sanyang Motor shares in the market.

Turning Ideas Into Actions

- Embark on your investment journey to our 1956 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanatour Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A039130

Hanatour Service

Provides travel and related services in South Korea, Northeast and Southeast Asia, the United States, and Europe.

Flawless balance sheet, undervalued and pays a dividend.