- South Korea

- /

- Consumer Durables

- /

- KOSE:A115390

Lock&Lock Co., Ltd.'s (KRX:115390) 30% Share Price Surge Not Quite Adding Up

Despite an already strong run, Lock&Lock Co., Ltd. (KRX:115390) shares have been powering on, with a gain of 30% in the last thirty days. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

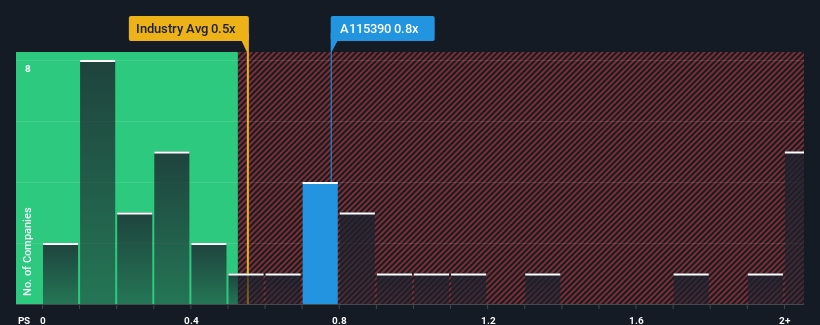

Although its price has surged higher, there still wouldn't be many who think Lock&Lock's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Korea's Consumer Durables industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Lock&Lock

What Does Lock&Lock's Recent Performance Look Like?

For example, consider that Lock&Lock's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lock&Lock will help you shine a light on its historical performance.How Is Lock&Lock's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Lock&Lock's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.0%. The last three years don't look nice either as the company has shrunk revenue by 3.4% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 4.4% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Lock&Lock is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Its shares have lifted substantially and now Lock&Lock's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Lock&Lock currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Lock&Lock (at least 2 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Lock&Lock, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A115390

Lock&Lock

Manufactures and sells kitchen household products in South Korea, China, Vietnam, and internationally.

Excellent balance sheet low.