- South Korea

- /

- Personal Products

- /

- KOSE:A002790

Earnings are growing at AMOREPACIFIC Group (KRX:002790) but shareholders still don't like its prospects

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held AMOREPACIFIC Group (KRX:002790) for five whole years - as the share price tanked 74%. And some of the more recent buyers are probably worried, too, with the stock falling 28% in the last year. The falls have accelerated recently, with the share price down 25% in the last three months.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for AMOREPACIFIC Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, AMOREPACIFIC Group actually saw its earnings per share (EPS) improve by 11% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We don't think that the 1.2% is big factor in the share price, since it's quite small, as dividends go. Arguably, the revenue drop of 8.8% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

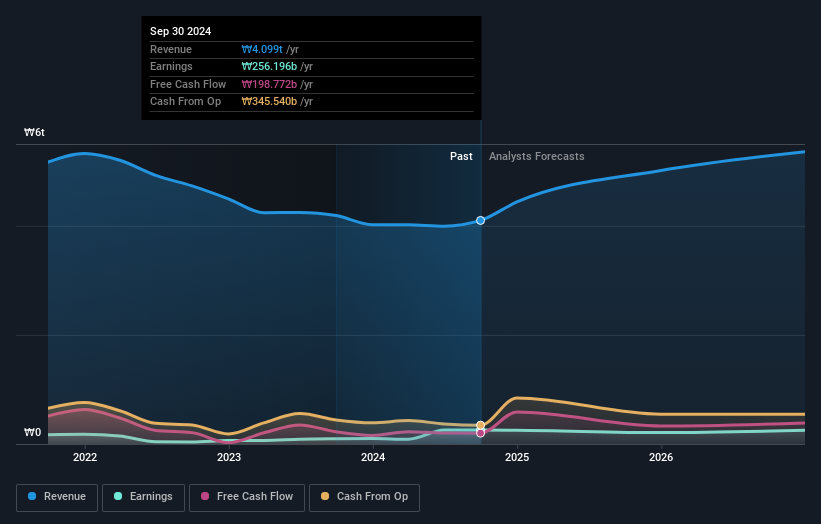

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that AMOREPACIFIC Group has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for AMOREPACIFIC Group in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 10% in the twelve months, AMOREPACIFIC Group shareholders did even worse, losing 28% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - AMOREPACIFIC Group has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course AMOREPACIFIC Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002790

AMOREPACIFIC Holdings

Through its subsidiaries, engages in manufacturing, marketing, and trading of cosmetics, household goods, and health functional foods in Korea, Asia, North America, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026