- South Korea

- /

- Luxury

- /

- KOSE:A011300

Investors in Seong An MaterialsLtd (KRX:011300) from three years ago are still down 44%, even after 15% gain this past week

This week we saw the Seong An Materials Co.,Ltd (KRX:011300) share price climb by 15%. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 44% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

On a more encouraging note the company has added ₩9.3b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Seong An MaterialsLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

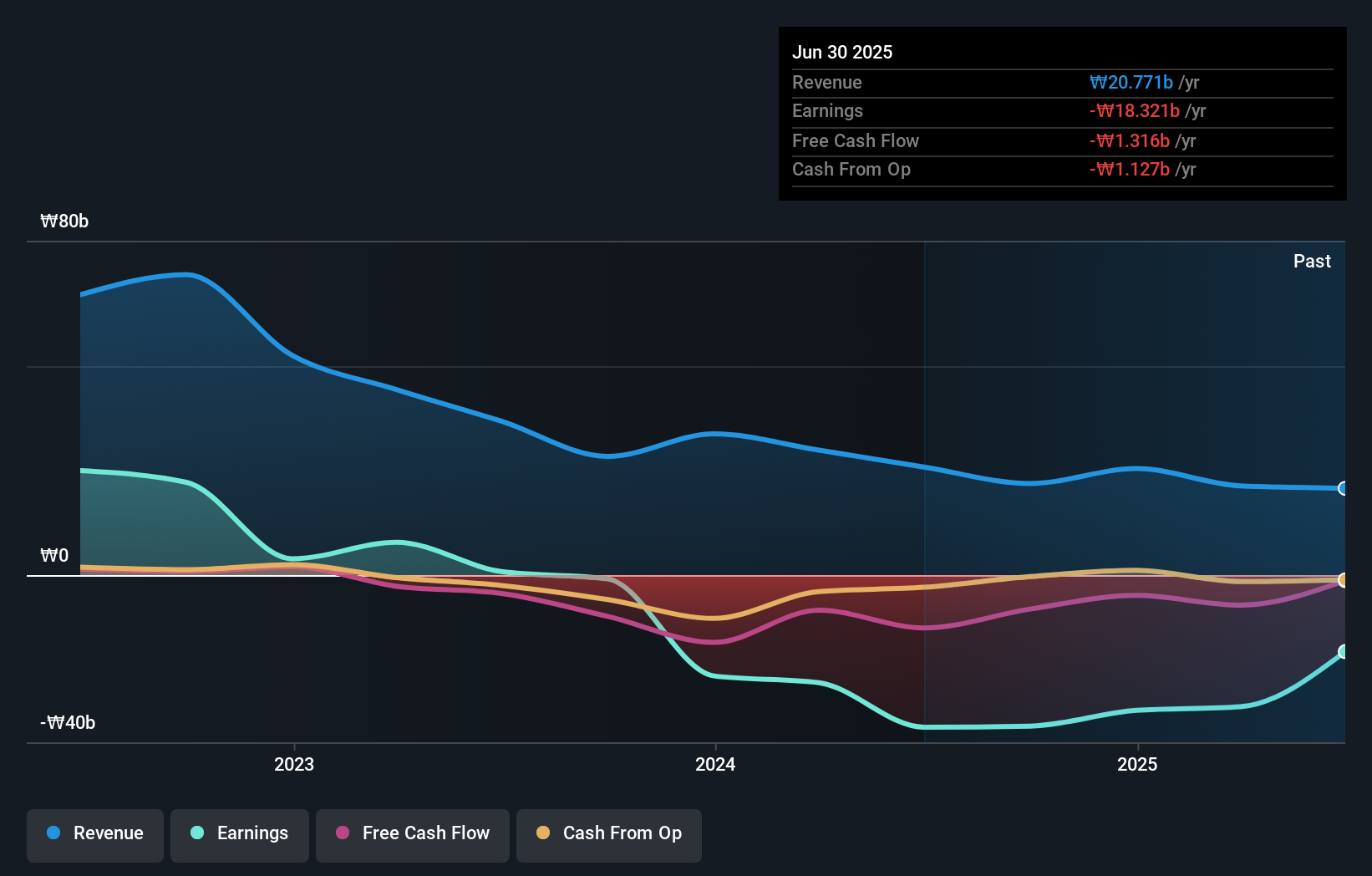

Over the last three years, Seong An MaterialsLtd's revenue dropped 43% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 13% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Seong An MaterialsLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Seong An MaterialsLtd shareholders are down 37% for the year, but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Seong An MaterialsLtd (at least 3 which make us uncomfortable) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011300

Seong An MaterialsLtd

A textile company, manufactures, exports, and sells fabric related products in Korea and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives