- South Korea

- /

- Professional Services

- /

- KOSE:A030190

NICE Information Service Co., Ltd.'s (KRX:030190) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

NICE Information Service (KRX:030190) has had a great run on the share market with its stock up by a significant 17% over the last three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study NICE Information Service's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for NICE Information Service is:

19% = ₩86b ÷ ₩454b (Based on the trailing twelve months to September 2025).

The 'return' refers to a company's earnings over the last year. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.19 in profit.

See our latest analysis for NICE Information Service

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

NICE Information Service's Earnings Growth And 19% ROE

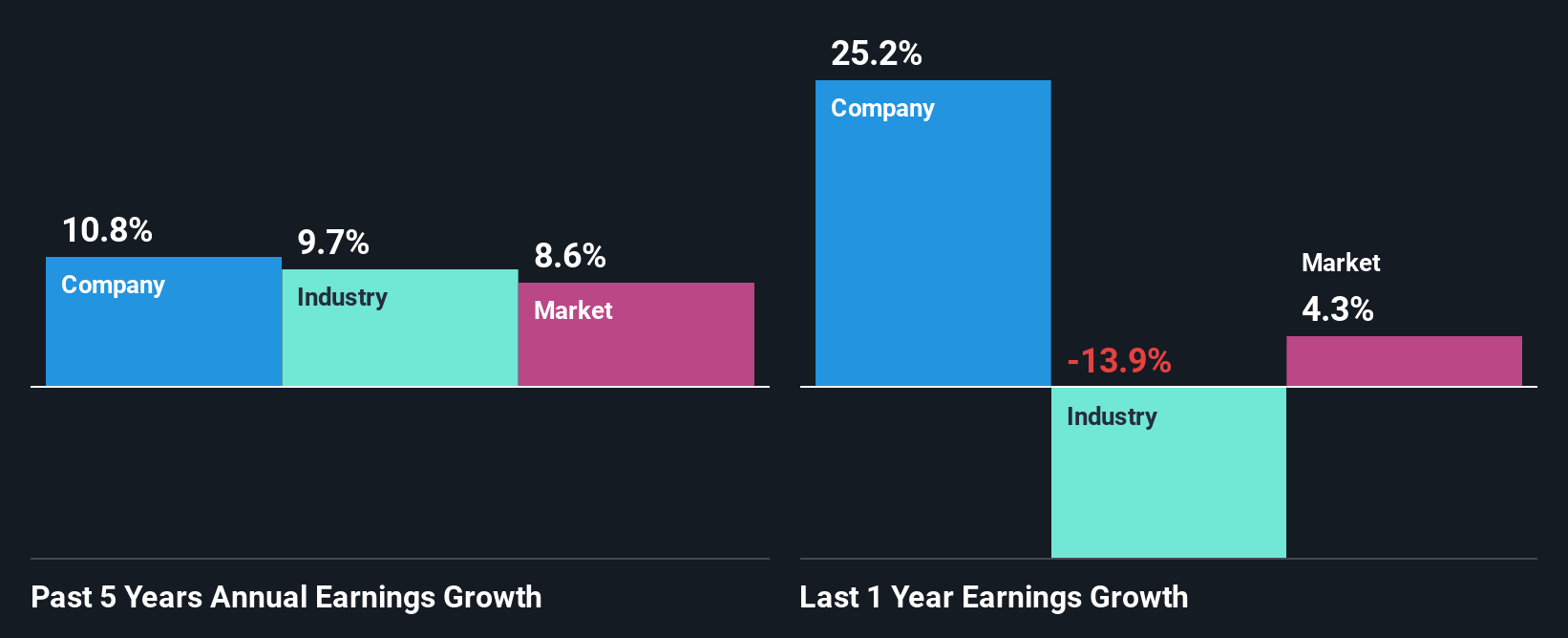

At first glance, NICE Information Service seems to have a decent ROE. On comparing with the average industry ROE of 12% the company's ROE looks pretty remarkable. Probably as a result of this, NICE Information Service was able to see a decent growth of 11% over the last five years.

Next, on comparing NICE Information Service's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 9.7% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is NICE Information Service fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is NICE Information Service Making Efficient Use Of Its Profits?

NICE Information Service has a healthy combination of a moderate three-year median payout ratio of 39% (or a retention ratio of 61%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Moreover, NICE Information Service is determined to keep sharing its profits with shareholders which we infer from its long history of six years of paying a dividend. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 36%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 18%.

Summary

In total, we are pretty happy with NICE Information Service's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NICE Information Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A030190

NICE Information Service

Provides credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion