- South Korea

- /

- Commercial Services

- /

- KOSDAQ:A063440

SM Life Design Group's (KOSDAQ:063440) Weak Earnings May Only Reveal A Part Of The Whole Picture

The subdued market reaction suggests that SM Life Design Group Co., Ltd.'s (KOSDAQ:063440) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Examining Cashflow Against SM Life Design Group's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

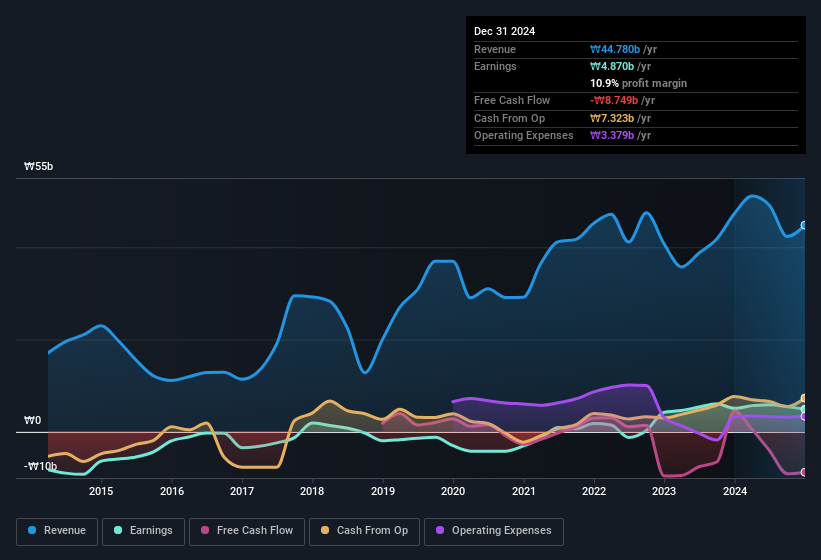

SM Life Design Group has an accrual ratio of 0.36 for the year to December 2024. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Over the last year it actually had negative free cash flow of ₩8.7b, in contrast to the aforementioned profit of ₩4.87b. We saw that FCF was ₩4.5b a year ago though, so SM Life Design Group has at least been able to generate positive FCF in the past. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio. This would certainly have contributed to the weak cash conversion.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SM Life Design Group.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that SM Life Design Group received a tax benefit of ₩813m. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On SM Life Design Group's Profit Performance

This year, SM Life Design Group couldn't match its profit with cashflow. On top of that, the unsustainable nature of tax benefits mean that there's a chance profit may be lower next year, certainly in the absence of strong growth. Considering all this we'd argue SM Life Design Group's profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To help with this, we've discovered 2 warning signs (1 makes us a bit uncomfortable!) that you ought to be aware of before buying any shares in SM Life Design Group.

Our examination of SM Life Design Group has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A063440

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)