- South Korea

- /

- Electrical

- /

- KOSE:A373220

January 2025's Estimated Undervalued Stocks For Savvy Investors

Reviewed by Simply Wall St

As we enter 2025, global markets reflect a mixed picture with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains in the final week of December. Amidst these fluctuating conditions, investors are increasingly focused on identifying undervalued stocks that may offer potential opportunities despite broader economic uncertainties. A good stock in this context is often characterized by strong fundamentals and resilience to market volatility, offering a potential buffer against economic shifts while maintaining growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.08 | 49.9% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.59 | MYR1.18 | 49.8% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Lea Bank (OB:LEA) | NOK10.40 | NOK20.78 | 49.9% |

Here's a peek at a few of the choices from the screener.

Doosan (KOSE:A000150)

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, Europe, and internationally with a market cap of approximately ₩4.07 trillion.

Operations: The company's revenue segments include Doosan Bobcat with ₩8.72 billion, Doosan Energy with ₩8.05 billion, Electronic BG with ₩883.69 million, Doosan Fuel Cell with ₩266.42 million, and Digital Innovation BU with ₩287.45 million.

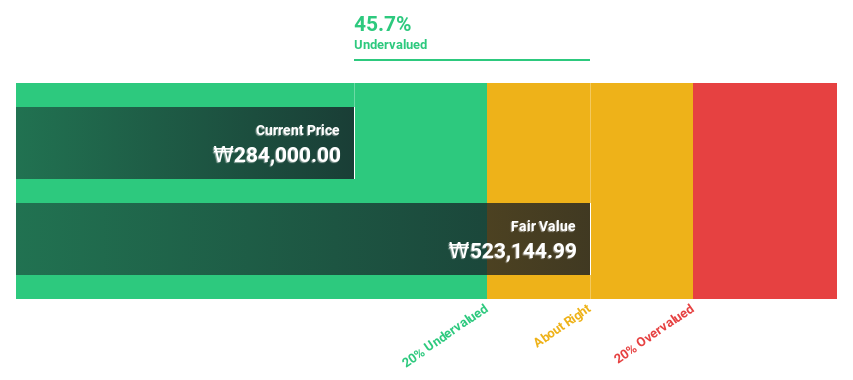

Estimated Discount To Fair Value: 49.4%

Doosan is trading at 49.4% below its estimated fair value of ₩573,214.78, highlighting its potential as an undervalued stock based on cash flows. Despite a net loss of ₩88,317.12 million in Q3 2024, earnings are forecast to grow by 75.7% annually with profitability expected within three years. However, revenue growth is projected at only 4.3% per year, lagging behind the broader Korean market's growth rate of 9%.

- Our growth report here indicates Doosan may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Doosan stock in this financial health report.

T'Way Air (KOSE:A091810)

Overview: T'Way Air Co., Ltd. offers air transportation services both within South Korea and internationally, with a market cap of ₩530.40 billion.

Operations: The company's primary revenue segment is the Aviation Business, generating ₩1.50 billion.

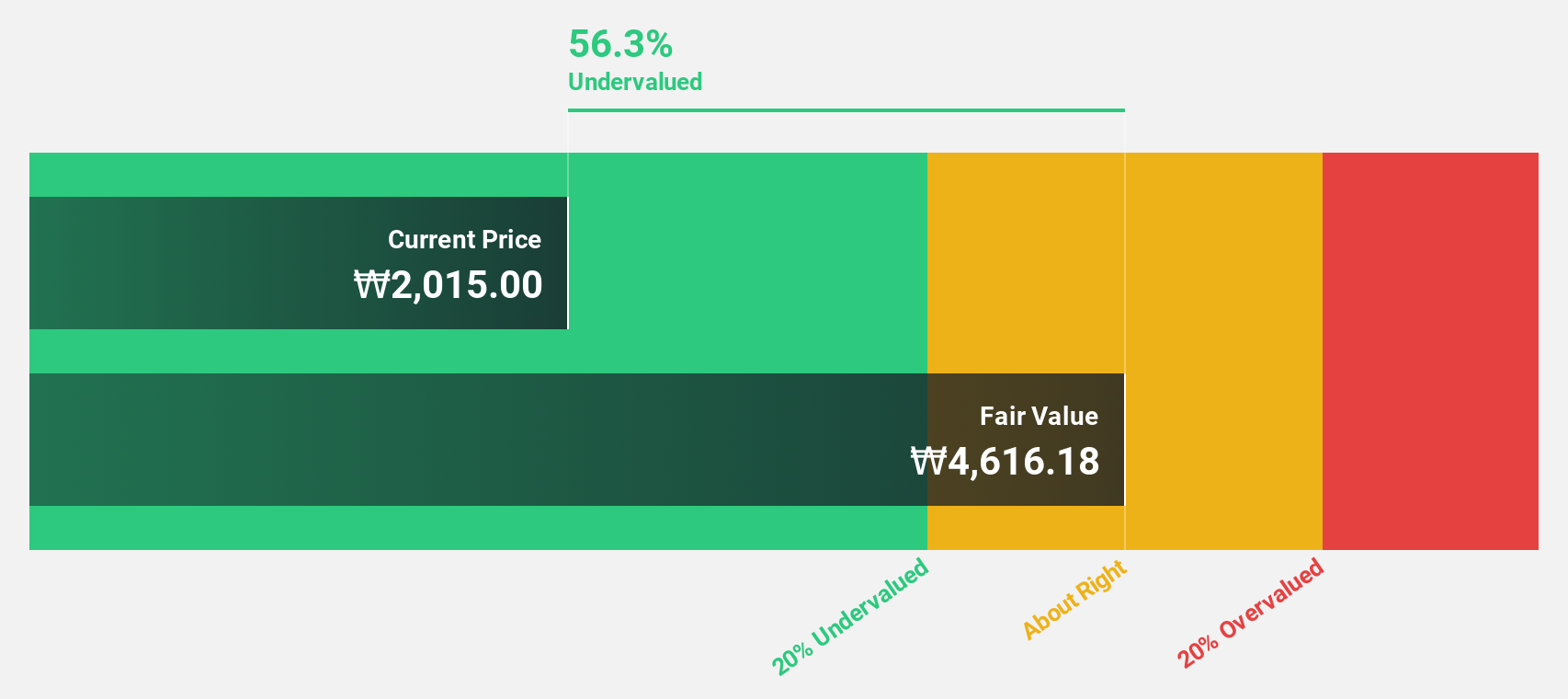

Estimated Discount To Fair Value: 46.9%

T'Way Air is trading at ₩2,670, significantly below its estimated fair value of ₩5,032.96, suggesting it might be undervalued based on cash flows. Although profit margins have decreased from 7.8% to 3.2%, earnings are projected to grow substantially by 44.85% annually over the next three years, outpacing the Korean market's growth rate of 28.7%. However, shareholder dilution and recent share price volatility present potential concerns for investors.

- Our earnings growth report unveils the potential for significant increases in T'Way Air's future results.

- Get an in-depth perspective on T'Way Air's balance sheet by reading our health report here.

LG Energy Solution (KOSE:A373220)

Overview: LG Energy Solution, Ltd. provides energy solutions worldwide and has a market cap of approximately ₩80.96 trillion.

Operations: The company's revenue is primarily derived from Batteries / Battery Systems, amounting to ₩27.17 billion.

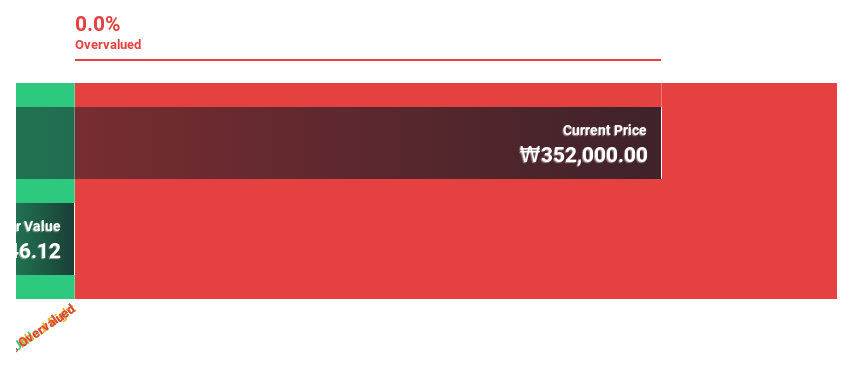

Estimated Discount To Fair Value: 49.6%

LG Energy Solution is trading at ₩357,500, which is 49.6% below its estimated fair value of ₩709,633.58, highlighting potential undervaluation based on cash flows. Despite recent earnings challenges with a net loss for the nine months ending September 2024, earnings are forecast to grow by 56.02% annually. Strategic partnerships with GM and Rivian bolster its market position in EVs and robotics, potentially enhancing future cash flows and profitability prospects.

- Insights from our recent growth report point to a promising forecast for LG Energy Solution's business outlook.

- Dive into the specifics of LG Energy Solution here with our thorough financial health report.

Turning Ideas Into Actions

- Discover the full array of 903 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A373220

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives