- South Korea

- /

- Electrical

- /

- KOSE:A298040

Market Cool On Hyosung Heavy Industries Corporation's (KRX:298040) Revenues Pushing Shares 27% Lower

Hyosung Heavy Industries Corporation (KRX:298040) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 53%, which is great even in a bull market.

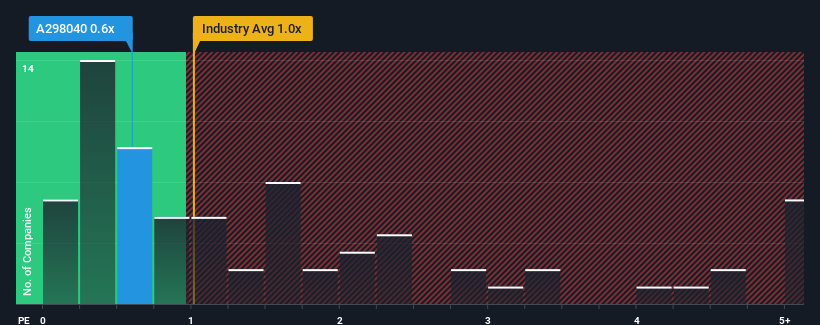

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Hyosung Heavy Industries' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in Korea is also close to 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hyosung Heavy Industries

How Hyosung Heavy Industries Has Been Performing

Recent times have been advantageous for Hyosung Heavy Industries as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Hyosung Heavy Industries' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hyosung Heavy Industries' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The strong recent performance means it was also able to grow revenue by 52% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 11%. With the rest of the industry predicted to shrink by 2.9%, that would be a fantastic result.

With this in mind, we find it intriguing that Hyosung Heavy Industries' P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Hyosung Heavy Industries' P/S?

Hyosung Heavy Industries' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though Hyosung Heavy Industries trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hyosung Heavy Industries you should be aware of, and 1 of them is potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Hyosung Heavy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyosung Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A298040

Hyosung Heavy Industries

Manufactures and sells heavy electrical equipment in South Korea and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives