- South Korea

- /

- Construction

- /

- KOSE:A126720

Asian Market Value Stock Picks For Potential Growth

Reviewed by Simply Wall St

As global markets face volatility and uncertainty, particularly with renewed tariff threats and fluctuating bond yields, investors are increasingly looking towards Asia for potential opportunities. In such a climate, identifying undervalued stocks that have strong fundamentals can be crucial for those seeking to capitalize on potential growth in the region's diverse economies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.42 | CN¥28.31 | 49.1% |

| Darbond Technology (SHSE:688035) | CN¥38.89 | CN¥76.99 | 49.5% |

| H.U. Group Holdings (TSE:4544) | ¥3056.00 | ¥6057.10 | 49.5% |

| Polaris Holdings (TSE:3010) | ¥222.00 | ¥440.49 | 49.6% |

| Brangista (TSE:6176) | ¥595.00 | ¥1177.43 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥835.00 | ¥1646.30 | 49.3% |

| Devsisters (KOSDAQ:A194480) | ₩38800.00 | ₩76155.13 | 49.1% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.79 | NZ$1.58 | 50% |

| Dive (TSE:151A) | ¥920.00 | ¥1821.73 | 49.5% |

| TLB (KOSDAQ:A356860) | ₩17760.00 | ₩34911.45 | 49.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Soosan Industries (KOSE:A126720)

Overview: Soosan Industries Co., Ltd. specializes in power plant construction and maintenance services in South Korea, with a market cap of ₩377.19 billion.

Operations: The company's revenue segments include solar power, generating ₩11.25 billion, and power plant maintenance, contributing ₩305.92 billion.

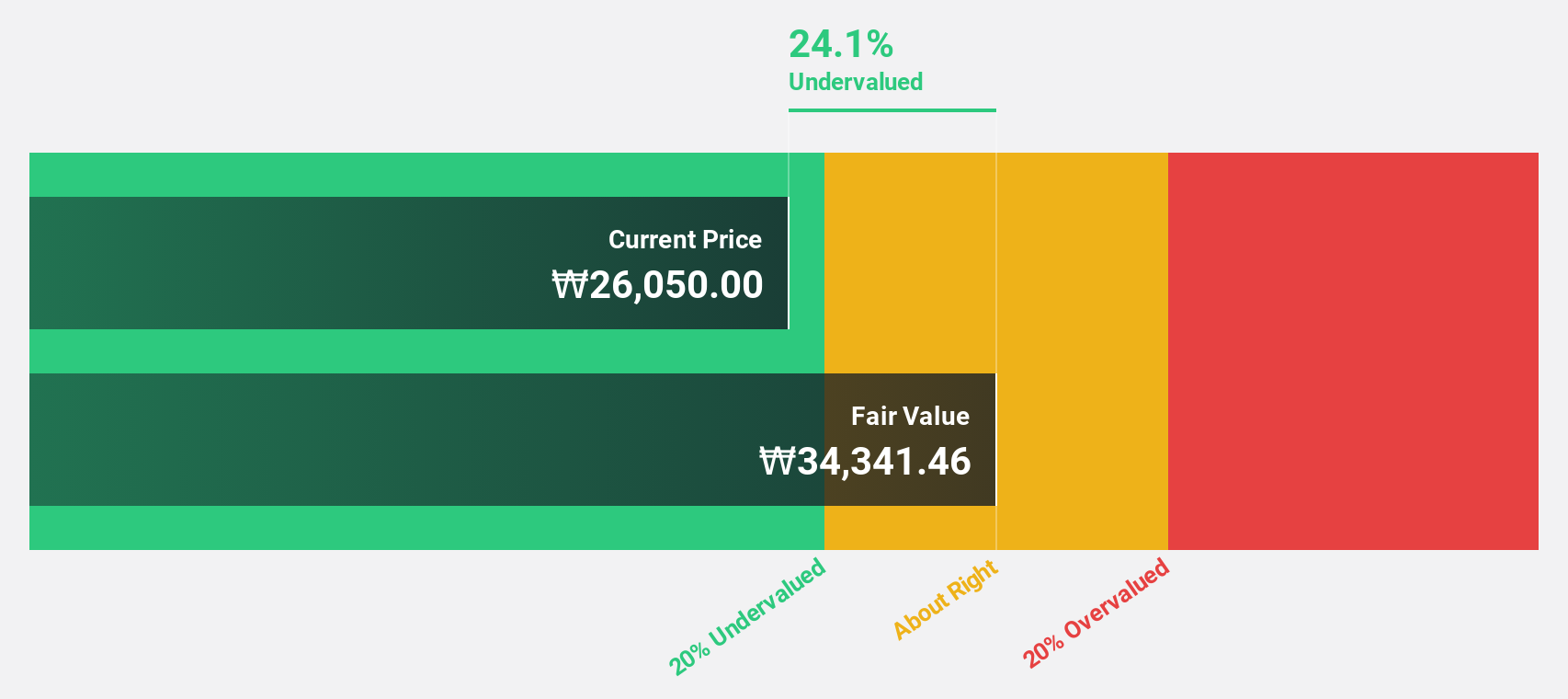

Estimated Discount To Fair Value: 18.7%

Soosan Industries is trading at ₩26,800, below its estimated fair value of ₩32,974.42. Despite not being significantly undervalued by discounted cash flow analysis standards, the stock offers potential with earnings expected to grow significantly at 27.88% annually over the next three years. While revenue growth is projected at 8% per year—faster than the Korean market average—its return on equity remains forecasted to be relatively low at 11.5%.

- Our earnings growth report unveils the potential for significant increases in Soosan Industries' future results.

- Dive into the specifics of Soosan Industries here with our thorough financial health report.

Kunshan Kinglai Hygienic MaterialsLtd (SZSE:300260)

Overview: Kunshan Kinglai Hygienic Materials Co., Ltd. (SZSE:300260) operates in the hygienic materials industry and has a market cap of CN¥13.98 billion.

Operations: Kunshan Kinglai Hygienic Materials Co., Ltd. generates its revenue from various segments within the hygienic materials industry, contributing to its market presence with a capitalization of CN¥13.98 billion.

Estimated Discount To Fair Value: 40.4%

Kunshan Kinglai Hygienic Materials is trading at CNY 34.46, significantly below its estimated fair value of CNY 57.85, suggesting undervaluation based on discounted cash flow analysis. Despite recent earnings declines, the company's revenue and earnings are forecast to grow substantially at 24.2% and 46.71% annually, respectively—outpacing the broader Chinese market growth rates. However, investors should note its high debt levels and recent share price volatility as potential risks.

- Upon reviewing our latest growth report, Kunshan Kinglai Hygienic MaterialsLtd's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Kunshan Kinglai Hygienic MaterialsLtd's balance sheet by reading our health report here.

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan, with a market cap of ¥168.51 billion.

Operations: The company's revenue is primarily generated from its House for Resale Reproduction Business, amounting to ¥129.54 billion.

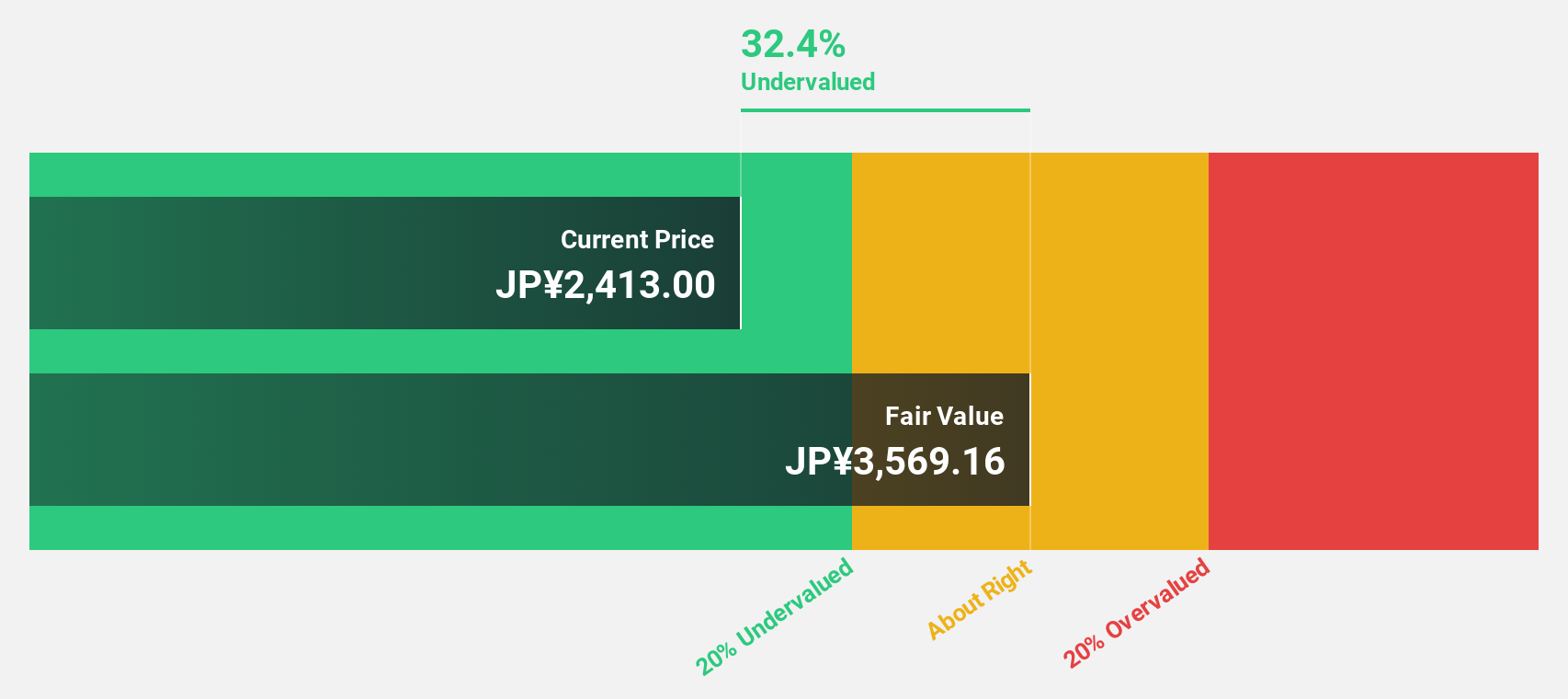

Estimated Discount To Fair Value: 37.5%

KATITAS is trading at ¥2,155, significantly below its estimated fair value of ¥3,450.21, highlighting its undervaluation based on cash flows. The company's revenue and earnings are forecast to grow at 8.1% and 9.17% per year respectively, outpacing the Japanese market growth rates. However, the dividend yield of 3.25% is not well covered by free cash flows despite recent dividend increases and strong future earnings guidance indicating robust financial health ahead.

- In light of our recent growth report, it seems possible that KATITAS' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in KATITAS' balance sheet health report.

Seize The Opportunity

- Gain an insight into the universe of 303 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A126720

Soosan Industries

Provides power plant construction and maintenance services in South Korea.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives