- Taiwan

- /

- Metals and Mining

- /

- TWSE:2015

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding policy changes and economic indicators has led to a mixed performance across key indices, with small-cap stocks experiencing notable fluctuations. As investors navigate this dynamic environment, identifying lesser-known stocks with strong fundamentals and growth potential can provide an opportunity to enhance portfolio diversification.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Spright Agro | 0.24% | 85.62% | 88.80% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

HD-Hyundai Marine Engine (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★★

Overview: HD-Hyundai Marine Engine Co., Ltd. is engaged in the manufacturing and sale of marine engines, industrial facilities, and plants both domestically in South Korea and internationally, with a market capitalization of approximately ₩649.26 billion.

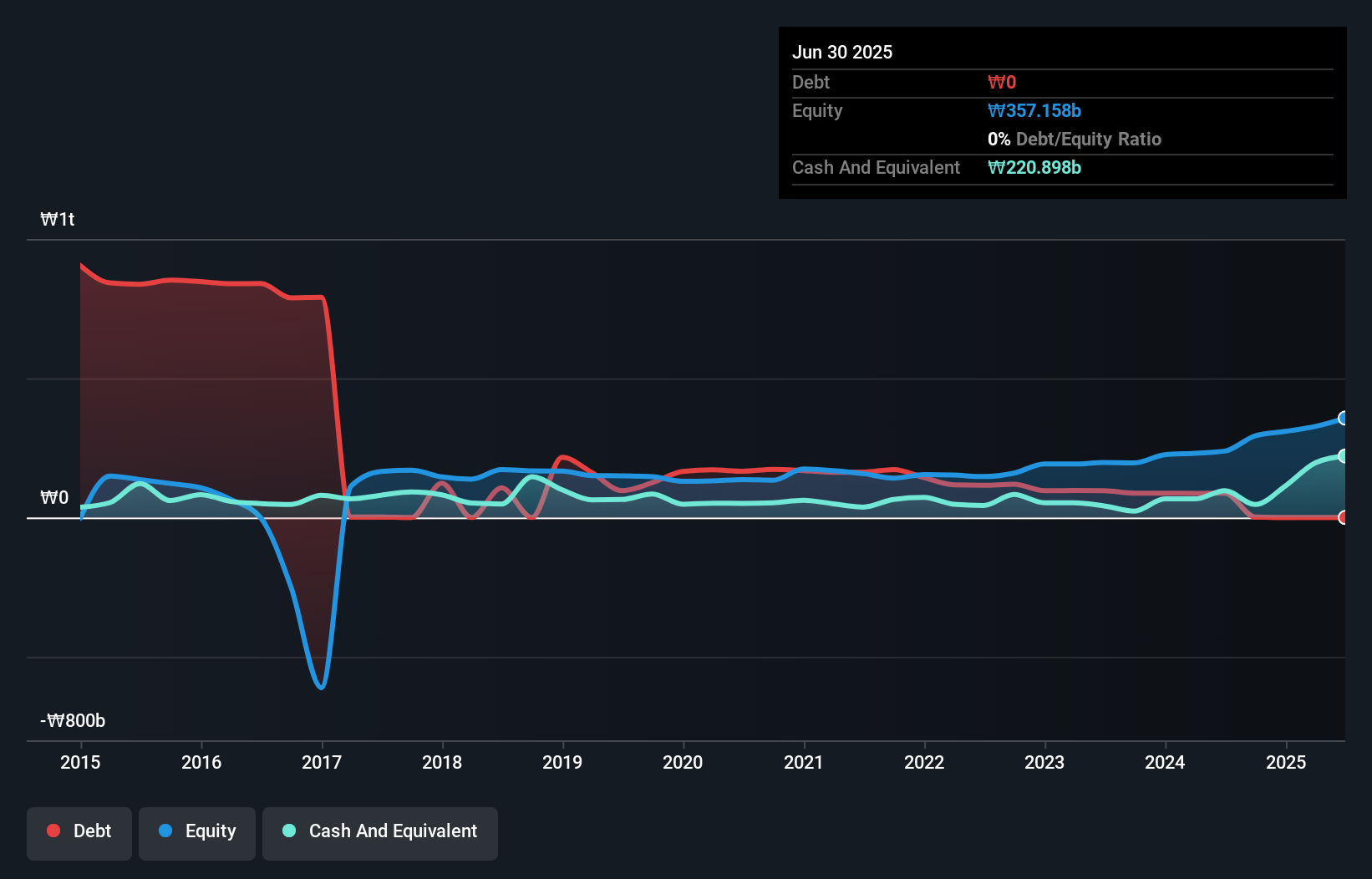

Operations: HD-Hyundai Marine Engine generates revenue primarily from its Engine and Equipment segment, which accounts for ₩296.25 billion.

HD-Hyundai Marine Engine, a smaller player in the machinery sector, has shown impressive earnings growth of 97.7% over the past year, outpacing the industry's 1.1%. The company demonstrates strong financial health with its debt-to-equity ratio reducing from 64.2% to 36.6% over five years and interest payments well covered at 9.3 times by EBIT. Despite being profitable and having high-quality earnings, shareholders experienced dilution recently, which may concern some investors. Recently added to the S&P Global BMI Index, HD-Hyundai is set to announce its Q3 results soon on November 21st, adding potential interest for market watchers.

Mitani (TSE:8066)

Simply Wall St Value Rating: ★★★★★★

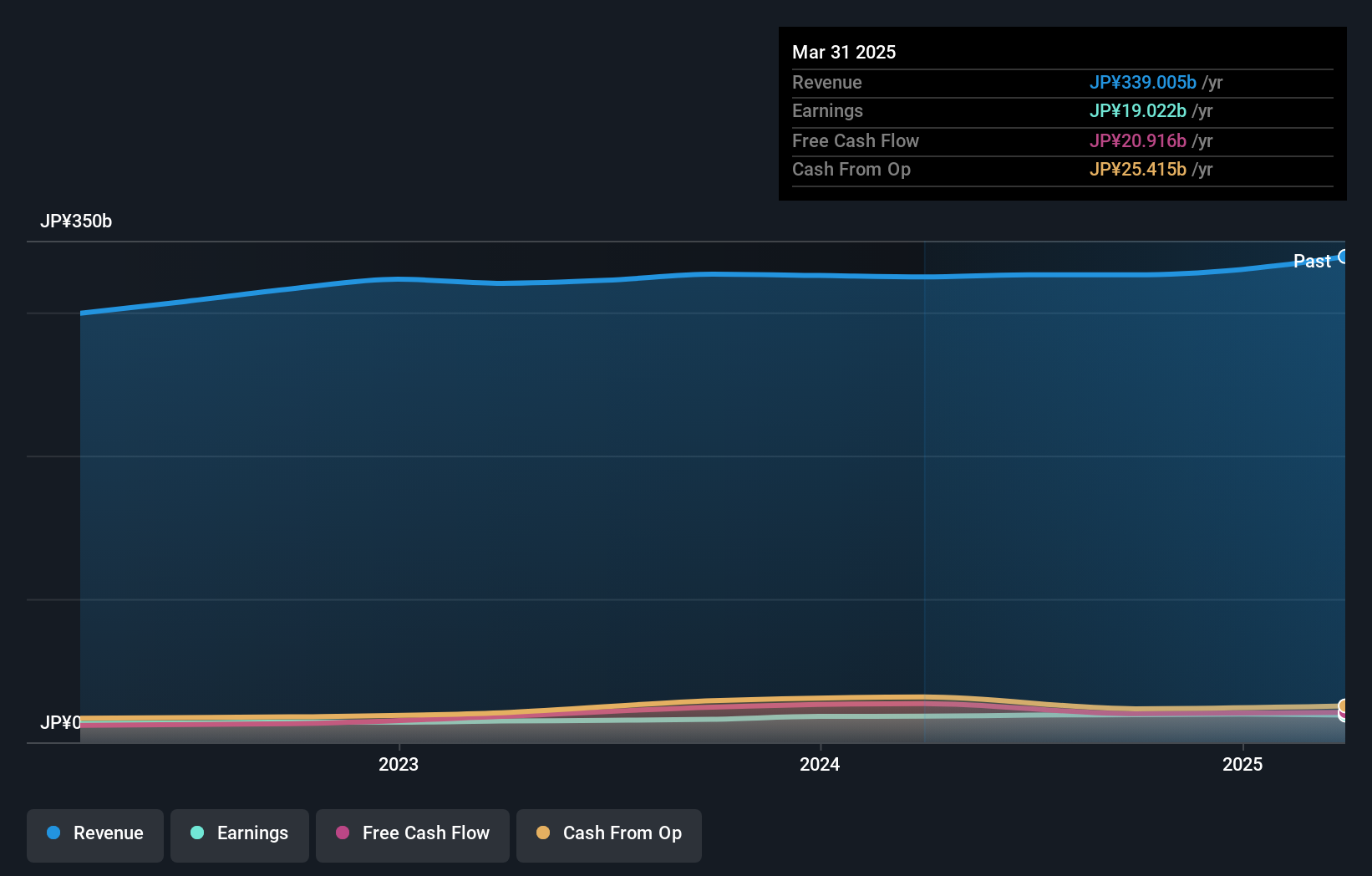

Overview: Mitani Corporation operates in the information system, construction, and energy sectors both in Japan and internationally, with a market cap of ¥160.43 billion.

Operations: Mitani generates revenue from its operations in the information system, construction, and energy sectors. The company has a market cap of ¥160.43 billion.

Mitani, a nimble player in the trade distribution sector, shows promising signs with its earnings growth of 24% over the past year, surpassing the industry average of 1.8%. The company's debt to equity ratio has improved from 6.9 to 4.1 over five years, indicating better financial health. Trading at nearly 70% below estimated fair value suggests potential undervaluation. Recent strategic moves include a share repurchase program aimed at enhancing shareholder returns by buying back up to 1.2 million shares for ¥2.4 billion (US$16 million), reflecting confidence in its long-term prospects and commitment to capital efficiency.

- Delve into the full analysis health report here for a deeper understanding of Mitani.

Understand Mitani's track record by examining our Past report.

Feng Hsin Steel (TWSE:2015)

Simply Wall St Value Rating: ★★★★★★

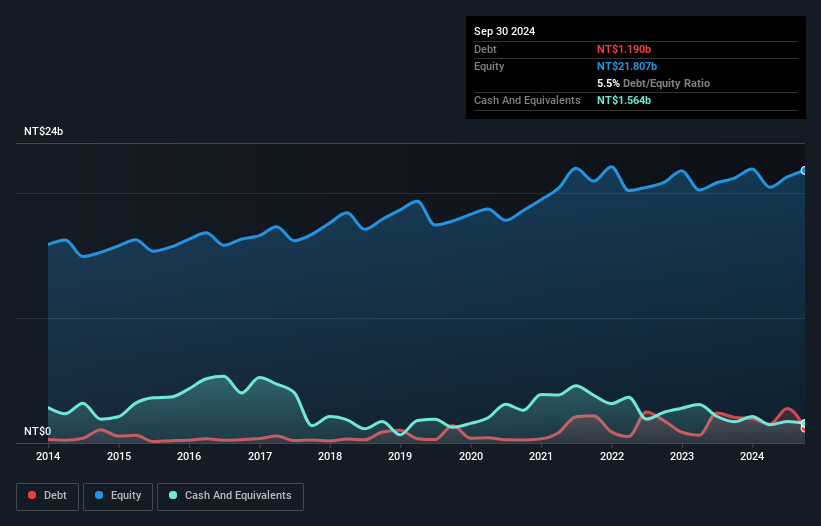

Overview: Feng Hsin Steel Co., Ltd. is a Taiwanese company that manufactures, processes, and trades steel products with a market capitalization of NT$45.31 billion.

Operations: The primary revenue stream for Feng Hsin Steel comes from the manufacture and processing of various steel products, generating NT$34.77 billion. The company's market capitalization stands at NT$45.31 billion, indicating its significant presence in the Taiwanese steel industry.

Feng Hsin Steel, a noteworthy player in the steel industry, has shown resilience despite some challenges. Over the past five years, its debt to equity ratio improved significantly from 7.9% to 5.5%, indicating better financial health. The company reported TWD 8.18 billion in sales for Q3 2024, slightly up from TWD 8.06 billion last year, though net income dipped to TWD 456 million from TWD 528 million previously. With a price-to-earnings ratio of 18x below the market average and earnings growth forecasted at over eight percent annually, Feng Hsin offers potential value amidst industry fluctuations and recent leadership changes.

- Navigate through the intricacies of Feng Hsin Steel with our comprehensive health report here.

Evaluate Feng Hsin Steel's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 4653 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2015

Feng Hsin Steel

Manufactures, processes, and trades steel products in Taiwan.

Flawless balance sheet established dividend payer.