- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

Asian Equity Selections Possibly Priced Below Valuation Benchmarks For May 2025

Reviewed by Simply Wall St

As the Asian markets respond positively to the recent easing of U.S.-China trade tensions, investors are keenly observing opportunities that may arise from this temporary truce. In such an environment, identifying stocks potentially priced below their intrinsic value could offer strategic advantages, especially when these equities are positioned to benefit from improved economic relations and reduced tariff pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.43 | CN¥52.51 | 49.7% |

| H.U. Group Holdings (TSE:4544) | ¥3024.00 | ¥5994.30 | 49.6% |

| GEM (SZSE:002340) | CN¥6.23 | CN¥12.46 | 50% |

| Kolmar Korea (KOSE:A161890) | ₩84500.00 | ₩168491.96 | 49.8% |

| Dive (TSE:151A) | ¥921.00 | ¥1813.08 | 49.2% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.83 | NZ$1.64 | 49.4% |

| ALUX (KOSDAQ:A475580) | ₩10640.00 | ₩21018.68 | 49.4% |

| Medley (TSE:4480) | ¥3110.00 | ¥6174.60 | 49.6% |

| Innovent Biologics (SEHK:1801) | HK$55.30 | HK$109.45 | 49.5% |

| InnoCare Pharma (SEHK:9969) | HK$10.60 | HK$21.19 | 50% |

Here's a peek at a few of the choices from the screener.

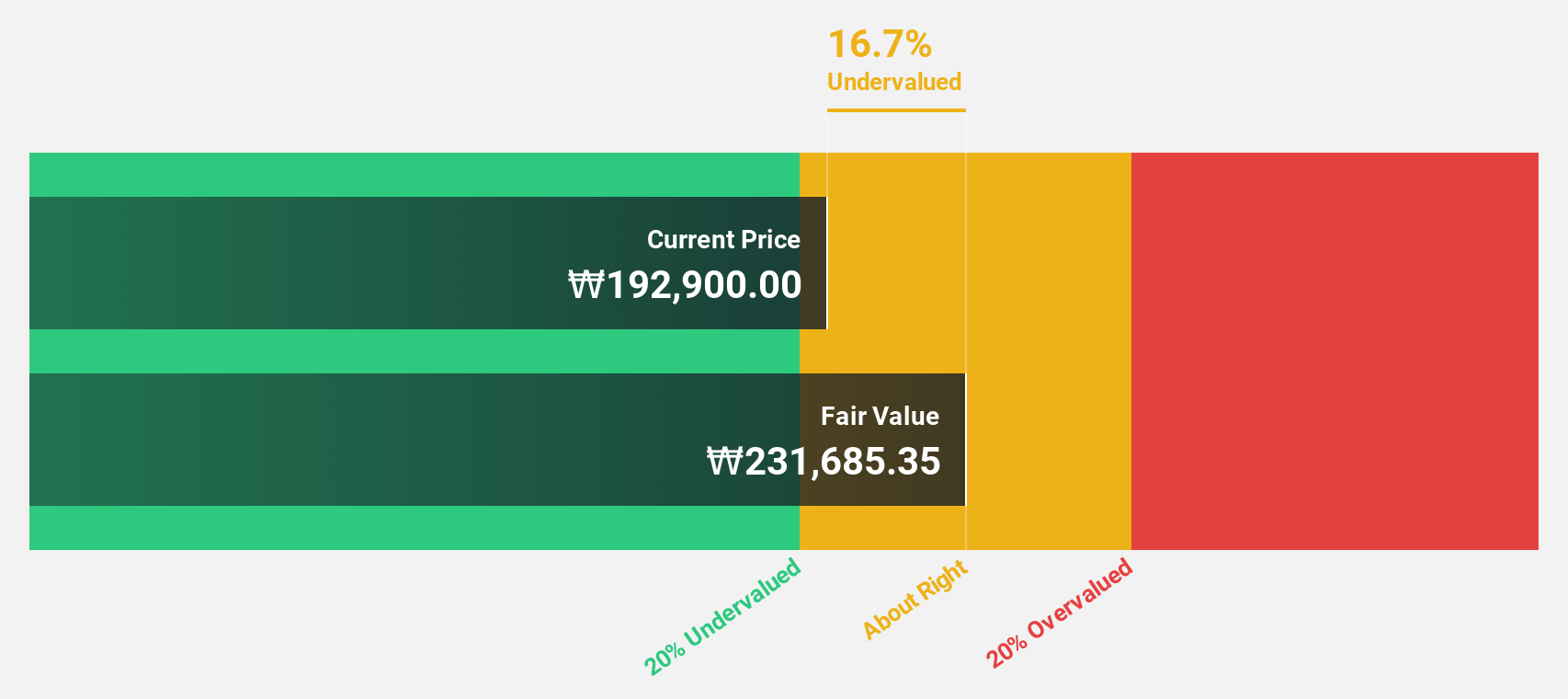

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery in South Korea and internationally with a market cap of ₩12.41 trillion.

Operations: The company's revenue is derived from three main segments: Eco Plant at ₩477.99 million, Rail Solution at ₩1.62 billion, and Defense Solution at ₩2.71 billion.

Estimated Discount To Fair Value: 30.9%

Hyundai Rotem is trading at ₩113,700, significantly below its estimated fair value of ₩164,460.31. Despite recent share price volatility, the company shows strong fundamentals with earnings having grown 156.6% last year and a forecasted annual growth of 20.03%. While revenue growth is expected at 12.5% per year—faster than the Korean market's 7.6%—analysts anticipate a potential stock price increase of 30.9%.

- Upon reviewing our latest growth report, Hyundai Rotem's projected financial performance appears quite optimistic.

- Dive into the specifics of Hyundai Rotem here with our thorough financial health report.

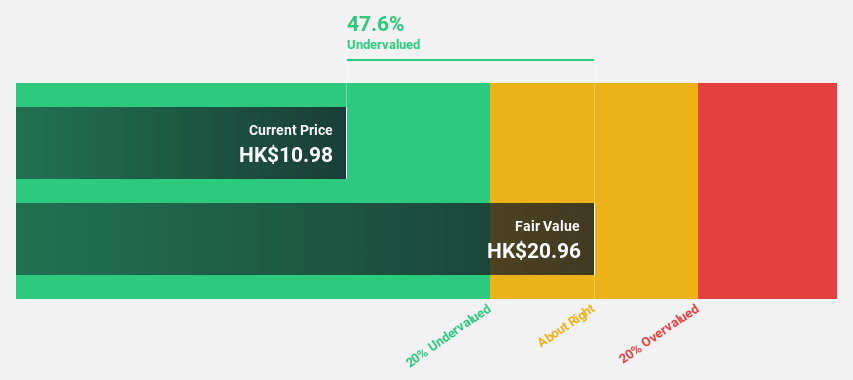

InnoCare Pharma (SEHK:9969)

Overview: InnoCare Pharma Limited is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for cancer and autoimmune diseases in China, with a market cap of HK$22.27 billion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated CN¥1.01 billion.

Estimated Discount To Fair Value: 50%

InnoCare Pharma is trading at HK$10.6, significantly below its estimated fair value of HK$21.19, suggesting it may be undervalued based on cash flows. Despite a net loss of CNY 440.63 million in 2024, earnings have grown annually by 28.9% over the past five years and are forecast to increase by 58.85% per year moving forward. Recent clinical advancements in treatments like Soficitinib and Mesutoclax highlight potential revenue growth opportunities exceeding market averages.

- The growth report we've compiled suggests that InnoCare Pharma's future prospects could be on the up.

- Navigate through the intricacies of InnoCare Pharma with our comprehensive financial health report here.

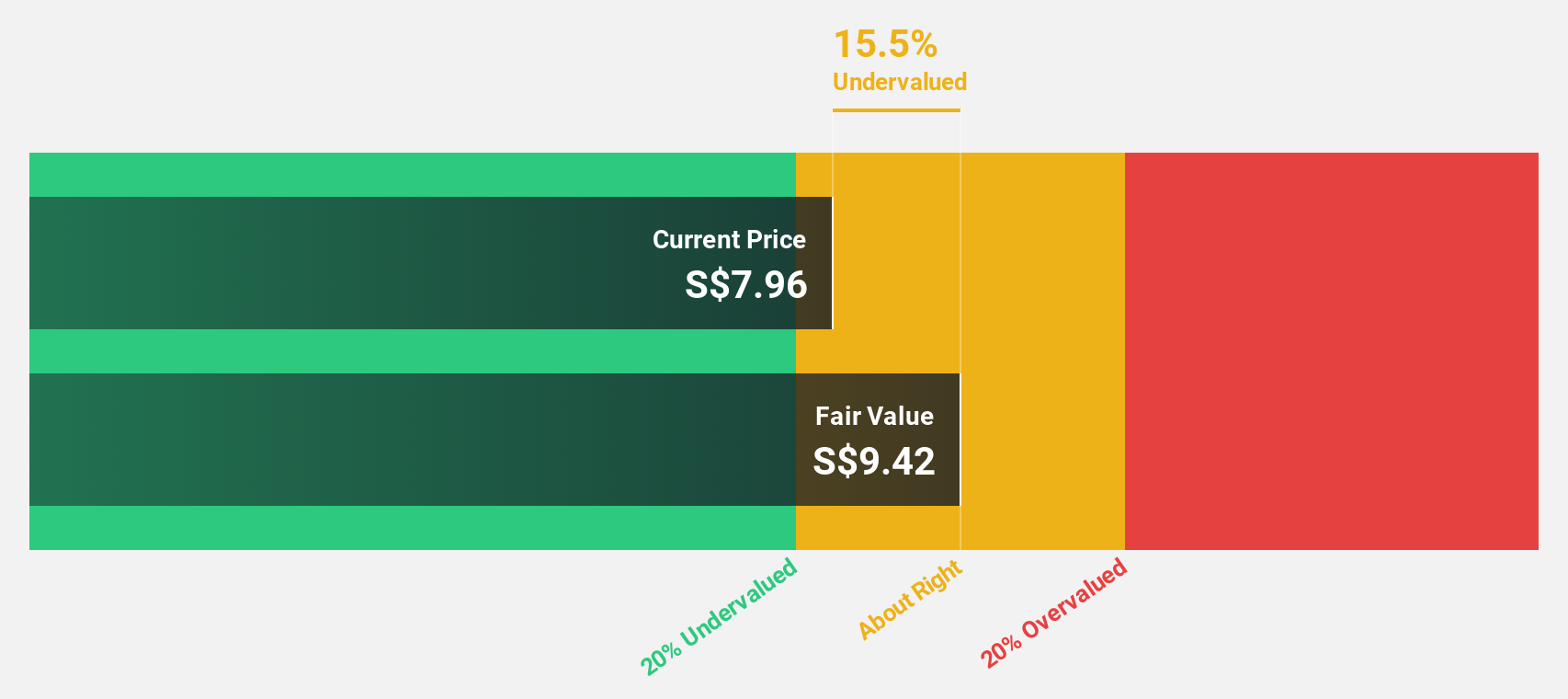

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD23.41 billion.

Operations: The company's revenue is primarily derived from three segments: Commercial Aerospace with SGD4.44 billion, Urban Solutions & Satcom generating SGD2.01 billion, and Defence & Public Security contributing SGD4.97 billion.

Estimated Discount To Fair Value: 22.4%

Singapore Technologies Engineering is trading at S$7.5, below its estimated fair value of S$9.67, highlighting potential undervaluation based on cash flows. With forecasted revenue growth of 7.4% annually and earnings growth outpacing the Singapore market at 12.5%, the company shows promising financial prospects despite high debt levels. Recent contract wins totaling S$4.4 billion across various segments could bolster future cash flows, though immediate impact on net tangible assets per share is minimal.

- In light of our recent growth report, it seems possible that Singapore Technologies Engineering's financial performance will exceed current levels.

- Click here to discover the nuances of Singapore Technologies Engineering with our detailed financial health report.

Turning Ideas Into Actions

- Dive into all 300 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives