- South Korea

- /

- Machinery

- /

- KOSE:A010140

Investing in Samsung Heavy Industries (KRX:010140) three years ago would have delivered you a 96% gain

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Samsung Heavy Industries Co., Ltd. (KRX:010140), which is up 96%, over three years, soundly beating the market decline of 21% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 53%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Samsung Heavy Industries

Given that Samsung Heavy Industries didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Samsung Heavy Industries saw its revenue grow at 15% per year. That's pretty nice growth. While the share price has done well, compounding at 25% yearly, over three years, that move doesn't seem over the top. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

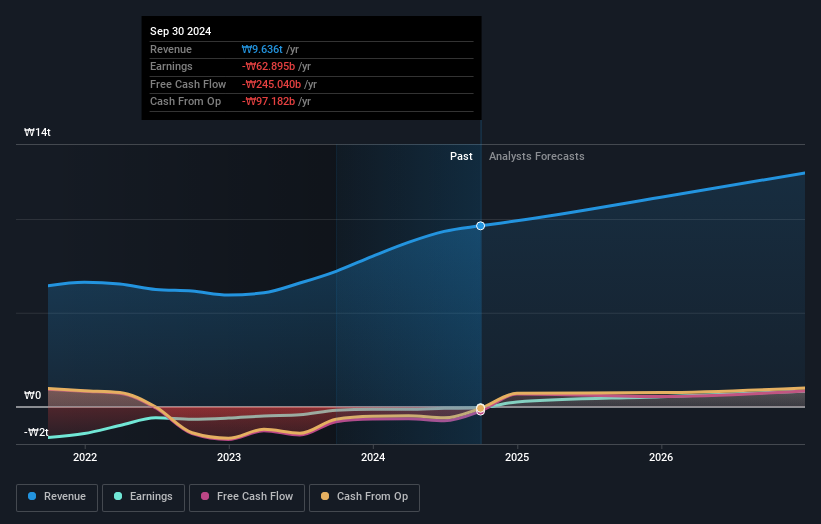

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Samsung Heavy Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Samsung Heavy Industries in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Samsung Heavy Industries has rewarded shareholders with a total shareholder return of 53% in the last twelve months. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Samsung Heavy Industries better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives